Daily Comment (April 22, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, and happy Earth Day! It’s a busy Thursday, with lots of items to cover. U.S. equity futures are steady to lower this morning. Our coverage begins with Biden’s two-day climate summit. The ECB holds its meeting, and we cover that too. We update the Archegos event. Russia and China news follow. Our update on economics and policy is up next. Then comes an international news roundup, some technology news, and we close with our regular pandemic update.

Climate summit: The U.S. is holding a virtual Climate Summit today with 40 world leaders invited. In anticipation of the meeting, the Biden administration announced it would reduce U.S. greenhouse gas emissions by 50% before 2031.[1] Although the administration disputes the claim, it is hard to see a path to that goal without the proposed infrastructure package passing in Congress.

- Despite elevated tensions, Vladimir Putin will join the meeting. General Secretary Xi will too.

- Canada was the only G-7 nation that had higher CO2 emissions last year.

- Brazil, which has tended to downplay environmental issues under President Bolsonaro, has changed its position, likely in the hope it will be paid to avoid cutting down its forests.

- An interesting sidelight; cattle methane emissions are reduced if the animals are fed seaweed.

Overall, we view summits such as these as PR campaigns, and we suspect this one will be too. International environmental policy suffers from two problems. First, everyone is for the environment as long as the costs are modest, but once it starts to hurt, it gets difficult to make changes. Second, there is a strong temptation to “free ride.” In other words, a nation benefits from cutting emissions but does even better if other nations do so while theirs does not. But what is important about this one is that China and Russia are participating, even with tensions high.

ECB: Policy, as expected, was left unchanged. In the press conference, Lagarde is clearly getting better at managing the art of central bank speak, which is to express lots of works but say little of substance. We note her comments that the ECB doesn’t set a target for the EUR did lead the currency to rally. The June meeting may be more problematic. Hawks would like to start withdrawing bank purchases in the second half of the year. We doubt this will occur due to the slow action on EU vaccinations, but this will bear watching.

Archegos: As we note below in the China section, regulators there are dealing with a serious financial problem. Meanwhile, the fallout from Archegos continues. Credit Suisse (CS, USD, 10.38) appears to be bearing the brunt of the losses. It was revealed the bank had more than $20 billion of exposure to Archegos. It is rather stunning to have that much exposure, but apparently, the caused was improper accounting for derivative risk. Senior executives are leaving, including the heads of the prime brokerage unit that oversaw the lending to Archegos and the risk managers. The losses (estimated at around $4.7 billion so far) are causing the bank to raise $1.9 billion of capital. The Swiss banks used to be the apex of high net worth banking. However, in this incident, they were clearly outclassed by their U.S. rivals. The bigger issue? The earlier outperformance of Swiss banks appears, in the end, to be due to its country’s bank secrecy laws. As those have been rolled back, they have lost their edge.

The bigger concern we have with the recent financial firm crises is that if we are seeing such blowups when monetary policy is arguably the most accommodative since WWII, what happens when policy tightens?

Russia: Putin conducted his annual press conference yesterday, and worries about the military buildup are front and center this morning.

- Every year, President Putin holds a press conference where he addresses the nation. It is a sort of state of the union address. A number of topics were discussed, including Ukraine, U.S. sanctions, and Navalny. Although he stated that he would protect Russian security, he did not offer any specific actions in retaliation for recent sanctions or diplomat explosions. Putin made it clear that Russia will react if the West crosses any “red lines,” but he didn’t detail what those red lines were. While Putin was holding his conference, protestors called for the release of Alexi Navalny.

- The military buildup around Ukraine continues unabated. Although we don’t expect Russia to invade Ukraine (it would be difficult to win and even harder to control; it might trigger a stronger response from the West than Putin could manage), the escalation is hard to miss. We suspect this action is mostly to intimidate Ukraine and test Biden, but there is still a degree of uncertainty that hasn’t been discounted by financial markets.

- Eastern European nations are becoming increasingly uncomfortable with Russia’s actions. The Czech Republic released a statement explaining why it expelled Russian diplomats and is asking for EU support in opposing Russia.

- The U.S. military suspects Russia used directed energy weapons on American troops. There were no details offered about the incident.

China: Xi argues for a new world order, and we are watching yet another financial system problem.

