Daily Comment (August 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The S&P 500 is off to a slow start today as investors shrug off yesterday’s rally. In sports news, the US Men’s Basketball team was able to mount a comeback against Serbia in its quest for Olympic gold. Today’s Comment will examine the factors driving investors back to large-cap stocks after the recent market downturn. We’ll also delve into the reasons behind the surge in equity and bond volatility and provide an update on the conflict in the Middle East. As usual, the report will conclude with a summary of key economic indicators.

Market Rotation Trade: A week into the market meltdown, investors have reverted to old habits seeking reassurance.

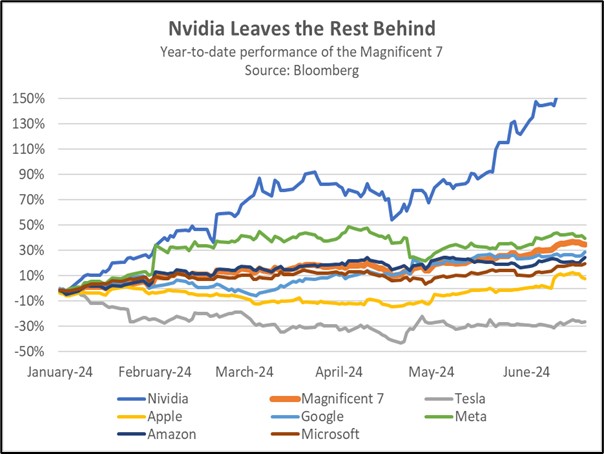

- The market rallied after initial jobless claims posted their largest weekly decline since January 2023. This drop helped reassure investors that the labor market was cooling more slowly than anticipated, bolstering hopes for a Fed-engineered soft landing. Major tech companies, led by the Magnificent 7, outperformed the S&P 500 by a significant margin, rising 3.0% compared to the index’s 2.0% gain. This sharp increase suggests investors are cautiously re-entering the market and are eager to gauge the sustainability of the improved sentiment.

- The S&P 500 rally may be poised to broaden beyond the tech sector, echoing a pattern observed in the weeks preceding the market downturn. While Yardeni Research indicates a slowdown in earnings growth for the Magnificent 7 in the second quarter, the remaining S&P 500 components have collectively returned to profitability. This strong performance has challenged the notion that the S&P 500 has grown over-reliant on tech companies to drive earnings and reinforce the view that mega-tech companies are running out of steam.

- Don’t be misled by the recent surge in tech stocks. While it’s tempting to get caught up in the excitement, it’s crucial to remember why investors initially exited the sector. Doubts persist about tech companies’ ability to justify their lofty valuations, prompting us to maintain our optimism for other S&P 500 sectors. The prospect of a rate cut has buoyed undervalued sectors like real estate and financials, while the potential for increased power consumption in AI has lifted utility stocks. As a result, we are confident that the market will broaden out once more, replicating the pattern that was seen before the recent sell-off.

Volatility Is Back: The unwinding of the carry trade highlights the unusually low equity volatility of recent months in comparison to bonds.

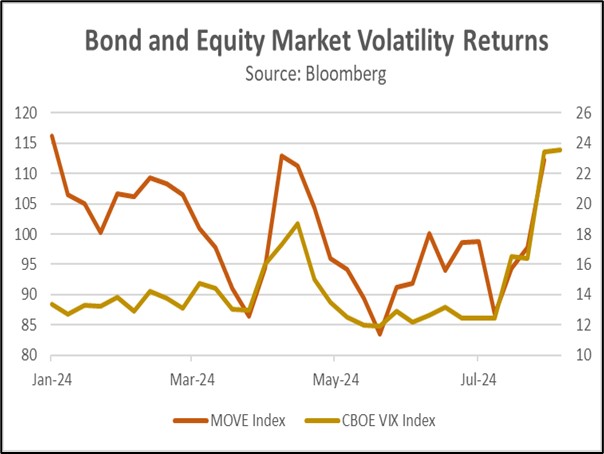

- For the first time in a significant period, both the VIX and MOVE indexes are signaling heightened market risk. While the MOVE index, a measure of bond market volatility, has persistently exceeded its long-term average of 95 since the Fed’s 2022 rate hikes began, the VIX had remained relatively subdued, generally below its fear threshold of 20, despite prevalent inflation and recession concerns. Contrary to the prevailing view that investor sentiment explains the VIX-MOVE divergence, we believe the discrepancy is linked to carry-trade dynamics, which has artificially held down equity market volatility.

