Daily Comment (August 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are off to a strong start to the day as data reassured investors that the country is not in recession. In sports news, US Men’s Track and Field athlete Quincy Hall staged a comeback in the 400m to take gold. Today’s Comment will discuss the market reaction to poor performance in the Treasury auctions, review the growing signs that consumption is waning, and examine Europe’s decision to target the ultra-wealthy for its budgetary challenges. As usual, our report will conclude with a round up international and domestic data releases.

Auction Failure: Uncertainty over the path of interest rates continue to weigh on the equity market.

- The S&P 500’s early gains evaporated Wednesday, with the index closing down 0.6% amid weak Treasury auction results. A $42 billion sale of 10-year notes was met with tepid demand and ended with a yield of 3.960%, which is 3 bps higher than what investors were anticipating. While lower than the previous auction’s 4.276% yield, the result highlights investors’ ongoing aversion to current bond yields. The miss triggered a sell-off in equities as investors remain concerned that the Fed will fail to implement rate cuts in time to avert a hard landing.

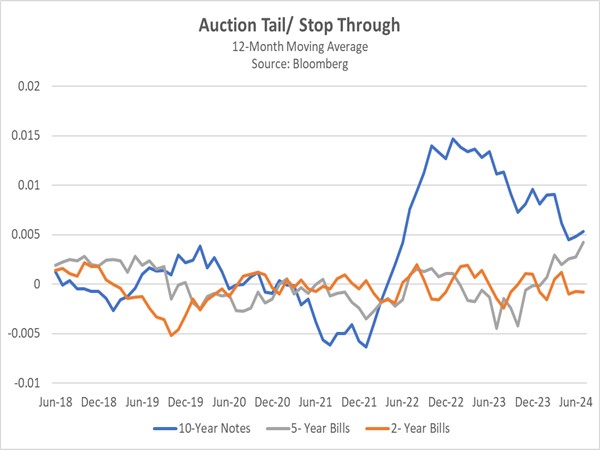

- Treasury bond auctions have struggled since the Fed embarked on its rate-hiking campaign in 2022. The chart below illustrates escalating auction tails, signaling weak demand, which peaked in late 2023 amid expectations of an imminent shift in monetary policy. While shifting Treasury issuance towards shorter maturities has eased some pressure, it has exacerbated challenges in the five-year sector. Recent narrowing of auction tails for both 10-year and five-year Treasury bonds suggests growing investor discomfort with holding mid and long-term bonds.

- The surge in failed bond auctions indicates that the market’s capacity to absorb Treasury issuance has been overwhelmed. While a potential Fed rate cut could offer temporary relief, the underlying issue is excessive government spending. The burgeoning US debt burden will be a formidable challenge for the next administration. Despite vague campaign promises of tax increases or Social Security reform, neither candidate has offered concrete plans to address the growing deficit. Consequently, a return of bond yields to pre-pandemic levels appears unlikely in the near term.

Households Holding Back: Although consumption figures remain positive, a rising chorus of corporate voices warns of potential reductions in consumer spending.

- Earnings reports continue to allude to a consumer pullback in spending. The travel and leisure industry, including key players like Airbnb and Disney, has been hit hard. Airbnb reported delayed bookings and shorter stays, suggesting a shift towards more spontaneous travel plans. Disney blamed declining consumer spending for its bleak outlook. These challenges are mirrored in the fast-food sector, with companies such as McDonald’s and Domino’s also reporting weaker-than-expected results. The pessimism has led shares of these stocks to fall as investors fear a broader economic slowdown.

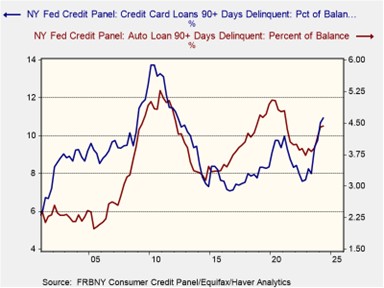

- Economic indicators point to growing household financial strain. Auto and credit card delinquency rates have soared to levels not seen since the COVID-19 pandemic, according to the New York Fed, signaling mounting pressures on household balance sheets. Moreover, a sharp $1.7 billion decline in consumer debt — the largest since early 2021 — suggests consumers are tightening their belts amid economic challenges. This sudden weakness in the data comes nearly a week after the breach of the Sahm rule.

- While concerns of a looming recession persist, current economic indicators suggest a different trajectory. The Atlanta Fed’s GDPNow forecast predicts a 2.9% annualized growth rate for the third quarter, an acceleration from the previous quarter’s 2.8%. Historically, significant economic downturns in the past three decades were recognized following exogenous shocks like the global pandemic, the collapse of Lehman Brothers, the 9/11 attacks, or the Gulf War. In the absence of such disruptive events, like a major financial crisis or widespread conflict, the economy is likely to continue expanding.

Italy Getting Tough: Italian Prime Minister Giorgia Meloni faces the challenge of balancing the nation’s need for fiscal restraint with her campaign pledge to support struggling families.

- To shield middle-class households from higher taxes, Meloni has focused on the ultra-wealthy and financial institutions. On Wednesday, her cabinet endorsed a plan to double the flat tax on foreign income for new residents from $100,000 to $200,000. Additionally, it was revealed last week that her administration has begun revisiting plans to tax banks and insurers that profited from higher interest rates. Last year, her administration was forced to walk back plans for a 40% windfall tax on excessive financial institution profits after the proposal triggered a market sell-off.

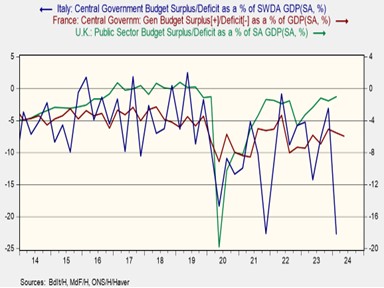

- The move underscores a growing European populist trend targeting the wealthy as countries look to balance their budget. This trend is underscored by the UK’s decision to end non-domiciled tax status and the growing support for France’s Left Alliance, which has promised higher taxes on billionaires and which may revive the wealth tax. This decision stems from the pressure these governments face to address their budget deficits without harming the middle class. France and Italy are currently in breach of the EU’s 3% deficit limit, while the UK is struggling to meet its debt reduction target set in 2020.

- While targeting the wealthy to address budget deficits might be politically expedient, historical evidence suggests that it’s an ineffective strategy. Not only can high-net-worth individuals easily transfer assets offshore, but those in positions of power often possess the means to shape legislation in their favor. Therefore, we predict that a Robin Hood-style fiscal policy will be unsustainable in the long term. As budgetary pressures intensify, governments are likely to resort to more conventional measures, such as pension and social program reforms.

In Other News: Ukraine’s surprise attack on Russia has intensified the ongoing conflict, and it shows no signs of de-escalation. Meanwhile, global economic concerns are mounting as Asian chipmakers face pressure from weakening AI demand. Adding to the uncertainty, a major earthquake struck southwest Japan, triggering tsunami fears and potentially impacting Japanese equities.