Daily Comment (August 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good Morning! Investors are reacting to the strong economic data released on Thursday. In sports news, New York Yankee Aaron Judge became the player to hit 300 home runs the fastest in MLB history. Today’s Comment will delve into the market’s newfound optimism surrounding positive economic data, examine the factors driving gold’s strong performance this year, and provide a comprehensive overview of global monetary policy. As always, the report will include a summary of key domestic and international economic indicators.

September Take Off? While a rate cut at next month’s FOMC meeting appears likely, a strong economy has dampened expectations of a mega cut.

- More members of the Federal Reserve are backing a September rate cut. St. Louis Fed President Alberto Musalem reinforced this view on Thursday, endorsing a modest rate reduction as recent data suggests the economy is regaining balance. This marks a significant shift from his June stance, where he argued that rate cuts were appropriate only after several quarters, not months, of solid data. Musalem now aligns with Federal Reserve officials like Chicago and Atlanta Fed presidents Austan Goolsbee and Raphael Bostic, who also support a rate cut at the upcoming meeting.

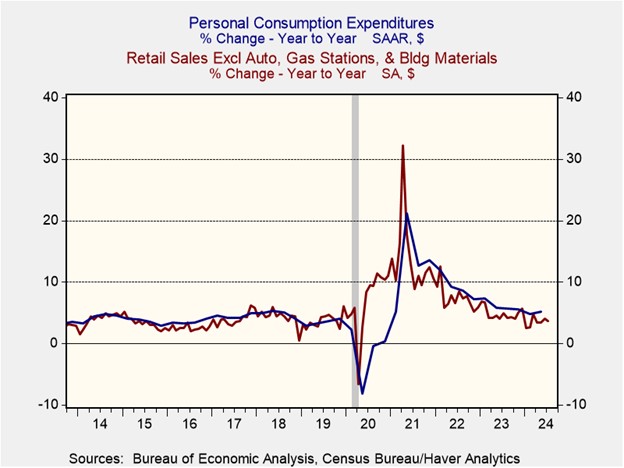

- Strong retail sales and Walmart’s upbeat outlook eased concerns that consumer demand was slowing. In July, retail sales surged at their fastest pace since January 2023, according to the Commerce Department. While the rebound in auto purchases following a crippling software attack on dealerships contributed significantly to the overall sales surge, broad-based spending growth was evident across most retail sectors. Walmart reinforced this positive trend by reporting increased spending, particularly among high-income households looking for bargains, and subsequently upgraded its company outlook for earnings.

- As September nears, market attention will likely transition from the question of whether the Fed will pivot to the timing and pace of rate cuts. A sustained period of robust economic data will probably induce a gradual approach to monetary easing from the Fed, which will be aimed at preventing a resurgence of inflation and the need for policy tightening. Conversely, signs of economic weakness, particularly a rising unemployment rate, could prompt a more aggressive easing cycle.

Gold Bulls Are Back! Bullion prices have soared to record levels as investors seek refuge in the commodity amid escalating geopolitical tensions and currency debasement.

- Gold has outperformed the S&P 500 year-to-date, surging 20.3% compared to the index’s 16.8% gain. While Chinese gold purchases contributed to the metal’s early-year rally, the recent price surge has been fueled by a broader range of factors. Soaring geopolitical tensions, exemplified by the assassination of leaders associated with the war in Gaza and Ukraine’s incursion into Russia, have intensified safe-haven demand for gold. Moreover, concerns over currency debasement, driven by nations grappling with high debt loads and potential interest rate cuts, have fueled substantial gold purchases.

- Gold has increasingly supplanted 10-year Treasury notes as the preferred safe-haven asset. This decoupling intensified in 2022 as government spending soared and the Federal Reserve rapidly tightened monetary policy. The correlation between the two assets has weakened from a strong 88% to a more modest 75% over the past two years, primarily driven by an oversupply of Treasury bonds relative to demand. While redirecting Treasury issuance towards shorter maturities has mitigated some imbalances, the fundamental relationship between gold and 10-year Treasurys appears to be broken.

- We anticipate the negative correlation between gold and Treasury yields to persist due to escalating geopolitical tensions and the diminishing appeal of US dollar-denominated assets. As the global order fractures, a declining pool of interest rate insensitive Treasury buyers will likely contribute to higher and more volatile interest rates. While potential Treasury and emergency Federal Reserve interventions could temper extreme rate spikes, we anticipate a new interest rate environment over the next few years with persistently higher levels compared to the pre-pandemic era.

Global Rate Cut Angst: There is growing concern that central banks may not be able to continue cutting rates following setbacks in inflation.

- Central banks are adopting a more cautious tone despite a wave of policy pivots this year. Brazil, one of the first major economies to cut rates, is now considering a reversal due to a worsening inflation outlook. Meanwhile, an unexpected surge in German wages has prompted calls for the European Central Bank to exercise caution before implementing another rate cut next month. In contrast, recent market turbulence has led the Bank of Japan to reconsider its tightening plans to prevent further volatility.

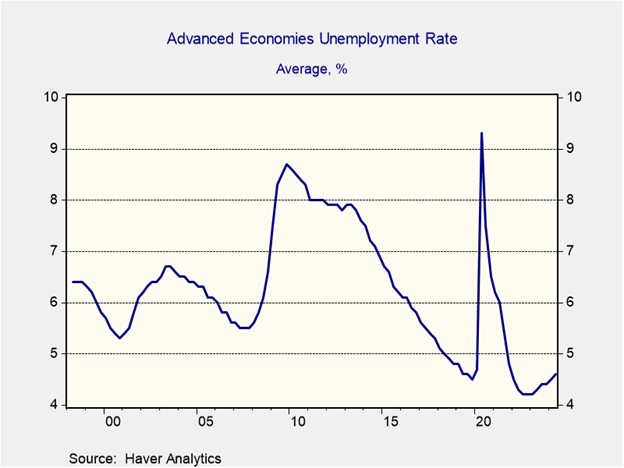

- Central banks face a complex landscape as they navigate persistent global labor shortages and the US dollar’s strength. While service sector inflation has eased, tight labor markets continue to fuel wage pressures. As the chart below shows, the unemployment rates remain notably below pre-pandemic levels. Moreover, exchange rate volatility has been a major problem, especially for countries dependent on dollar-denominated imports. The Bank of Japan’s surprise rate hike last month, partly attributed to yen weakness, underscores the challenges posed by currency fluctuations.

- As the global economy transitions towards policy normalization, investors should anticipate a more gradual process compared to previous cycles. Central banks are navigating an unprecedented post-pandemic landscape characterized by heightened geopolitical tensions and reduced global interconnectedness. These complexities will challenge policymakers to maintain consistent policy rate paths in either direction. Barring a catastrophic event, policy normalization is likely to proceed, albeit at a slower pace and in a more restrictive manner than the market currently anticipates.

In Other News: The Nigerian government claims diplomatic immunity after a French court ordered the seizure of three of its jets in a dispute with a Chinese company. The case is a test of tolerance for multilateralism in an increasingly fractured world. Democratic presidential candidate Kamala Harris has announced a plan to give first-time home buyers a $25,000 home tax credit. Saudi Arabia’s holdings of US Treasurys rose to the highest level in history, which is another sign that the demand for Treasurys is still there for foreigners looking to play both sides of the US-China rivalry.