Daily Comment (August 19, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some notes on Vice President Harris’s big economic speech on Friday, which appears to have fallen rather flat. (We also note that the Democratic Party opens its national convention in Chicago today.) We next review several other international and US developments with the potential to affect the financial markets today, including another move by China to weaponize its rare-earth mineral resources and a new statement by a Federal Reserve policymaker pointing to only cautious interest-rate cuts starting in September.

US Economic Policy: In a speech on Friday laying out her economic agenda if she were to win the presidency, Vice President Harris proposed several populist measures aimed at cutting taxes and reducing living costs for working-class families. As with her proposal the previous week to make tips to service and hospitality workers tax-exempt, some of her proposals echoed the populist goals of the Republican ticket. As we’ve noted before, it appears the two sides are in a potentially expensive bidding war for working-class voters.

- Harris’s proposals include re-instating the expanded child tax credit from the pandemic era, but she would raise it to $6,000 until the child’s first birthday. That echoes a recent proposal by Sen. JD Vance, the Republican’s vice presidential candidate, to hike the child tax credit to $5,000.

- To help bring down housing costs, Harris proposed tax incentives and subsidies aimed at encouraging homebuilders to construct more affordable homes. She laid out a goal of having three million new housing units built by the end of her term.

- Harris also proposed a series of regulatory actions to bring down prices, including moves to stop alleged “price gouging” by companies and negotiating lower prices for more drugs bought by the Medicare and Medicaid programs.

- In energy policy, Harris has adopted an ambiguous approach, even though she has stepped back from the idea of banning hydraulic fracturing to search for oil and gas on federal lands, which she had proposed in her 2019 run for president as she made a play for the progressive wing of the Democratic Party.

- Finally, in international trade policy, Harris criticized former President Trump’s proposal for massive tariffs of 60% against imports from China and across-the-board tariffs of 10% or more on imports from other countries, saying those moves would raise prices for US consumers.

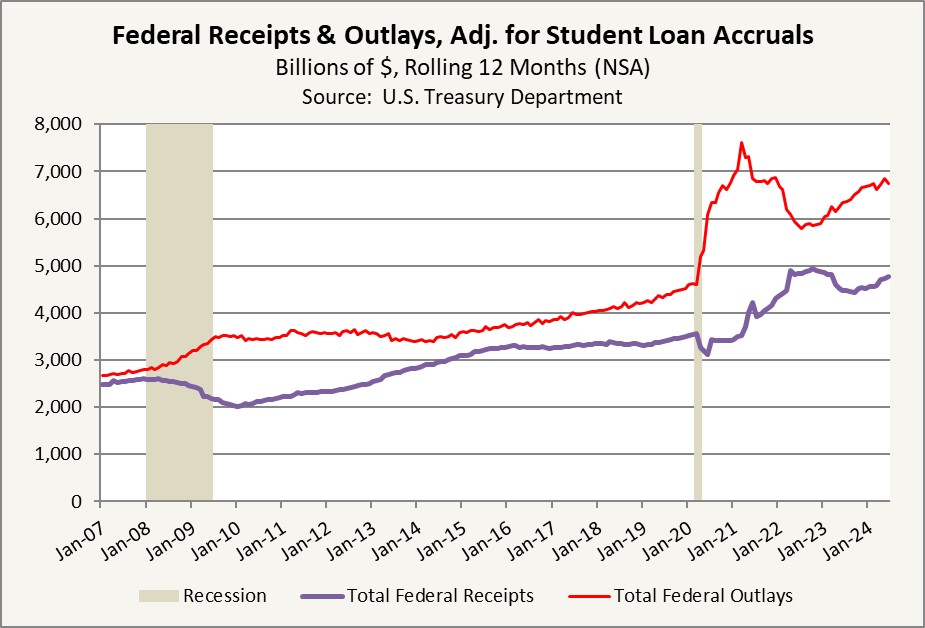

- Of course, even if Harris is elected, her ability to pass these economic ideas would largely depend on whether the Democrats or the Republicans control Congress. Nevertheless, the overall populist tenor of the two parties’ proposals is consistent with our expectation that the US budget deficit, consumer price inflation, and interest rates will be higher in the coming years than over the last couple of decades.

