Daily Comment (August 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a potentially groundbreaking deal in which a Canadian firm is seeking to buy the Japanese company that owns the 7-Eleven chain of convenience stores. If successful, the deal would be the biggest-ever foreign takeover of a Japanese firm. We next review several other international and US developments with the potential to affect the financial markets today, including an interest-rate cut by Sweden’s central bank and a proposal by Vice President Harris to hike the US’s maximum corporate income-tax rate to 28%.

Japan: Seven & i Holdings, the Japanese firm that owns 7-Eleven, has announced it is considering a friendly takeover offer from Canadian retailer Alimentation Couche-Tard, which has a controlling stake in the Circle-K chain. Any deal would face US antitrust scrutiny, of course. Nonetheless, if a transaction is concluded, it would be the biggest-ever foreign takeover of a Japanese company.

- If a deal can be concluded, it would also signal that Japan has made further progress in dismantling its prior protective, inflexible business culture and regulatory approach.

- To date, the progress on that front has already helped make Japan a darling of stock investors in recent years. If the proposed Seven & i deal is successful, it could unlock even more value in Japanese stocks.

Australia: The minutes of the Reserve Bank of Australia’s latest policy meeting, which were released today, showed that the central bank has ruled out any interest-rate cuts in the near term due to continued price pressures. With the Bank of Japan starting to hike rates and the RBA holding them steady, that makes the two Asia-Pacific central banks the most important holdouts against the broader trend toward rate cuts in major developed economies.

China: The Shanghai and Shenzhen stock markets yesterday said they have cut the amount of data they will provide on foreign inflows into onshore shares, apparently to reduce the influence of foreign capital flows on the domestic markets. The move, which was likely made under pressure from Beijing, is another example of government intrusion into China’s private markets, which we think is one reason for China’s recent slowdown in economic growth.

Israel-Hamas Conflict: Hamas and Palestinian Islamic Jihad said they were responsible for an attempted suicide bombing in Tel Aviv yesterday. The bomb detonated early, killing the attacker and slightly injuring just one bystander. Nevertheless, as Israel continues pummeling Gaza to destroy its Hamas-led government, the attack may signal that the Palestinians are shifting tactics back to the frequent suicide bombings that rocked Israel in the early 2000s. If successful, such tactics could leave Israel with prolonged security issues, even if Hamas is routed in Gaza.

Sweden: Citing “somewhat” weaker economic growth and roughly on-target consumer price inflation, the Riksbank today cut its benchmark short-term interest rate by 25 basis points to 3.50%. The central bank also signaled it will probably cut rates two or three more times before the end of the year if the inflation outlook doesn’t worsen again. The move reflects the broad trend toward lower interest rates in key economies around the world (excluding Japan and Australia, as mentioned above).

Canada: Ahead of a railroad strike that could be launched as soon as Thursday, global shipping giant A. P. Moller-Maersk said it will stop taking orders for Canada-bound cargoes that would have to be transferred to rail transport. More broadly, the threatened strike could significantly disrupt the operations of companies across North America, given how intertwined the US and Canadian economies are.

US Tax Policy: As the Democratic Party opened its national convention in Chicago yesterday, Vice President Harris’s campaign office said she now endorses hiking the maximum corporate income tax rate to 28% from today’s 21%. The proposal sharpens the contrast between Harris and Republican nominee Donald Trump, who has proposed cutting the rate to 15%.

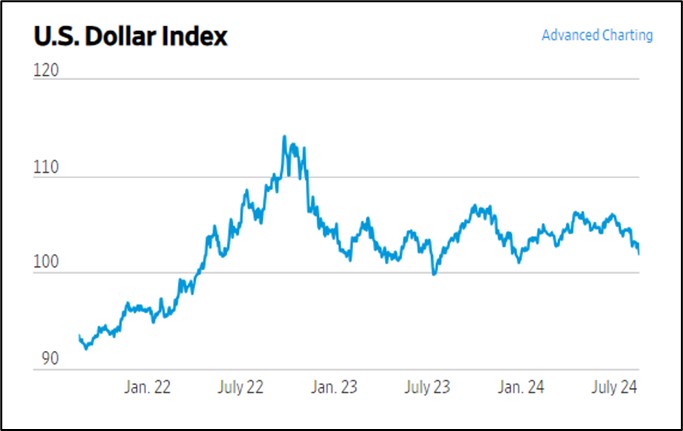

US Dollar: The greenback weakened against a key basket of currencies again today, leaving the widely followed US Dollar Index down 4.1% from its most recent high in May and basically right where it was at the start of the year.

- The index is still historically high after the dollar’s long bull market that began more than a decade ago, but it has been stuck in a range between about 106 and 100 since the beginning of 2023.

- If the prospect of falling US interest rates now pushes the index below 100, it could potentially signal a longer-term downtrend for the greenback.

- Any potential bear market in the greenback would likely be positive for international stocks going forward.