Daily Comment (April 20, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning and happy Monday! Equities are lower this morning, but the market catching most of the attention is oil. In equities, there is a large short position developing against the S&P 500. We update the COVID-19 news. Here are the details:

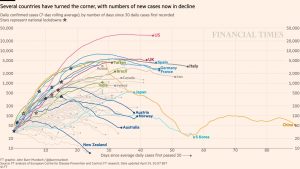

COVID-19: The number of reported cases is 2,416,135 with 165,939 deaths and 632,983 recoveries. Here is the FT chart:

The U.S. data is showing a flattening. We continue to note the data because it is the best we have, but data collection is problematic. The anecdotal reports strongly suggest serious undercounting of infections and fatalities, especially in emerging economies.

The virus news:

- The reopening after lockdown is the next phase of the virus.

- In the U.S., there are growing tensions against state orders. And, tensions are not unique to America. There are protests to government lockdowns around the world. Protests have emerged in Lebanon, Iraq, India and Israel.

- We are starting to see halting measures to reopen economies.

- In Denmark, schools have reopened.

- Other European nations are slowly reopening; the common theme is to open up previously restricted businesses.

- The problem with reopening is confidence. For example, even if restaurants reopen, patrons have to feel confident that if they venture out they won’t get sick. That confidence is tied to testing.

- Sadly, the testing apparatus is still a problem in the U.S. Backlogs are up. The testing companies are finding that the only tests they are processing are COVID-19, which is reducing their earnings. Test reliability varies widely. The regents necessary to conduct the tests are in short supply and often come from China. Until these bottlenecks are resolved, policies to open up the economies will not be all that effective in lifting growth.

- The other element of testing is the serological studies. These are anti-body tests to determine who has been exposed to the disease. New York is starting these tests; so is Germany. However, as with confirmation testing, problems with this type of testing continue as well.

- The bigger problem with serological testing is that if a person has anti-bodies for the virus, what sort of immunity does it confer? Although immunity follows most viral infections, it isn’t clear how long it lasts with COVID-19. There has been talk of using a system similar to China’s in which a previously infected person gets a “passport” making them eligible to work and circulate in the population. That in and of itself could lead to all sorts of issues. We could see the young and desperate having “COVID-19 parties,” similar to the old “chickenpox parties” before there was a vaccine, because having the passport would likely bring a wage premium. Of course, as anyone who has visited a college town knows, the potential for fraudulent passports could become a serious problem as well.

- One strength of the U.S. federal system is that a good deal of authority is devolved to state and local governments, allowing these smaller government entities to tailor policies to their specific needs. At the same time, it can create differences that can be somewhat difficult to discern. In other words, one state’s non-essential business can be another state’s essential one. This can lead to cross-border activity and other issues.

- Surveys suggest Americans are still unsure of how much they should circulate, so even if stay-at-home orders are relaxed, a rapid rebound in traffic isn’t likely. This isn’t just a U.S. issue, either. Europe has similar concerns.

- One of the problems with creating policy to deal with the pandemic is that we don’t have complete data. In the absence of certitude, we are left with models. Modeling outcomes is perfectly normal; in economics and finance, we use them all the time. But, anyone familiar with modeling knows its weaknesses; the outcome will not only be affected by the variables included and excluded, but also assumptions must be made about relationships. Although models can help guide decisions, problems develop when decisionmakers are not the modelers. A decisionmaker wants to know the future so he can make good decisions; if a model offers an outcome, the modeler should know the impact of the outcome if assumptions are changed. But, the decisionmaker probably doesn’t. With regard to the pandemic, we have seen forecasts very wide of the actual. For example, if fatalities are lower than expected, it might be that the model underestimated the degree or impact of social distancing. Or, it might be that the virus isn’t as virulent as assumed. But, when decisionmakers are not aware of this nuance, the inaccuracy of forecasts may lead them to assume modeling is a worthless exercise. In our experience, modeling isn’t worthless, but it is important that the modeler explain to the decisionmaker where the best estimate might lead astray. And, of course, once the media gets ahold of a model estimate, nuance is almost always lost.

The policy news:

- Although a deal to expand funding for small businesses hasn’t been passed yet, it does appear a deal is in the offing.

- The U.S. is giving businesses a partial tariff holiday.

- The Fed’s aggressive expansion of its backstop is starting to raise concerns—where does it stop? In other words, the Fed is venturing into dangerous territory politically because it may become hard to justify why some borrowers are supported while others are left to their own devices. Our view is that, so far, the Fed has mostly expanded its backstop to prevent systemic risk. But, once this path is taken, it will become increasingly difficult to maintain a “bright line” between systemic risk and economic support. It isn’t hard to imagine the Fed buying up student debt to extinguish it due to the support it would give the economy. And that might be a reasonable policy. But, in the absence of price controls on tuition, which would come from legislation, this sort of policy would simply be a green light for higher college costs.

The economic news:

- One of the areas we continue to watch is behavior after the pandemic. There is a rising chance that the millennial generation will end up behaving like the silent generation, who came to adulthood under the scars of the Great Depression and WWII.

The market news:

- S&P earnings releases will ramp up this week. It’s probably going to be a bit ugly, but that isn’t really a surprise.

- As we noted above, oil prices are getting hammered this morning. Much of this is tied to the futures expiration but the longer-term worry is the lack of storage. Exacerbating this problem is the deep contango in the futures market. For example, the spread between June futures and September futures is over $8 per barrel. Thus, if one can find storage, a producer could sell into September and use the spread to defray the cost of storage. Tank storage costs vary but are well below $8 per barrel. But, once that storage is filled, costs rise rapidly. Once that occurs, the front-month prices are at risk of falling even further. The only solution is to shut in production; unfortunately, some of that production will never return. Therefore, as long as firms have hedges in place, they will continue to produce oil, putting further downside pressure on prices.

- The entire airline industry, from manufacturing to airlines themselves, has been rocked by the COVID-19 crisis.

- We have been watching the dividend/buyback issue for the past several weeks. The core to the issue is the tension between return to capital versus return to labor. Recent news from Disney (DIS, 106.63) will add to tensions.

- Another area of tension is between insurers and the insured. Companies are making claims for business interruption; insurers are arguing that they never intended to insure against pandemic risk (which they really couldn’t—the insurance model can’t handle systemic risk).

- COVID-19 has crippled the drug cartels.

- Australia is mandating that news aggregators pay originators for content.

- The lockdown of people has done the same for bees. Commercial beekeepers, who usually transport bees to pollinate crops, have been less able to do so due to shut-in orders. As a result, various crops are at risk.

- U.S. strip mall owners paid less than half April’s rent.

The foreign policy news:

- China is dealing with the shortages of debt payments with widespread forbearance. The regime can do this because it has near-complete control of the banking system.

- When COVID-19 hit the West there was a run on personal paper products. In Russia, there was a massive move to cash.

Odds and ends: Bondholders are not impressed with Argentina’s restructuring proposal. North Korea disputes reports of correspondence between Kim and President Trump.