Daily Comment (August 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The stock market is currently grappling with the potential for interest rate cuts, fueled by the recent downward revisions to BLS payroll data and dovish commentary from Federal Reserve officials. In sports news, Cincinnati Reds first baseman and 2010 NL MVP Joey Votto has announced his retirement at the age of 40. Today’s Comment delves into the recent Federal Reserve meeting minutes, explores the escalating tensions between the West and China in the race for clean energy dominance, offers a comprehensive update on Mexico, and discusses the increase in US concern about China’s nuclear capabilities. As always, our report concludes with a concise overview of key domestic and international data releases.

Doves Take the Wheel: Expectation of a rate cut in September appear locked in after it was revealed that some policymakers were willing to cut in July.

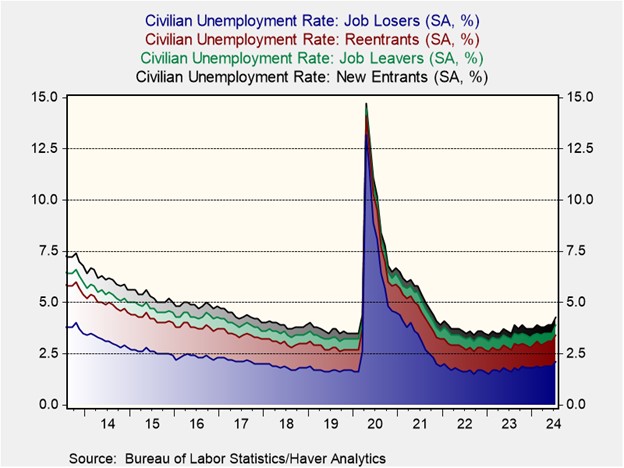

- The Federal Open Market Committee (FOMC) released the minutes from its July 30-31 meeting, which highlighted the growing shift in Fed officials’ focus away from its inflation mandate and toward employment. Nonfarm payroll data and the unemployment rate have exhibited signs of increasing and raised red flags for the committee. Additionally, FOMC members expressed optimism that inflation is likely to continue its downward trend. Despite a unanimous vote to maintain interest rates, several members expressed an openness to supporting a decision to cut interest rates by 25 basis points.

- While the recent triggering of the Sahm Rule has fueled expectations for a substantial interest rate cut at the Fed’s upcoming meeting, we maintain a cautious outlook. Although the rule (which measures the three-month moving average of the unemployment rate against its 12-month minimum) has surpassed its recession threshold of 0.5%, the spike could be transitory. The early July passage of Hurricane Beryl through the southern states likely contributed to a temporary surge in job losses.

- The Federal Reserve’s decision on interest rate cuts will likely be influenced by the August employment and Consumer Price Index (CPI) reports. While the July Personal Consumption Expenditure (PCE) data may offer some insights, its impact is expected to be relatively minor. If these figures continue to support the notion of a cooling labor market and inflation, the Fed is likely to implement a 25-bps rate cut in September. A larger, more substantial cut would likely only be considered if there is another unexpected surge in the unemployment rate.

The Great Split: While it appears that demand for EVs have waned, the geopolitical war over dominance in the space has started to heat up.

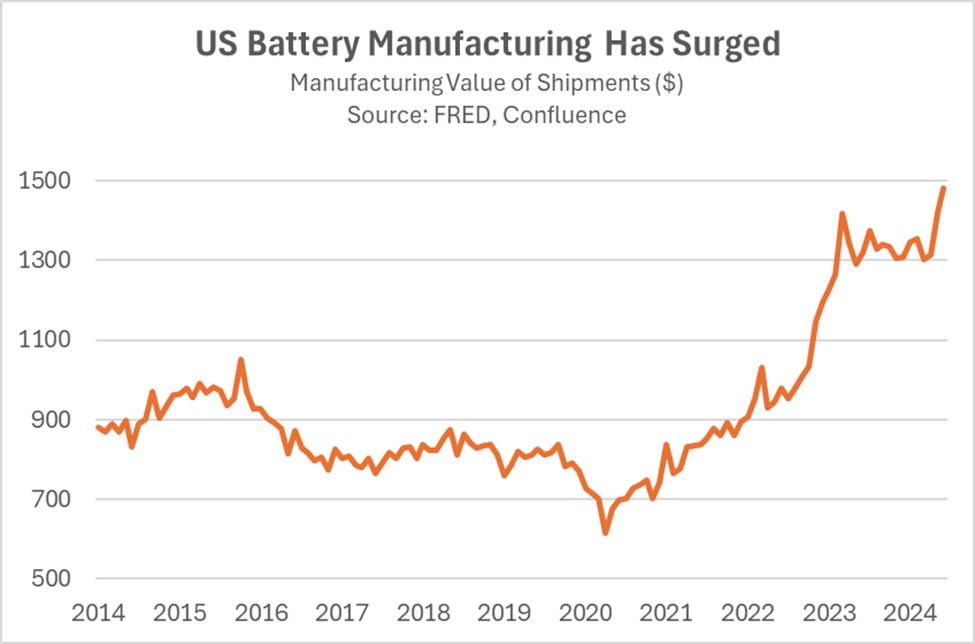

- The West is actively working to prevent China from dominating the clean energy sector. Next month, the EU plans to impose tariffs as high as 36% on Chinese-made electric vehicles, including Tesla, due to unfair competition concerns. This move is intended to protect its struggling industrial sector by preventing China from dumping its artificially cheap plug-in vehicles in Europe. The production of electric vehicles in the West has faced challenges due to limited consumer demand. Recently, Ford scrapped plans to build a fully electric SUV.

