Daily Comment (August 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is still anxiously awaiting clues on the Federal Reserve’s next move. In sports news, Hideki Matsuyama continued his impressive run at the BMW Championship with a remarkable 73-yard putt for his third consecutive birdie. Today’s Comment will discuss our views on interest rate expectations and long-term bond rates, the persistent threat that unions pose to controlling inflation, and our early impressions of the two leading presidential candidates. As always, our report includes an overview of domestic and international news.

After the Fed Cuts: While investors eagerly await Powell’s speech for hints about the Federal Reserve’s September moves, we contend that monetary policy’s sway over the market is waning.

- Before his speech, several Federal Reserve officials have been working to temper market expectations. On Thursday, Boston Fed President Susan Collins and Philadelphia Fed President Patrick Harker both indicated a willingness to consider rate cuts at the Fed’s upcoming meeting but advocated for a cautious approach. However, there is noticeable hesitation about easing policy. Kansas City Fed President Jeffrey Schmid expressed that he would like to see more data before endorsing a rate cut, a sentiment shared by Fed Governor Michelle Bowman.

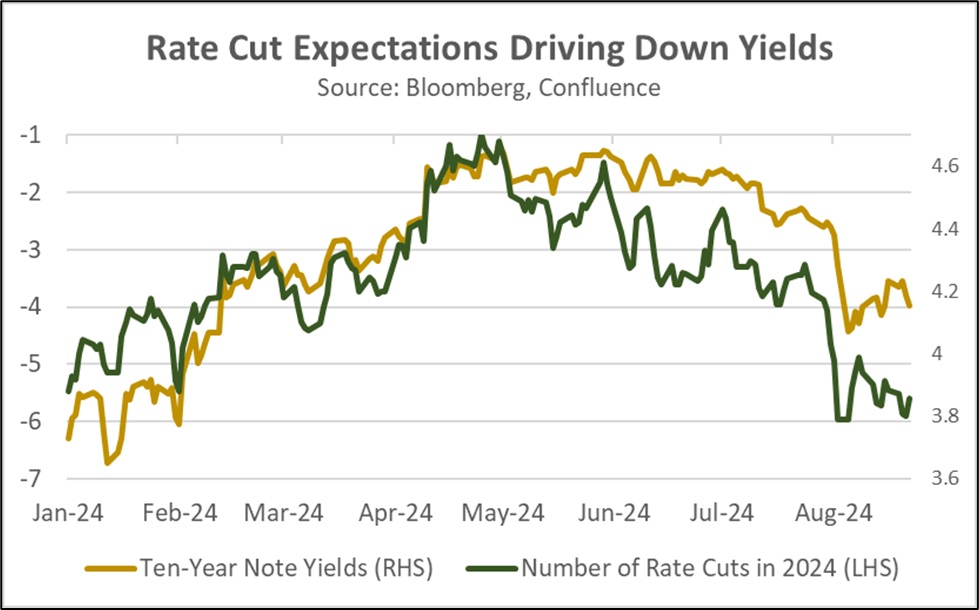

- Historically, Fed expectations have been a strong predictor of long-term interest rates. However, this year, the correlation between these two factors has become less pronounced. This divergence is likely attributable to concerns that the Fed may not be as aggressive in cutting rates as it has been in past cycles. The FOMC’s latest economic projections indicate that members anticipate the long-run rate to reach 2.8%, which is above the 20-year average by 100 basis points. This suggests that the market may be looking past the first rate cut.

- While the market may be looking to Powell’s Jackson Hole speech for signals of a potential 50 basis point rate cut at the September FOMC meeting, we believe such a move is unlikely. Even if we are mistaken, we would expect the effect on long-term rates to be minimal because the market has likely already priced in most of the expected rate cuts for the coming year, leaving little room for further declines. Consequently, other factors such as the widening fiscal deficit, aging demographics, and economic growth are more likely to influence long-term rates in the coming months.

