Daily Comment (April 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The markets remain laser-focused on developments in the escalating trade war. In sports news, Arsenal secured a decisive 3-0 victory over Real Madrid in last night’s Champions League showdown. Today’s Comment will examine the growing anxiety in bond markets, the latest updates on tariff implementations, and other key market-moving events. As always, we’ll conclude with our comprehensive roundup of both domestic and international economic data releases.

Bond Market Sell-Off: Investors are growing increasingly apprehensive as the trade war escalates, sparking a sell-off in Treasurys.

- The first day of the increased tariff implementation triggered a sell-off in global bond markets as investors retreated to the sidelines amid escalating uncertainty. Bond prices plummeted while yields surged, reflecting a rush to liquidate holdings as trade war tensions intensified. Despite these liquidity concerns, the US dollar has not strengthened — a potential sign that investors are diversifying their currency exposures.

- A recent Treasury auction has also raised fresh concerns about the growing federal deficit. Tuesday’s three-year note sale drew unexpectedly weak demand, signaling investor reluctance to increase their holdings of government debt. The lackluster performance suggests market participants may be preparing to reduce their Treasury exposure if economic conditions deteriorate in coming weeks.

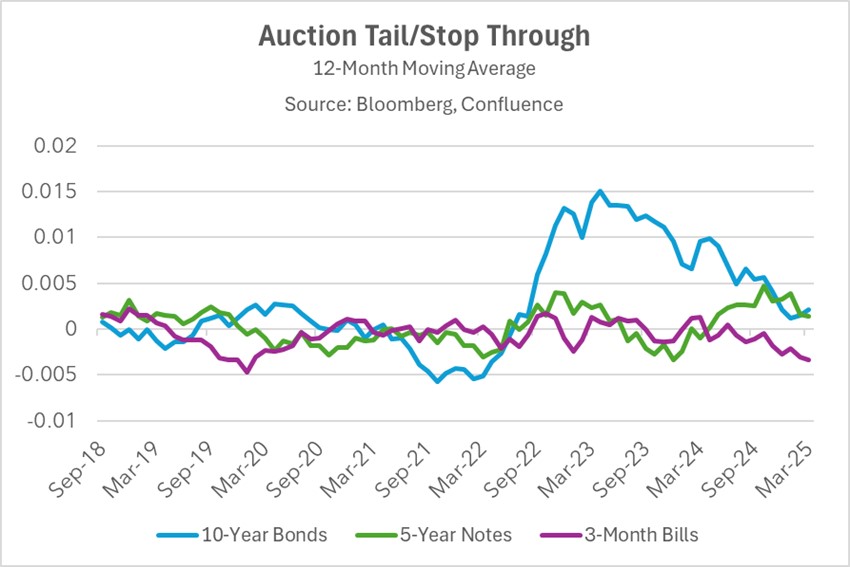

- Recent bond market activity indicates declining appetite among US debt investors for medium-to-long term duration exposure. As illustrated in the chart above, tail and stop auction levels, which reflect where yields settled relative to market expectations, confirm this trend. The Treasury’s shift toward shorter-term issuance has enhanced liquidity in long-dated securities, though at the cost of reduced demand for intermediate maturities. Meanwhile, Treasury bills continue to demonstrate robust investor interest.

- Growing concerns about bond market liquidity could force the Federal Reserve to stop quantitative tightening earlier than they planned, and possibly even start buying bonds again. While lowering interest rates is still a possibility, the Fed would likely only do that if there were serious solvency risks, such as companies being in danger of not being able to pay their debts. Right now, it doesn’t look like we’re facing that kind of problem.

Dealing With Tariffs: Amid rising economic headwinds, foreign policymakers are implementing targeted relief measures to protect vulnerable sectors and maintain stability — while also seeking a deal with the US.