- Despite weak demand, the West has continued efforts to bridge the technological gap with China. Earlier this week, the Department of Defense approved a $20 million grant to fund a cobalt sulfate refinery in Canada, a mineral that is a critical precursor for battery production. Meanwhile, the EU secured a deal with Serbia to allow lithium mining last month. These moves align with both regions’ plans to expand their renewable energy capacity. US battery production is expected to increase from 257 to 1000 gigawatts hours over the next decade, while Europe aims to become battery cell self-sufficient by 2026.

- The battle for clean energy dominance is likely to intensify over the coming years. The Inflation Reduction Act, designed to incentivize clean energy projects, has strategically targeted Republican districts to counter conservative efforts to undermine its goals. Meanwhile, Europe’s ability to wean itself off imported fossil fuels from hostile powers like Russia hinges on the successful development of its renewable energy resources. While China will likely dominate the space for now, we expect the West to push through plans for renewable energy despite the political headwinds.

The New Mexico: Growing concerns surround the country’s direction as Claudia Sheinbaum prepares to become president.

- Mexican judicial officials staged a strike on Wednesday in protest of controversial reforms aimed at overhauling the country’s court system. The proposed system would elect judges, including those in the high court, through popular vote. This initiative, championed by outgoing President Andrés Manuel López Obrador (AMLO), is intended to combat corruption and impunity within the judiciary. However, it has been widely criticized as a tactic to replace judges who oppose his agenda with those who will support it. The push has led to concerns about the lacking balance of powers within the government.

- The push to reform the country’s judicial system could further tarnish Mexico’s reputation as a nearshoring hub for companies seeking proximity to the US supply chain. During the AMLO presidency, the judiciary served as a valuable check on the president’s overreach. For instance, earlier this year, the Supreme Court struck down a law that would have favored state-owned power companies over private ones. The proposed reforms could pave the way for more policies that would increase the costs of doing business in Mexico for foreign investors.

- With AMLO’s Morena party securing a supermajority, a sweeping overhaul of the judicial system appears inevitable. The market has already reacted, leading to a sharp sell-off in the country’s currency, with the Mexican peso (MXN) dropping 10% against the dollar since the election. Meanwhile, Mexican equities have also suffered. This trend could shift after the US election if the next American president pushes for changes to the USMCA. As a result, we believe the situation in Mexico remains fluid.

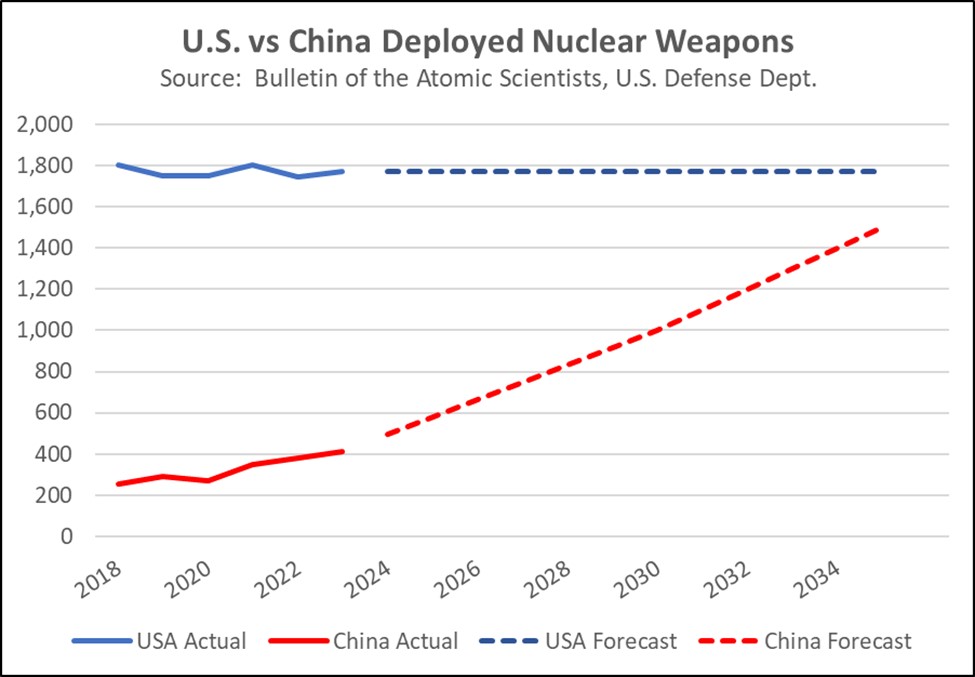

United States-China-Russia: According to the New York Times, President Biden in March approved a highly classified nuclear strategic plan, the “Nuclear Employment Guidance,” that prioritizes China ahead of Russia for the first time. It also directs preparation for a coordinated joint nuclear attack from China, Russia, and North Korea. The new plan is consistent with fears that China’s nuclear arsenal will match or exceed the deployed US arsenal within 10 years.

- The rapid growth in China’s strategic nuclear arsenal will likely reinforce the US’s emerging bipartisan support for nuclear modernization and rising defense budgets.

- More broadly, it will probably also contribute to further tensions between the Chinese bloc and the West.