Supply Chain Mayhem: The threat of disruptions to shipments has increased as Canadian railway workers continue their strike and US East and Gulf Coast port workers consider similar actions.

- North American supply chains will likely cope with twin strikes. In Canada, the government has intervened in the ongoing rail strike. The labor board has been ordered to end the shutdown that has halted freight traffic for the past two days. Two railway unions went on strike following failed contract negotiations with Canadian National Railway and Canadian Pacific Kansas City regarding railway schedules, safety, and time management. Meanwhile, US port workers are also threatening a strike in October. Negotiations have stalled over the use of automation for processing trucks without human labor.

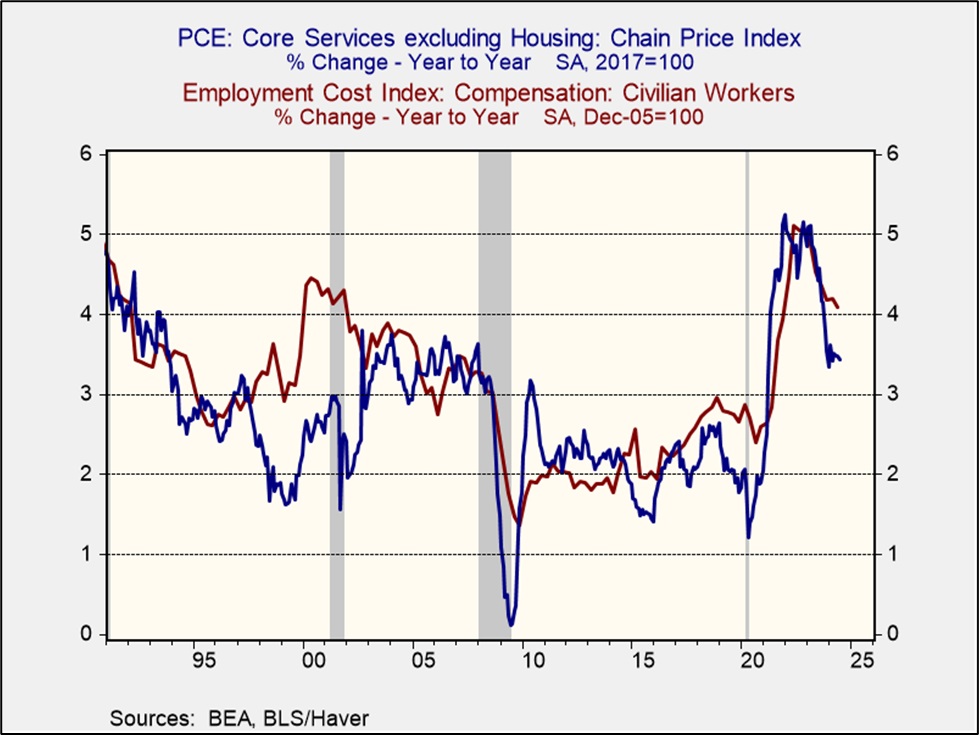

- The threat of strikes arrives at a politically charged moment. Since the pandemic, unions have experienced a resurgence, with the percentage of US workers belonging to unions reaching its highest point since the mid-1960s. The shift in sentiment has occurred as union leaders have been able to leverage a shortage of labor supply to demand higher wages for workers. Over the past four years, worker compensation has risen at the fastest pace since the early 2000s, though recent data suggests a slowdown.

- Unit labor costs are arguably the most reliable indicators of long-term inflation. As marginal production costs rise, firms are more likely to pass these costs on to consumers. Consequently, the resurgence of labor unions could hinder the Federal Reserve’s efforts to achieve its 2% inflation target. As the chart above demonstrates, worker compensation has been a primary driver of core PCE services, a key inflation metric closely watched by the Fed. While rising productivity has thus far helped offset increased wage bills, a reversal of this trend could significantly complicate inflation control efforts.

