Daily Comment (August 1, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news that the coup leaders who seized power in Niger have announced an embargo on sending uranium and gold to France—a move that’s entirely consistent with the type of behavior we’ve been warning about from the China/Russia bloc. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including modest new economic stimulus measures in China and more political pressure to clamp down on U.S. investment into Chinese companies.

Niger-France-Russia: The junta that seized power in a coup late last week accused France of plotting a military attack to return democratically-elected President Bazoum to power. The coup leaders also said they will immediately ban all exports of uranium and gold to France.

- Because of strong anti-Western sentiment in parts of Africa, we believe France (and the U.S.) would be reluctant to launch military action in Niger. The coup leaders’ statement is more likely just an effort to ward off French interference, and their uranium embargo probably aims to inflict pain on Niger’s former colonial master. Uranium from Niger reportedly provides 75% of the fuel for France’s nuclear reactors.

- Some reports suggest the coup leaders had help from Russian mercenaries. Whether or not that’s true, cutting France off from Niger’s uranium is consistent with the behavior we’ve been warning about from members of the China/Russia geopolitical bloc. Since members of the China/Russia bloc, including Niger, control so much of the world’s key mineral resources, we think they are likely to cut off those supplies to exert pressure against the U.S. and the rest of its bloc, exactly as Russia has done in its war with Ukraine.

Russia-Ukraine War: For the second time in three days, Ukrainian drones have apparently struck Moscow’s premier IQ-Quarter skyscraper, which houses several big government ministries and key Russian companies. The repeat attack suggests the Ukrainians are trying to bring the war home to the Russian elites and perhaps force the deployment of more air defense assets to the capital region. Meanwhile, Russian forces last night staged their own missile attacks against residential areas of Kharkiv, and combat remained intense on parts of the front line running from eastern to southern Ukraine.

Chinese Economy: The government yesterday published a long list of measures it said it would implement to encourage more consumer spending and help boost economic growth. However, the measures were generally vague and seemed quite modest. For example, people who trade in older automobiles for newer ones would receive a subsidy, as would people who buy insulation and other goods to cut home energy use. The announcement also suggested that the central government would leave it up to the cash-strapped provincial and local governments to pay for the programs.

- The modest measures show how the central government has become reluctant to rely on the big, dramatic, debt-fueled fiscal programs of the past, which have helped create a serious problem with excess debt among companies and provincial and local governments.

- In sum, the modest measures are unlikely to provide a significant boost to Chinese economic growth, which is likely to remain in the doldrums for the time being, although the positive side of that is that weaker Chinese demand will probably help bring down global inflation.

Chinese Armed Forces: President Xi has apparently purged the top two commanders of the People’s Liberation Army Rocket Forces, which are responsible for the country’s conventional and strategic nuclear missiles. The little press reporting available suggests the two commanders were sacked for “corruption,” possibly related to selling military secrets. The firing comes fast on the heels of the sacking of former Foreign Minister Qin Gang. It also comes shortly after CIA Director Burns said his agency is making progress on rebuilding its spy network in China.

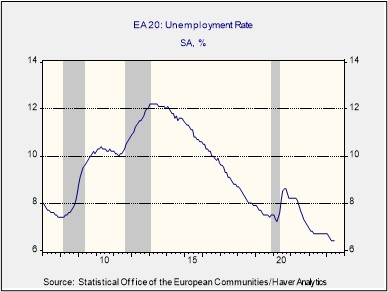

Eurozone: The region’s June unemployment rate fell to 6.4%, and revisions showed the jobless rate was also at that level in each of the previous two months. The jobless rate was not only better than anticipated, but it also marked a record low for the eurozone. The figures will raise hopes that strong labor demand and firm wages will help the region’s economy rebound in the coming months but falling vacancies in Germany and France suggest the labor market could soften from here.

European Union-China: On a visit to the Philippines today, European Commission President von der Leyen rebuked China for offering tacit support to Russia in its invasion of Ukraine, rather than supporting the principle of territorial integrity. She also warned that China’s own territorial aggressiveness in the South China Sea could have “global repercussions.” The speech illustrates von der Leyen’s effort to align more closely with the U.S. in its approach to China, even though many other European politicians continue to resist any de-coupling.

United States-China: Yesterday, the House Select Committee on the Chinese Communist Party notified giant investment manager BlackRock (BLK, $738.85) and index provider MSCI that they are being investigated for facilitating investment in Chinese companies that the U.S. government has accused of bolstering China’s military and violating human rights. The investment activities already studied aren’t illegal, but the committee said they are “exacerbating an already significant national-security threat and undermining American values.”

- Reporting so far suggests the HSCCCP is focusing on international or global index funds that channel a portion of assets into Chinese companies.

- To reiterate, the HSCCCP hasn’t accused the firms of illegal activity. Indeed, the point here is the growing U.S. political pressure against economic ties with China. As we have warned repeatedly, the strengthening bipartisan trend toward clamping down on China presents risks for investors, who could face new investment restrictions suddenly and unexpectedly.

U.S. Stock Market: Some of the nation’s top active fund managers say they’re having trouble attracting money from large investors, given that those investors today can enjoy such high yields in money market funds without taking much risk. Indeed, some fund managers are suffering net outflows from their funds as large, sophisticated investors pull back from equities. All the same, we also think the enormous amounts in money market funds represent future fuel for equities, especially if the stock market rally broadens and/or the Fed eventually starts to cut interest rates.

Global Gold Market: Data from the World Gold Council shows second-quarter demand for the yellow metal totaled 1,255 tons, up 7.0% year-over-year. In contrast with recent trends, buying by central banks fell to 103 tons, but that was mainly because of net sales by Turkey’s central bank due to that country’s unique economic turmoil. Central bank buying in the entire first half of the year hit a record 387 tons. We continue to believe that geopolitical tensions and the longer-term uptrend in central bank purchases will help boost gold prices over time.