Daily Comment (April 4, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are digesting the latest jobs data while reacting to new tariffs from China. In sports, Chattanooga defeated UC Irvine to win the NIT Championship. Today’s Comment will analyze whether the tariff impact will be temporary or long lasting, examine recession risks, and highlight other market moving news. As always, we’ll close with key domestic and international economic data.

The Day After! With flat tariffs set to take effect on April 5 and even more extreme tariffs to follow four days later, the market continues to assess the potential economic impact.

- President Trump has signaled a willingness to consider reducing tariffs — but only in exchange for the right deal. His remarks suggest a potential shift, marking the first indication that he may reconsider the aggressive tariffs imposed on other countries. His response appears to be a reaction to the backlash following his tariff announcement, which triggered the worst market sell-off since the COVID pandemic.

- The sell-off has intensified this morning after China announced a 34% tariff on all US goods, along with export restrictions on rare earths, a critical resource for semiconductor production and other advanced technologies.

- Despite threats of retaliation from other countries, the responses to US tariffs have been relatively muted so far. Canada imposed tariffs on US auto imports but exempted those covered under the USMCA agreement. Meanwhile, France has encouraged corporations to stop investing in the US but has not put a formal law in place.

- The muted response suggests that negotiations between the US and other nations may still be underway. While existing tariffs could remain in place — and retaliatory measures from trading partners remain possible — the US’s reluctance to escalate tensions after Canada’s retaliatory auto tariffs signals that the White House may at least be willing to tolerate limited pushback. However, China’s tariffs may be a different story.

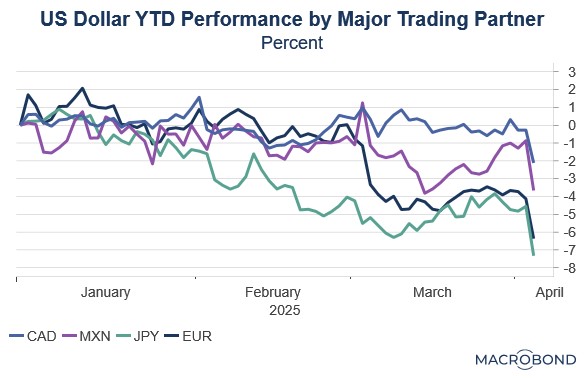

- The key question facing markets is whether these tariffs will fundamentally reshape global trade dynamics and challenge the dollar’s dominance. Yesterday’s sharp decline in the US greenback suggests investors are pricing in a scenario where the US retreats from its role as global importer of last resort. This could force trading partners to accelerate currency diversification.

The Recession Question: There are growing signs that the economy is losing momentum; however, there is still no conclusive evidence of a downturn.

- In March, the ISM Services PMI dropped from 53.5 to 50.8, signaling a potential slowdown in economic momentum. The decline was primarily driven by weakening employment conditions, as survey respondents cited growing pessimism about hiring. Notably, the prices-paid component also softened, suggesting businesses may be losing confidence in their ability to sustain pricing power.

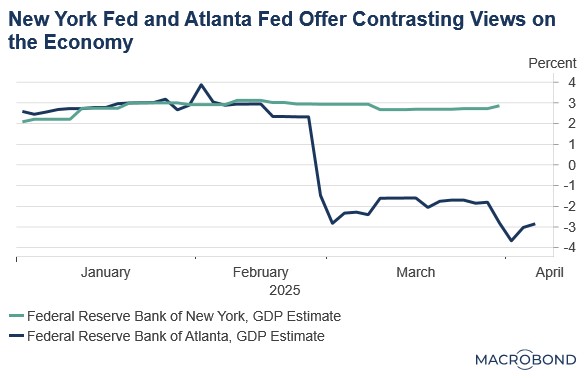

- Meanwhile, regional central banks are sending mixed signals. The Atlanta Fed’s GDPNow tracker points to a sharp slowdown in recent months, while the New York Fed’s Nowcast maintains its projection of steady growth. Markets appear to be more heavily weighting the Atlanta Fed’s model, as its real-time tracking, though more volatile, has proven more reliable than the New York Fed’s estimates in recent cycles.

- While tariffs remain a concern, markets are primarily focused on economic fundamentals. As long as data continues to show US economic expansion, a market recovery appears likely in the near term. However, should economic indicators deteriorate, the risk of a bear market would increase significantly. At this time, we still think it is a coin toss as to whether we are in midst of a downturn; therefore, we still advise investors to remain calm and patient as things play out.

Tax the Rich? Republicans may drop budget cuts and instead raise taxes on the wealthy, signaling a shift from neoliberal economics to a more populist ideology.

- Conservative lawmakers are proposing to increase the top marginal tax rate to 39.6%, reversing previous Trump-era cuts for high earners. This measure aims to offset costs while maintaining other tax reductions. The proposed revenue would fund the elimination of taxes on tips, overtime pay, and Social Security benefits, as well as the increase in the SALT deduction cap from $10,000 to $25,000.

- The move to raise taxes on top earners signals a deliberate shift by conservatives to shed their “party of the wealthy” image. Conservatives are also targeting two controversial loopholes: eliminating the carried interest tax break — long criticized for favoring private equity — and ending preferential tax treatment for sports team purchases.

- The proposed tax hike on high earners will likely face internal GOP resistance, as many members have historically pledged opposition to all tax increases. Just this year, nearly every Republican voted against measures that would limit tax cuts for the wealthy if paired with Medicaid reductions, highlighting the party’s traditional stance.

- Republican support for taxing the wealthy may be a last-ditch effort to pass their stalled tax bill. With the party divided and deficit-conscious members hesitant, this move could both satisfy fiscal conservatives and potentially draw Democratic backing. As a result, we are highly optimistic that a tax bill will be finalized over the next few weeks.

Shake Up in Defense: The president has fired several members of his National Security Council team as part of the fallout over the Signal leak.

- The decision appears to stem from Laura Loomer, a social media personality and trusted Trump confidant. She reportedly urged the president to target those responsible for leaking information to a journalist during sensitive discussions about the administration’s approach to Houthi conflicts in the Red Sea.

- Loomer’s growing influence in the administration signals the populist wing’s resurgence within a presidency that has traditionally favored tech and financial sector allies. Earlier this year, she had an X account suspended and lost access to certain pay features after she challenged Elon Musk’s stance on visas for skilled workers claiming that they go against the “America First” agenda.

- Loomer’s rise amid Musk’s waning clout underscores the president’s transactional leadership, rotating favor between party factions as political winds shift. Should populists consolidate influence, expect a doubling down on contentious policies, potentially rattling markets with abrupt ideological pivots.