- In a speech earlier this week at the Boao Forum, General Secretary Xi argued for a new world order, a slightly veiled message against U.S. hegemony. The thinking in the U.S. and China has changed markedly in the past four years. In the prior period, the accepted wisdom was that China, following the pattern of other Asian tigers, would gradually democratize. In fact, market liberalization would foster this shift to democracy, so supporting globalization was based on reforming China. The consensus has clearly shifted. Although there were dissenting voices in the prior period, now the consensus is that China is and always will be a revisionist power tied to a particular version of Marxist/Leninist thought that will never liberalize. But it should be noted that China’s thinking has also changed. It realizes it now faces a hostile environment and thus is preparing for a world of trade restrictions. The “dual circulation” strategy is part of this change. Xi also believes that the decline of the U.S. is inevitable, and thus, the world is heading into a period without a global hegemon. To some extent, China wants to gain some control over the world the U.S. has built by raising its stature in multilateral organizations, e.g., World Bank, IMF, U.N., etc.

- A problem China faces in this evolving order is that it lacks allies, and the Biden administration is openly courting allies in the region.

- Japan is blaming the Chinese military for a series of cyberattacks. The U.S. has suffered numerous attacks as well.

- Australia has revoked the state of Victoria’s agreement to participate in the belt and road initiative.

- The EU and India are formulating an alternative to the Belt and Road Initiative.

- The Chinese financial system continues to spawn debt, and some of it goes bad. The latest credit event we are watching is Huarong Asset Management (2799, HKD, 1.02). This company was created to absorb and liquidate bad debt created in the period following the Asian Financial Crisis. Chinese regulators created “bad banks,” designed to be workout groups. Bad banks try to manage distressed assets, maximizing the return from the bad debt. Under normal circumstances, such banks eventually wind themselves up after disposing of what debt has value and liquidating the rest. However, Huarong took on a life of its own, becoming a normal bank and making new loans. It borrowed heavily and had a number of loans go sour. The chairman of the company, Lia Xiaomin, was executed in January for his crimes tied to the company, essentially, corruption and accepting bribes.

- For world financial markets, the concern is $22 billion of USD-denominated bonds that have plunged in value on fears of default. Foreign investors tend to treat bonds issued by SOE’s as obligations of the central government. In other words, they expect the government to prevent default. This belief creates a serious moral hazard problem. On the one hand, the government wants to force investors to be more careful in what they purchase and allow the bonds to default to send this message. However, it doesn’t want a debt crisis either.

- China is rapidly moving to expand its CBDC.

- China’s voracious demand for commodities exposes a geopolitical vulnerability. Although tensions with the U.S. are elevated, China is importing record levels of American corn, and the need for iron ore is undermining Beijing’s attempt to punish Australia.

- China has expanded its naval base in Djibouti to accommodate its aircraft carriers. It is also working on a third aircraft carrier that appears to be similar to the U.S. Ford-class carrier.

- Tesla (TSLA, USD, 744.12) has made a major push into China. It is finding that to be a difficult road. First, the company’s spotty record on reliability is leading to an uproar of consumer complaints. Initially, the government quashed the protests. But, as they have increased, Beijing has turned its fire on the company. Unsavory sales tactics are also undermining the brand.

- Reports suggest that the CPC is systematically rooting out banned religious groups.

Economics and policy: Taxes, inflation, and infrastructure are today’s headlines.