- While China has raised tariffs on US goods to 84%, it has also signaled its readiness to hold talks with the US. This comes after President Trump imposed tariffs of up to 104% on Chinese goods. Meanwhile, the People’s Bank of China has sought to cushion the impact by devaluing its currency, aiming to preserve competitiveness in the ongoing trade war.

- The European Union, having retaliated with tariffs against the US, now faces growing calls to counter US trade measures by lowering its own duties and pivoting toward China. Two ECB policymakers have already endorsed rate cuts at the upcoming meeting to cushion the economic blow from rising US tariffs. Meanwhile, Spanish Prime Minister Pedro Sánchez is urging the EU to deepen trade relations with China, aiming to reduce dependence on the US market.

- In Southeast Asia, countries are taking steps to mitigate the economic fallout by rolling out stimulus measures. Taiwan has activated its stabilization fund to shore up local equity markets following a sharp sell-off. Meanwhile, South Korea has announced a $2 billion aid package to bolster its auto industry. Elsewhere, Japan has established a task force to address the tariff dispute, with speculation mounting that it may consider an emergency budget.

- As the new tariffs take effect, signs of diplomatic progress are emerging. The US continues negotiations with trade partners to potentially reduce these measures, with several key developments: Vietnam has agreed to reduce its trade balance by purchasing more US arms, South Korea anticipates finalizing a significant trade agreement imminently, and Japan appears to be receiving preferential attention in ongoing trade discussions.

Big, Beautiful, Bill in Jeopardy? Republican lawmakers are increasingly hesitant to back the president’s tax bill, voicing concerns over its fiscal impact and doubting its revenue potential amid ongoing trade tensions.

- Several House Republicans opposed the president’s signature tax bill on Tuesday, raising objections to its hefty price tag. The dissenters are now threatening to block a key procedural vote needed to advance the legislation — a move that could stall the bill indefinitely. The resistance comes just hours after a high stakes meeting between GOP lawmakers, the president, and House Majority Leader Mike Johnson failed to resolve the spending dispute.

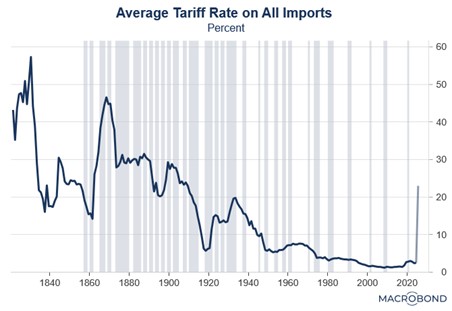

- The growing trade conflict has strengthened Republican opposition to the spending bill, as lawmakers express doubts about its ability to generate sufficient revenue to offset its costs. While the White House projects $600 billion in annual tariff revenue, economists caution that elevated rates could decrease trade volumes, thereby jeopardizing revenue targets. In an attempt to alleviate concerns, the president has set a goal of $1 trillion in spending cuts.

- While we expect Republicans will ultimately pass the tax bill, we question their ability to identify spending cuts substantial enough to reassure markets. This fiscal constraint may force lawmakers to consider revenue-raising alternatives, including potential tax increases on high-income households, as they prioritize preserving middle-class tax relief.

Coal on the Rise: President Trump signed an executive order to boost the production of coal with hopes that it can be used to fuel AI.

- The new executive order aims to roll back industry regulations that have contributed to coal’s persistent production decline. Through emergency measures, the president has authorized the Department of Energy to intervene in sustaining coal operations. The administration further underscored coal’s strategic value by classifying it as a “critical mineral,” a designation that directly links its production to national security.

- This move is expected to advance President Trump’s ambition to establish the US as a global AI leader. This comes as the president has sought to make the US the center of innovation for AI with his Stargate Project in which the US plans to invest $100 billion on co-located data centers, which would allow them to be built next to their energy source.

- Surging demand for data centers and semiconductor production has reversed years of stagnant electricity consumption in the US, triggering the first sustained increase in over a decade. This trend could drive up utility bills industry-wide while creating inflationary pressure on housing costs.