Daily Comment (August 2, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are off to a poor start today as investors fret over a possible recession. In sports news, US gymnast Simone Biles has claimed another individual all-around Olympic gold medal. Today’s Comment will examine investor concerns over rising capital expenditures, explain how labor costs could contribute to the Fed’s inflation target, and discuss China’s recent decision to expand its nuclear arsenal. As usual, we will conclude with a roundup of domestic and international economic data.

The Great Reset: AI woes and Fed uncertainty keep the market on edge, with investors bracing for September’s rate decision.

- The tech sector’s heavy focus on AI is increasingly frustrating investors seeking immediate returns. Amazon’s stock price plunged by as much as 5% on Thursday after the company issued disappointing Q3 guidance and announced plans to escalate capital expenditures on AI. Given current valuations, investors are concerned that tech companies’ AI ventures may not generate profits as quickly or significantly as anticipated. The market exhibited similar reactions to comparable strategies adopted by Alphabet, Microsoft, and Meta.

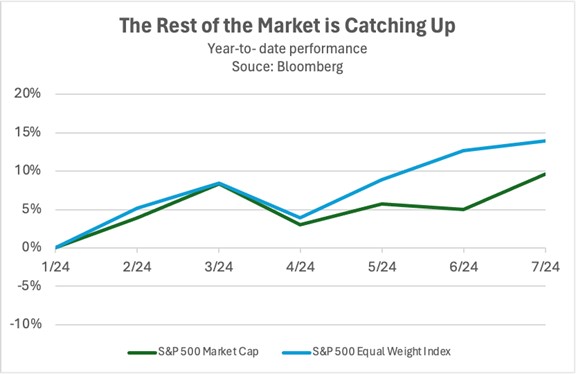

- Investor enthusiasm for highly valued tech stocks has cooled as the market anticipates interest rate cuts and analysts grow increasingly skeptical of companies prioritizing capital spending over immediate profits. Tech giants previously thrived as investors sought higher potential returns in a rising interest rate environment. However, with the prospect of declining borrowing costs, the market’s focus is shifting toward sectors like Real Estate and Utilities. This market rotation has allowed the S&P 500 Equal Weight Index to gain ground on its market-cap-weighted counterpart this year.

- The S&P 500’s three consecutive daily swings of over 1% this week, a level of volatility unseen since January, underscore the market’s fickle nature. As the Fed continues to tease a potential rate cut, we could see a shift in investor focus from growth to value stocks, which would emphasize current profitability over future earnings potential. However, investors must remain vigilant for a potential hawkish pivot by the Fed, especially if inflation unexpectedly resurges. This could cause investors to rethink their previous strategies and create even more volatility in markets.

Labor Costs and Inflation: Declining unit labor costs coupled with increased productivity further indicate easing inflationary pressures.

- Productivity, as measured by output per hour, surged in the second quarter, while labor costs remained relatively stable. According to the Bureau of Labor Statistics, nonfarm productivity rose at an annualized pace of 2.3% in the second quarter. This was an improvement from the previous quarter’s rise of 0.4%. Conversely, unit labor costs decelerated noticeably, declining from an annualized pace of 3.8% to 0.4% in the same period. This is the lowest reading in 2.5 years.

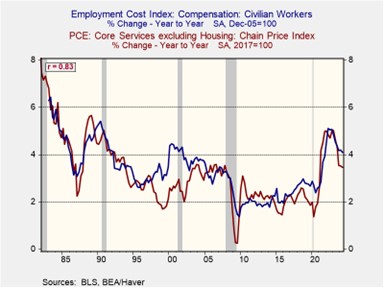

- Significant productivity gains are likely to bolster the Fed’s confidence in engineering a soft landing. This sharp increase indicates the economy can sustain growth without igniting inflationary pressures. Last quarter’s accelerated GDP growth from 1.4% to 2.5% coincided with a notable decline in price pressures, as evidenced by the GDP deflator falling from 3.1% to 2.3%. Moreover, moderating wage growth will be instrumental in keeping inflation on track toward the 2% target. As the chart below illustrates, the Fed’s core services index is highly correlated with employment costs.

- The Fed is confronted with the challenge of curbing inflation without precipitating a recession. Despite recent GDP growth, indicators point to a potential economic slowdown. Corporate reports of waning consumer price tolerance and a near high for the year in jobless claims amplify these concerns. While we do not share the market’s pessimistic recessionary outlook, we acknowledge the possibility of economic deceleration. Notably, the current economic landscape echoes that of 2023, characterized by a summer surge in initial jobless claims followed by a subsequent normalization.

Nuclear Proliferation: China seeks to rewrite the rules of nuclear buildup as it looks to catch up to the US.

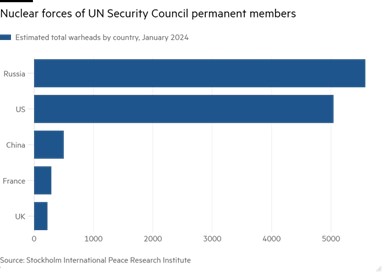

- Beijing has proposed a pledge among the five permanent UN Security Council members to refrain from using nuclear weapons first. As the sole council member to make such a proposal, China appears to be seeking a tactical advantage in the ongoing nuclear disarmament debate. This move comes in response to US-led efforts to reduce nuclear arsenals globally. Notably, China has accused the US of violating the Non-Proliferation Treaty due to its pledge to defend European allies in the event of a nuclear attack.

- Despite criticism, the motives behind China’s nuclear buildup remain a subject of debate. Projections indicate that China could possess over 1,000 nuclear warheads by 2030, a substantial increase from the 200 it held in 2019. However, this pales in comparison to the US and Russia, with each estimated to have over 5,000 warheads. Due to this significant disparity, some analysts theorize that China’s goal is not to achieve nuclear parity with its rivals but rather to deter potential aggression.

- We are moving toward a more hostile world. As global geopolitical tensions rise, other nations may pursue their own nuclear deterrents. Iran and North Korea have already expanded their nuclear capabilities. Additionally, countries aligned with the US could potentially follow suit, especially if US security guarantees are perceived to have weakened. This increased demand for uranium, coupled with production constraints, could drive up uranium prices significantly over the next decade. Additionally, the potential increase in nuclear ability may raise the possibility of a miscalculation that leads to a major conflict.

In Other News: The US has secured the largest prisoner exchange in the post-Soviet era as the president seeks to reassure critics of his administration’s effectiveness. Additionally, the tech sell-off has spread to other markets, particularly Japan, as investors reassess portfolio allocations in light of shifting interest rate expectations.