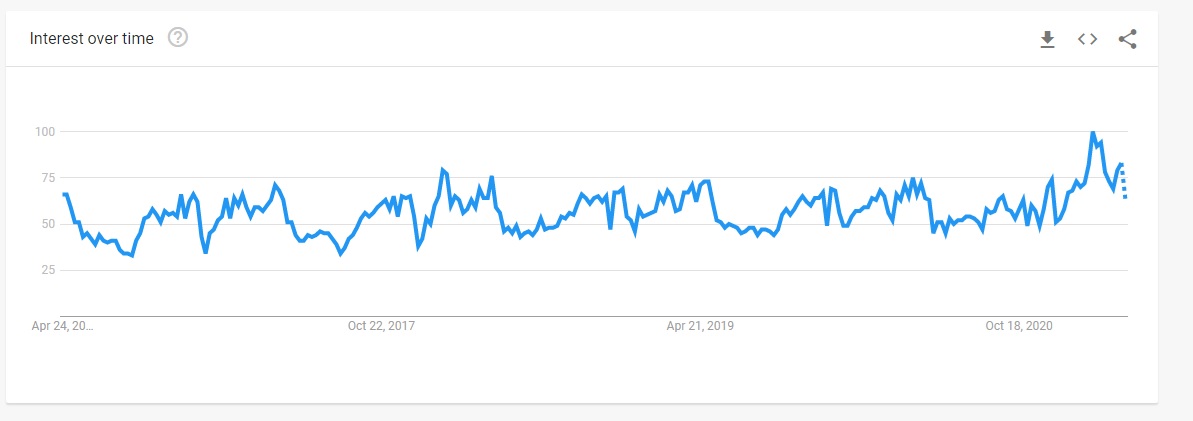

- Inflation worries have been rising; we have been hearing more questions on the issue and mentions are rising too.

(Source: Google Trends)

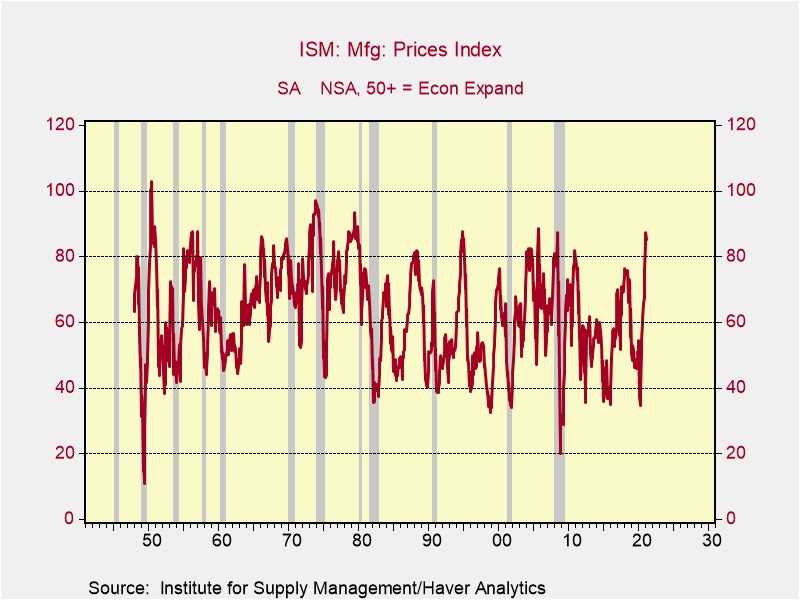

Searches for inflation peaked in late February, but interest remains elevated. Reports that consumer products companies are planning on raising prices have increased concerns. In earnings reports, companies are complaining about rising costs. These reports are consistent with the ISM data on prices paid.

The key unknown is the degree to which firms can pass along higher costs. We fully expect some of these costs will filter through to consumer prices. We continue to maintain that the price increases will be temporary due to the lack of inflation expectations, but we are monitoring conditions closely. We do note that Chair Powell vows to react to a “substantial” overshoot of inflation.

- There are continued concerns about the labor market as well. Although the labor force is clearly lower in the wake of the pandemic, it is unclear if some of those workers will return anytime soon. Generous fiscal aid, fear of the virus, and perhaps rethinking career choices may make finding workers difficult.

- On the other hand, there is growing evidence of a surge in business formation. It is possible that workers are using the fiscal spending to venture out into their own businesses. If so, we could see a renaissance in small businesses, which would expand supply.

- We have been positive on residential real estate and homebuilders. Recent data shows the strongest buying from Hispanics in two decades, supporting this sector of the economy.

- GOP senators are offered a counter to the Biden administration’s infrastructure package. It does not include changes to corporate taxes. It is also smaller, at $800 billion over eight years. Senate Democrats are unimpressed.

- The semiconductor shortage continues to hamper auto production, both in the U.S. and Europe.

- Weak lending in Europe is slowing the recovery there.

- LIBOR is in its waning days. U.S. regulators are pushing a replacement called the Secured Overnight Financing Rate (SOFR), which is a collateralized rate based on Treasury repos. However, Rich Sandor, who is considered the father of interest rate derivatives and futures and also the creator of carbon trading, has created an alternative, called the American Interbank Offering Rate (AmerIBOR). Corporations are favorable to this alternative to SOFR because it is not collateralized by Treasuries, and it is not just an overnight rate. Here is a broadcast on this issue from the Odd Lots podcast.

