Daily Comment (August 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest forecasts for global oil demand from the Organization of the Petroleum Exporting Countries. We next review several other international and US developments with the potential to affect the financial markets today, including news of a new, advanced artificial-intelligence chip from Chinese tech giant Huawei, data showing plummeting economic optimism in Europe, and new US regulatory initiatives from the Biden administration.

Global Oil Market: The Organization of the Petroleum Exporting Countries yesterday cut its forecasts of global oil demand in 2024 and 2025, largely because of the ongoing slowdown in Chinese economic growth and the risk that high interest rates could kick the US economy into recession. The cartel now sees demand rising by 2.11 million barrels per day this year, versus its previous growth estimate of 2.25 mbpd. The new growth forecasts put total global demand at 104.3 mbpd in 2024.

- Global oil demand continues to grow faster than right before the coronavirus pandemic, but it is rapidly normalizing.

- The slowdown in demand continues to keep a lid on prices, although geopolitical tensions and the risk of supply disruptions in Eastern Europe and the Middle East have kept oil prices higher than they otherwise would be.

China: Technology giant Huawei has reportedly developed a new artificial intelligence chip to replace the advanced Nvidia chips now barred by the US government from being exported to China. The new Huawei chip, the Ascend 910C, has reportedly been provided to top Chinese internet and communications firms for testing.

- Huawei has apparently had production problems with the Ascend 910C, and it could face more such problems as the US clamps down further on exporting advanced chipmaking equipment and services to China.

- Nevertheless, the new chip illustrates how aggressively Beijing is pushing to develop China’s own independent technologies, both for its own security and to dominate key global markets of the future.

- Beijing’s push to develop advanced technologies such as semiconductors, solar panels, and electric vehicles (which it collectively calls “new quality productive forces”) probably would have happened even without the US’s recent export controls. Now that the effort is in full swing, it will likely feed into the spiral of geopolitical and economic tensions between the Beijing and Washington, presenting risks for investors.

Vietnam-China: The Washington Post reports Hanoi has dramatically accelerated its program to expand islands it claims in the South China Sea, putting it on track to add some 1,000 acres this year through dredging and land reclamation on existing islands and shoals. The program, which aims to thwart China’s territorial claims in the area, mimics the island-building tactics that China itself used about a decade ago to assert its sovereignty in the South China Sea.

- Vietnam’s effort to do the same now could worsen Chinese-Vietnamese tensions, potentially leading to conflict and/or disruptions in the area’s vital shipping lanes.

- As we noted in our Bi-Weekly Geopolitical Report from June 3, 2024, the South China Sea is marked by multiple territorial disputes, many of which are worsening.

Germany-China: Data from the Bundesbank shows German firms’ direct investment in China totaled 7.3 billion EUR in the first half of 2024, compared with 6.5 billion EUR in all of 2023. Much of the rise in foreign direct investment represented the re-investment of profits earned in China, but the acceleration this year also reflects German companies’ new strategy of investing in China to serve the Chinese market, rather than for export. The figures raise concerns that German firms are again discounting geopolitical risks, as they previously did by relying on Russian energy.

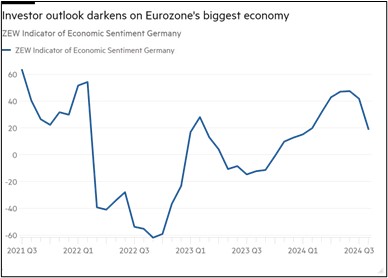

Eurozone: The ZEW Economic Sentiment Indicator for the eurozone plummeted by a seasonally adjusted 25.8 points in August to just 17.9, marking its biggest drop since early in the coronavirus pandemic. The indicator for Germany alone fell 22.6 points in a month to 19.2, for its biggest decline in two years. The drops apparently reflect the European Central Bank’s continued high interest rates, concerns about the US economy, and the risk of escalating war in the Middle East. They also raise the likelihood of further ECB rate cuts in the coming months.

Mexico: The government is bracing for a retaliatory war between two branches of the powerful Sinaloa drug cartel after its patriarch, Ismael “El Mayo” Zambada, last month was kidnapped and turned over to US authorities by the son of a longtime associate, Joaquín “El Chapo” Guzmán. To prepare for the conflict between the Zambada and Guzmán families, the government has deployed hundreds of special forces soldiers to the cartel’s home city of Culiacán, but reports say the two families are stockpiling weapons and preparing to fight each other.

- Significant new intra-cartel violence would further worsen Mexico’s reputation for insecurity. Even though Mexico is well placed to benefit from global fracturing and the “near shoring” of production closer to the US, weak rule of law and other factors have blemished Mexico’s investment environment and probably reduced how much it has benefited from current global economic trends.

- Importantly, increased intra-cartel fighting could also spill over into the US, given that the cartels have operatives north of the border.

US Regulatory Policy: As part of its “war on junk fees,” the Biden administration yesterday proposed several rule changes aimed at making it easier for consumers to cancel services and subscriptions. For example, a proposed rule from the Federal Trade Commission would require companies to make canceling a service or subscription as easy as signing up for one. While the proposals might play well politically, they could weigh on the profitability of some firms that rely on “sticky” client relationships.

US Stock Market: The Wall Street Journal today carries an interesting article on the strong outperformance of stocks recently kicked out of the S&P 500. According to new research by investment gurus Rob Arnott and Forrest Henslee, such stocks lose value quickly in the year before they are kicked out of the index, in part because of forced selling by index funds or index mimickers when their looming exit is announced. After they are out and that selling pressure dissipates, however, the stocks often outperform for about five years.

- As might be expected, Arnott and Henslee this week are launching a new index based on the strategy.

- Appropriately, the index will be called the NIXT.