- The global trend to push interest rates higher has encouraged investors to employ leveraged carry trades. This strategy involves borrowing funds in a low-interest-rate environment, such as Japan, and investing in higher-yielding assets in countries like Mexico, Brazil, or the US. Such trades typically thrive in liquid markets that facilitate easy entry and exit and a stable currency. However, these strategies become vulnerable to sudden market disruptions, such as an unexpected interest rate hike from the Bank of Japan or fears of an imminent US recession.

- The recent VIX spike has been partially attributed to the unwinding of carry trades as investors reevaluate positions in light of the yen’s strength and the narrowing US-Japan interest rate differentials. As these positions unwind, equity volatility should gradually subside, though it will likely remain sensitive to shifts in US growth expectations. In contrast, the MOVE index, which is sensitive to interest rate expectations, is likely to remain elevated as long as the Fed remains noncommittal on the path of interest rates. This index should fall if inflation continues on its downward trajectory.

Conflict in the Middle East: Israel and its allies are preparing for a retaliatory attack from Iran and Hezbollah in the coming days, which may impact supply chains.

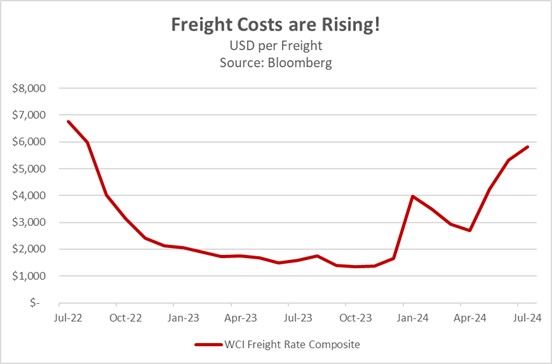

- Tehran is expected to retaliate for the assassinations of a Hezbollah leader in Lebanon and a top Hamas official visiting Iran. Israel has already intercepted an Iranian aerial attack but faces growing concerns about the sustainability of its defenses. The Israeli government has advised citizens to stockpile food as it prepares for potential defensive and offensive campaigns to deter future attacks. This development could escalate the conflict, drawing in additional nations and undermining recent ceasefire discussions.

- The conflict is likely to exacerbate supply chain uncertainties, potentially disrupting goods transportation through the Red Sea. Retailers have already begun stockpiling merchandise in anticipation of shipping disruptions, while Brent crude prices have increased nearly 3% over the last five days as investors assess potential repercussions. Furthermore, ocean freight costs have surged to their highest levels since 2022 as shippers bolster security measures to safeguard cargo delivery.

- The likelihood of a major Middle East conflict with significant global economic repercussions remains low, though not nonexistent. Iran has indicated a desire for retaliation without triggering a broader conflict. The US is maintaining backchannel communications to minimize the risk of unintended escalation. Presently, we remain optimistic about tensions de-escalating within the next few weeks. However, if our assessment proves incorrect, there is a realistic possibility of direct US involvement in the war. Nevertheless, this scenario remains unlikely.

In Other News: Russian President Vladimir Putin has legalized bitcoin and crypto mining, signaling the country’s intent to leverage its low-cost energy to attract investors in the burgeoning digital market. If elected in November, Republican presidential nominee Donald Trump asserts that he should have a greater say in Federal Reserve policy rate decisions. His statement is likely to fuel concerns about potential threats to the Fed’s independence. UK riots have shown signs of subsiding following days of protests against immigration policies.