- The Bank of Canada appears poised to tighten policy, the first of the G-7 nations to signal a change.

- High yield spreads in the U.S. have narrowed to historically narrow levels.

International roundup: Turkey, Myanmar, and Europe lead the news.

- President Biden is reportedly prepared to declare that Turkey’s actions against Armenians during WWI were genocide. U.S. presidents have tended to avoid this declaration, as Turkey vigorously disputes this position. If the reports are accurate, it tends to show how much U.S. and Turkish relations have cooled over the past 20 years.

- The Erdogan government is facing pressure over the rapid decline in foreign reserves. We suspect the reserves were spent to support the exchange rate.

- Continued protests in the wake of the recent coup are causing the economy of Myanmar to implode. There are growing fears the country is becoming a failed state. However, that isn’t stopping China from investing in the country.

- In Europe, Denmark is considering sending Syrian refugees back, arguing that conditions there have improved. Lithuania is opening its doors to Belarusian businesses that have been adversely affected by instability. President Draghi of Italy says his government will spend the EU aid on high-speed rail and technology. As we noted yesterday, German courts have opened the way for German participation in the fiscal transfer.

- Indonesia appears to have lost a submarine.

Technology: The industry continues to face the threat of regulation.

- It is becoming a global phenomenon; regulators around the world are taking steps to reduce the power of technology firms. In the U.S., the administration’s appointment of Lisa Khan is especially negative due to her calls for returning to a pre-Bork antitrust legal standard.

- British tabloids are suing Google (GOOG, USD, 2,293.29), arguing the firm adversely manipulated search results.

COVID-19: The number of reported cases is 143,962,157 with 3,061,748 fatalities. In the U.S., there are 31,862,987 confirmed cases with 569,404 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 277,938,875 doses of the vaccine have been distributed with 215,951,909 doses injected. The number receiving at least one dose is 134,445,595, while the number of second doses, which would grant the highest level of immunity, is 87,592,646. The FT has a page on global vaccine distribution. The weekly Axios map shows that infection rates have stabilized but have stopped falling.

Virology

- The vaccine process is becoming a “good news/bad news” story.

- A look at various countries shows that vaccines are reducing cases, fatalities and, hospitalizations. But, as this article shows, the data also shows rising cases in India and Latin America. In fact, Indian infections hit a global record, and the health system there is showing signs of stress.

- In the U.S., it appears we may be reaching the apex in vaccinations. This is mostly because the population of people willing to be vaccinated is near completion, and those who remain are vaccine-hesitant. This hesitancy will tend to reduce the likelihood the U.S. will achieve herd immunity. Meanwhile, U.S. infections and hospitalizations are rising; much of this is due to lockdown fatigue. Global data show that each successive lockdown was less effective, likely due to lockdown fatigue.

- At the same time, wealthy South Americans are flocking to the U.S. for vaccination.

- All this means that the optimism about opening up the economy should be tempered by the continued problems with moving past the pandemic.

- Texas A&M researchers have isolated yet another variant of COVIC-19 that appears related to the British B.1.1.7 type. It is not clear if this variant is a problem, but it has raised concerns because the aforementioned variant has been more potent.

- Pfizer (PFE, USD, 39.52) has discovered that criminal groups in Mexico and Poland are selling counterfeit versions of its vaccine.

- China is criticizing the WHO over the Wuhan leak theory. This criticism shows that Beijing will not tolerate any notion that it bears any responsibility for the pandemic.

- The Los Angeles Dodgers are planning to create vaccination sections that will not have strict social distancing, further evidence that the private sector is going to enforce some form of vaccine passporting.

- Otters, apparently, can contract COVID-19.

[1] To be specific, that’s 50% below 2005 levels. In 2005, U.S. CO2 emissions were 6.0 BN tonnes. Last year (abet with the pandemic), the DOE estimates emissions were 4.61 billion tonnes (for reference, 2019’s number was 5.13 billion tonnes). So, we are talking about a reduction to 3.0 billion tonnes, about a 35% reduction from last year’s number.