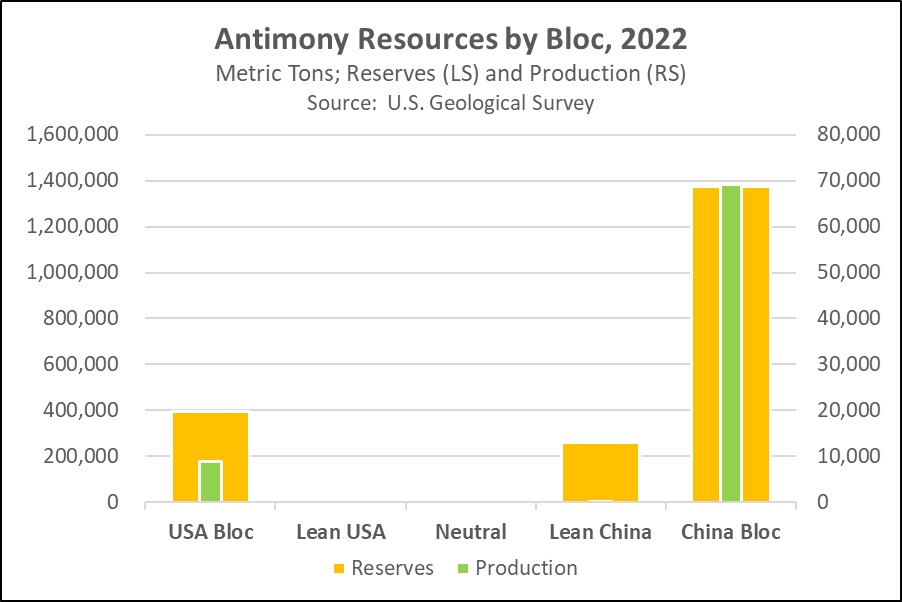

China-United States: The government last week said it will impose export controls on rare antimony metals, ores, and oxides, as well as equipment for processing superhard materials, starting September 15. Since antimony is critical to producing many advanced technologies, including armor-piercing ammunition, the new restrictions are being seen as retaliation for the recent US moves to block Chinese imports and investments and restrict China’s access to advanced US technologies.

- Given that the world continues to fracture into relatively separate geopolitical and economic blocs, a key question is whether China’s action will seriously crimp US access to antimony. As shown in the chart below, most of the world’s antimony reserves and output are in China’s bloc, meaning Beijing’s new measures could have a serious impact on the US and its allies.

- In our analysis of global fracturing, we have long expected the China bloc to weaponize its extensive commodity holdings to retaliate for the US’s recent trade, investment, and technology barriers. Besides antimony, Beijing and Russia (its junior partner) have already clamped down on natural gas and rare earths exports. Going forward, we believe the resulting risk to supplies will tend to boost commodity prices generally.

China-Philippines: According to Manila, Chinese coast guard ships rammed at least two Philippine coast guard vessels this morning near a disputed shoal in the South China Sea. The incidents caused significant damage to the Philippine vessels, but they apparently caused no injuries. Nevertheless, as we’ve noted before, the new tensions around Sabina Shoal show there is still some risk of a conflict developing between China and the Philippines, despite a deal the two countries recently struck to ease tensions around a separate shoal in the area.

- The tensions between Beijing and Manila are especially dangerous because of the US-Philippine mutual defense treaty. In the event of a Chinese attack on the Philippines or Philippine vessels, the US could be obligated to come to Manila’s defense.

- The Philippine government has said that a key red line would be if aggressive Chinese action killed a Philippine citizen.

Thailand: King Maha Vajiralongkorn yesterday endorsed Paetongtarn Shinawatra as Thailand’s new prime minister, following her election by parliament last week. Paetongtarn is now the third member of the billionaire Shinawatra family to lead Thailand. Her elevation follows yet another power play by the country’s conservative monarchists and their allies on the top court, which recently banned a key reformist party and forced out the previous prime minister. The incident shows that political instability remains an investment risk in Thailand.

Germany-Ukraine-Russia: Finance Minister Lindner, a member of the fiscally conservative Free Democrats Party, has reportedly sent a letter to the German ministries of foreign affairs and defense saying he won’t approve any new requests to send military aid to Ukraine unless new funding is identified to pay for it. Lindner was reportedly urged to write the letter by Chancellor Scholz, the leader of the center-left Social Democratic Party (SPD) who has been pressured by pacifists in his party to reduce involvement in the Russia-Ukraine war.

- To date, Germany has been the second-biggest donor of military aid to Ukraine, after the US. Any cut-off of German aid could have a significant impact on Kyiv’s ability to keep fending off the invading Russians.

- Lindner’s letter brings to light the fractious nature of Germany’s ruling three-party coalition. In contrast with the Free Democrats and SPD, the Greens have been more supportive of Ukraine and the need to boost defense spending. Panning Lindner’s letter, a Green lawmaker quipped, “One has the impression that it is about sacrificing peace and freedom, but remaining debt-free.”

- More broadly, we continue to believe that growing tensions between the China/Russia geopolitical bloc and the US bloc will keep driving defense budgets higher over time. Being closer to the Russian threat and not facing the toxic budget politics of the US, the Europeans have made much progress in that direction, giving European defense stocks a big boost. However, the news of Lindner’s letter has driven those stocks sharply lower so far today.

United Kingdom: Now that Prime Minister Starmer’s new government has offered generous pay hikes to striking doctors and train drivers, unions representing other healthcare and transport workers are reportedly considering going on strike to see what they can get. If the new strikes and pay hikes materialize, it would put further pressure on the UK’s big budget deficit and may tempt Starmer’s government to call for even bigger tax hikes than expected.

US Monetary Policy: In an interview with the Financial Times, San Francisco FRB President Daly said recent economic data has given her more confidence that inflation is coming under control, but she said the Fed should still be “prudent” and cut interest rates only gradually to make sure price pressures don’t increase again. Coming just days before the Fed opens its annual Jackson Hole monetary policy conference, the statement helps confirm that investors had gotten ahead of themselves in recent weeks as they began to expect an aggressive rate cut in September.

US Art Market: New reporting shows auction prices for paintings and other artworks have plunged over the last year, especially for the output of young, up-and-coming artists. The values of some celebrated paintings have plunged as much as 90% from their peak. Even though the art market was at a record high just a few years ago, prices are now dropping in response to higher interest rates and moderating economic growth.