Daily Comment (August 7, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are off to a strong start as risk sentiment improves. In sports news, Team USA’s basketball team dominated Brazil, securing their spot in the semifinals against Serbia. Today’s Comment will explore why the market has stabilized since Monday’s sell-off, share our thoughts on carry trades, and provide an update on the UK budget situation. As usual, our report includes a summary of international and domestic data releases.

All Calm on the Market Front: Equities staged a recovery from Monday’s sharp decline, yet investors remain cautious about potential future turbulence.

- The S&P 500 surged 1.7% on Tuesday, rebounding from a global sell-off ignited by recession concerns. Despite these fears, recent economic indicators point to a resilient economy. Wednesday’s S&P Global and ISM Purchasing Managers Indexes not only confirmed continued expansion but also surpassed market forecasts. Moreover, the Senior Loan Officer Opinion Survey revealed that while banks have tightened lending standards overall, the net share of lenders which have tightened conditions has decreased from the previous quarter, signaling potential optimism in the lending market.

- While the market has experienced a slight reprieve, underlying uncertainty persists. The CBOE Volatility Index (VIX) declined from 32.38 to 27.71 on Tuesday, though it remains significantly elevated above the 20 level, indicating continued market anxiety. This elevated reading reflects investors’ continued uncertainty about the Federal Reserve’s interest rate trajectory. While policymakers have indicated that recent events won’t prompt an immediate rate cut, market participants still anticipate potential adjustments to the rate cut outlook beyond the previously projected single reduction this year.

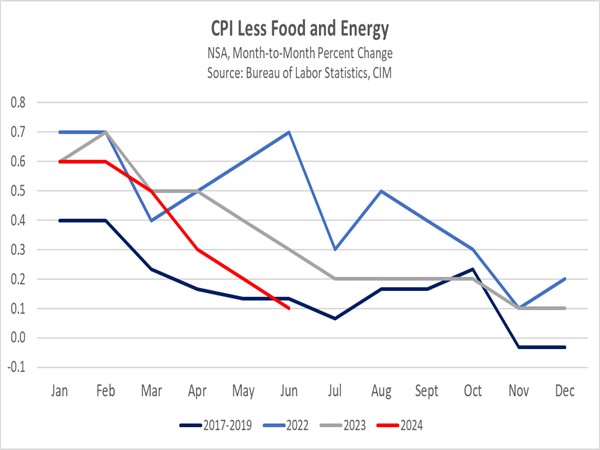

- The market will closely watch economic data in the coming weeks as investors anticipate the Federal Open Market Committee’s next move on September 18. Two additional CPI reports and another employment report will be released prior to the meeting and will likely influence market reactions. While a September rate cut is still expected if inflation continues its downward trajectory, the magnitude of the cut will hinge on labor market conditions. A rise in the unemployment rate to 4.4% could increase the odds of a substantial 50-basis-point reduction.

More than Japan: While the Japanese yen (JPY) dominated market attention, other currencies were also adversely affected by the downturn in the broader market.

- Emerging market currencies were battered by the market turmoil as carry trades unwound since the start of the week, with the Mexican peso (MXN) plunging below the critical 20 level against the dollar, marking its weakest point in two years. The Chinese yuan (CNY) also declined against the dollar. In contrast, the Swiss franc (CHF), a safe haven currency, soared to a six-month high, prompting some Swiss National Bank policymakers to consider currency intervention to curb its appreciation. Ironically, the dollar’s value has remained relatively stable amid these volatile currency movements.

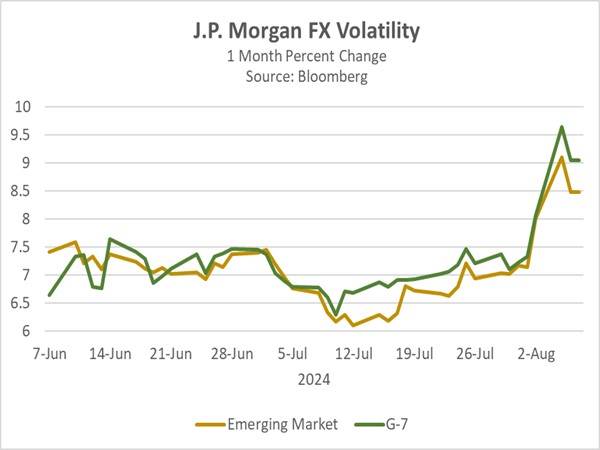

- This turmoil was ignited by the JPY’s sharp appreciation following the Bank of Japan’s (BOJ) surprise rate hike and weak US economic data. Although the BOJ has subsequently indicated no plans for further tightening, which has offered some relief, currencies continue to fluctuate amid growing recession fears in the United States. J.P. Morgan’s one-month volatility index indicates persistent uncertainty in currency markets as the duration of the current unwind remains unclear. By one estimate, the carry trade unwind is somewhere between 50%-60% complete.

- The unwinding of carry trades continues to threaten the equity market, particularly the tech sector, due to its heavy reliance on this funding. While recent market stability is encouraging, normalization is expected in the coming days. Following the BOJ’s announcement, European and Asian stocks rallied this morning, a trend we anticipate will continue. Despite our optimistic outlook, we remain vigilant for signs of significant market disruption, especially if US recession fears intensify.

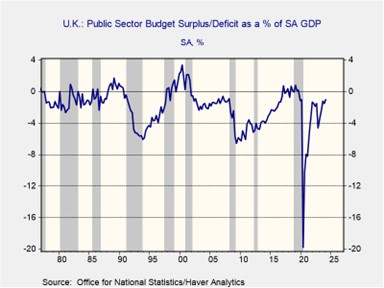

Labor Party Plan: A month after their decisive victory in the UK Parliament, the Labour Party is finally unveiling its plan to address the government budget deficit.

- UK Chancellor Rachel Reeves is expected to push for higher taxes and pension reform as she seeks to submit her budget by October 30. During a Bloomberg TV appearance this week, she announced plans to strike a balance on taxes and hinted that an increase in the capital gains tax could be on the table. Separately, rumors circulated on Wednesday about her exploring a public pension overhaul modeled after Canada’s system. This could involve consolidating local government pension plans to channel funds to infrastructure projects while also reducing costs and fees.

- Concerns about the new government’s fiscal policy have intensified following the revelation of a 22 billion GBP ($28 billion) public spending overrun last week. This deficit compounds the nation’s efforts to curb spending, as the Office for Budget Responsibility has reported that borrowing has exceeded its March forecast by 3 billion GPB ($3.8 billion) year-to-date. While a surprising first-quarter economic uptick has mitigated some of these costs, there are fears that the Labour Party may need to implement austerity measures unless growth accelerates significantly.

- While the UK’s market influence has diminished since its 2020 departure from the European Union, it remains a key country to monitor. The infamous Truss mini-budget and its subsequent financial market turmoil underscore the UK’s capacity to impact global markets. Unlike Truss’s administration, which triggered market instability with its unfunded tax cuts, the current government has been more measured in its fiscal policy, avoiding lofty spending pledges that could erode investor confidence. If the Labour Party can present a viable budget plan in October, it should support UK assets.

In Other News: Kamala Harris, Democratic presidential nominee, has selected Minnesota Governor Tim Walz as her vice-presidential running mate, a strategic choice aimed at enhancing her appeal among voters in the Rust Belt. Rioting continues in Bangladesh after the prime minister resigned following widespread protests. The country is a significant hub for garment manufacturers supplying US retailers.