Daily Comment (August 18, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment covers three main themes: 1) The impact of better-than-expected growth on global interest rates; 2) How China’s economic troubles are not going away anytime soon; 3) Why investors will be paying close attention to gatherings in South Africa and Jackson Hole, Wyoming, next week.

Party’s Over? Stronger-than-expected economic growth has kept central banks from cutting interest rates, leading to tighter financial conditions.

- Global bond yields have surged to their highest level since 2008 as investors price in additional rate hikes. The IMF had previously forecast that there was a 90% chance of a U.S. and European recession by the end of 2023. However, after two consecutive quarters of expansion, both economies seem on track to finish 2023 in expansion. Additionally, stubbornly high inflation rates suggest that banks may need to keep interest rates in restrictive territory for longer. These higher rates are likely to put a strain on the global financial system, which could spill over into bond markets.

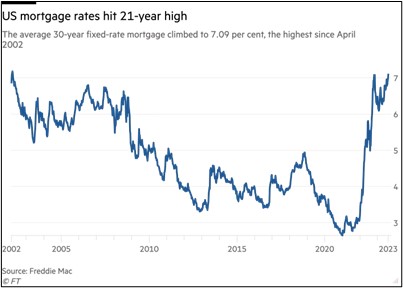

- This higher-for-longer sentiment has weighed on investor appetite for risk, sending the S&P 500 down 2.0% and the NASDAQ 100 down 3.2% since Monday. The major shift away from riskier assets is related to the growing attractiveness of higher-yielding safe assets, such as inflation-adjusted U.S. 10-year Treasuries, which surged to a 14-year high of 1.89%. The rise in yields has also impacted mortgage rates. According to the Mortgage Banker Association, the average 30-year mortgage rate has risen to its highest level since 2002 at 7.09%.

- Despite the economy being more resilient than investors thought at the start of the year, the strong economic performance is not likely to persist indefinitely. One of the primary reasons for the economy’s good run over the last few quarters is that fiscal and monetary policies have likely made households less sensitive to changes in interest rates. Over 60% of homeowners have mortgage rates below 4%, and firms were able to take advantage of favorable credit conditions to extend the duration of their loans before interest rates rose to their current levels. According to the Fed Small Business Credit Survey, over 58% of firms applied for new financing in 2022, which reduced their need for new loans.

China Worries Spreads: There is mounting evidence that China is still facing a severe property crisis.

- The Chinese financial system is coming under scrutiny after several institutions were unable to repay their debts. Zhongrong International Trust Co., which considerable real estate exposure, has missed payments on several products and currently has no immediate plan to make creditors whole. The situation has led to a spate of protests as clients look to hold the trust accountable. At the same time, China Evergrande Group filed for bankruptcy in New York and is currently working on restructuring its debt in Hong Kong. The ongoing turmoil shows that China’s property problems are likely worsening.

- The situation is likely to exacerbate China’s economic woes. Earlier this month, it was revealed that Chinese exports had fallen by the largest amount since the start of the pandemic. Meanwhile, consumer confidence remains near all-time lows. Additionally, Beijing’s resistance to providing additional stimulus is also likely to hamper the country’s economic growth and investor sentiment. The ongoing troubles have led to increasing calls for the People’s Bank of China (PBOC) to provide more aggressive policy easing to address these issues. The PBOC has already cut policy rates twice in three months and may offer more easing if the economic situation continues to deteriorate.

- The financial instability in China is currently isolated from the rest of the world. However, the global markets may still feel the spillover effects. Much of the domestic demand is expected to decline as China deals with its debt burdens. This problem could become more acute if Beijing forces households to absorb the losses from the property fallout. As a result, this could have a negative impact on international trade, as the lack of Chinese demand will weigh on commodity prices and make the country’s exports relatively cheap. This could help to reduce global inflation.

A New Chapter: Next week, two major conventions will take place, one in South Africa and the other in the United States.

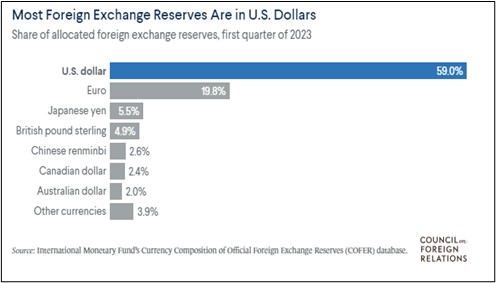

- The 15th BRICS summit will take place in Johannesburg, South Africa on August 22-24, 2023. Leaders are expected to discuss the development of a new common currency backed by the commodities of the group members. There is also speculation that the bloc may be expanding to include more countries. While the group has denied that it is trying to create a rival to Western dominance in international trade, it is clear that they are at least interested in providing an alternative to the current order. As a result, the event will be closely watched by the global community.

- Meanwhile, central bankers from around the world will be gathering in Jackson Hole, Wyoming, for the annual meeting of the Federal Reserve Bank of Kansas City. The meeting is traditionally a forum for central bankers to share their views on the global economy and monetary policy. This year’s meeting is likely to be particularly important as policymakers grapple with the challenge of tightening monetary policy without triggering a recession. Federal Reserve Chair Jerome Powell is set to speak at the summit, and his remarks will be closely watched for clues about the Fed’s future policy plans.

- The upcoming BRICS summit and the Jackson Hole Economic Policy Symposium may have major ramifications for interest rate expectations. The potential for BRICS to issue bonds backed by a non-U.S. currency could sap future demand for U.S. Treasuries, making it more expensive for the U.S. government to borrow money. Although this is unlikely to happen, it is a risk that investors will be watching closely. Powell’s speech at Jackson Hole is also likely to be closely scrutinized by investors. While he is widely expected to remain vague about the Federal Open Market Committee’s next rate decision, he could give investors some insight into the inner thinking of policymakers. Any hints about the direction of future rate hikes could have a significant impact on financial markets.

Odds and Ends: President Trumps said that he would not reappoint Powell if reelected. There are over 2.2 trillion options set to expire today.