First Impressions: With the major parties having officially selected their presidential nominees, it’s time to summarize their key ideas.

- The Republican presidential candidate, Donald Trump, a supply-sider with a populist edge, advocates for expanding domestic production through deregulation and incentives to bring manufacturing back to the US. He has pledged to lower taxes and eliminate restrictions on energy production. In contrast, the Democratic nominee, Kamala Harris, a traditional Keynesian, supports using subsidies and regulation to achieve her policy goals. She has endorsed price controls on medication, rent, and food and has proposed grants for first-time homebuyers.

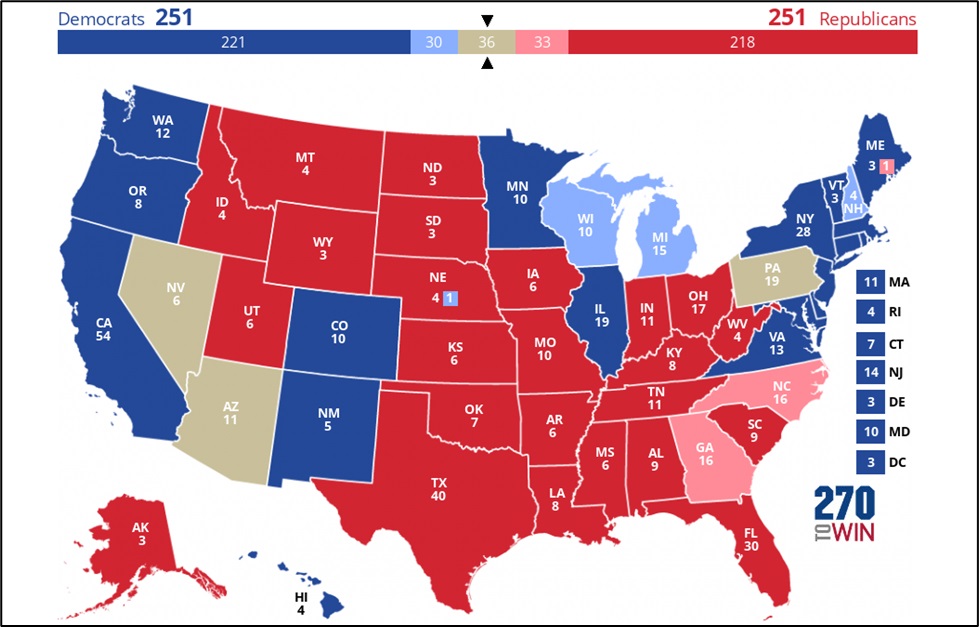

- While the president plays a key role, the primary arena for policy battles is Congress. In recent decades, rising partisanship has hindered both parties’ ability to pass legislation as groups have become increasingly focused on obstructing the other rather than passing laws. A prime example of this is the reliance on continuing resolutions, which avoid government shutdowns but fail to address the deficit. Although controlling both houses of Congress increases the chances of passing legislation, it has also made it easier for fringe groups to derail the process.

- The betting odds indicate a closely contested election. On PredictIt, Kamala Harris holds a slight lead of 55% to 48%, while Polymarket shows Donald Trump ahead at 51% to 47%. However, bettors are leaning toward a split in Congress. Polymarket suggests a 72% chance that Republicans will regain the Senate, while Democrats have a 62% chance of regaining the House. With plenty of time before Election Day, these odds are subject to change. That said, if they hold, both candidates will face challenges in fulfilling their campaign pledges.

In Other News: Hamas rejected the latest ceasefire agreement over demand to have troops in Gaza. The rejection is a reminder of how hard it will be for the two sides to end the conflict within a short time. An oil tanker was attacked in the Red Sea, another indication of the threat that geopolitical tensions pose to supply chains. Separately, RFK Jr. is widely expected to step down from presidential contention and is rumored to be endorsing President Trump in exchange for a potential role in his administration, possibly as the head of the National Institutes of Health or as Spy Chief.