Daily Comment (December 11, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with tantalizing signs that the Israel-Hamas conflict could be inching closer to its end game. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including new tensions between China and the Philippines, the surging market capitalization of India’s stock market, and various points on the U.S. economy.

Israel-Hamas Conflict: As the Israeli Defense Forces continue to press their attacks against Hamas fighters in southern Gaza, evidence over the weekend suggested Hamas may be starting to collapse politically and militarily. Arab television networks Al-Arabiya and Al-Jazeera aired interviews with Palestinians in Gaza who criticized Hamas and its leaders over the dire situation there, and Israeli television showed large numbers of Palestinian men surrendering in northern Gaza. IDF officials confirmed that Hamas’s military organization is starting to collapse.

- To accelerate a Hamas military collapse, the IDF is now redoubling its effort to find and kill the group’s leaders, who are believed to be hiding in the group’s tunnels in the south. If the IDF can take out the Hamas leadership, Israel’s offensive could end relatively soon.

- As long as major combat operations continue, there will still be a risk of the conflict spreading to other parts of the region and threatening oil supplies.

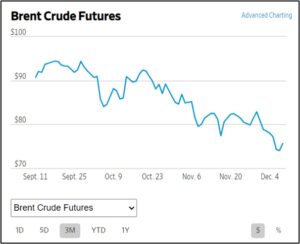

- Since Hamas touched off the conflict with its October 7 attacks on Israel, Brent crude oil has fallen from roughly $90 per barrel to about $75 per barrel, reflecting rebounding output from the U.S. and elsewhere and weakening demand as global economic growth moderates.

- Nevertheless, those prices probably include some risk premium to account for the chance that the Israel-Hamas conflict could spread. When and if the conflict ends and that risk premium goes away, near-term oil prices could fall further.

China-Philippines: In at least two incidents over the weekend, Chinese coast guard vessels again harassed Philippine coast guard and civilian supply vessels operating near disputed shoals in the South China Sea. In the confrontations, the Chinese once again apparently used acoustic weapons to disorient the Philippine sailors, fired water cannon at them, and collided with at least one of the Philippine vessels.

- China continues to aggressively assert its expansive territorial claims from the Himalayas to Taiwan and throughout the East China and South China seas. According to General Secretary Xi, taking control over the disputed areas is a key part of his goal to achieve “the great rejuvenation of the Chinese people.”

- Given the mutual defense treaty between the U.S. and the Philippines, Beijing’s increased aggressiveness in the South China Sea is especially risky as the sinking of a Philippine vessel or the killing of Philippine sailors could potentially require the U.S. to confront China.

North Korea: Security officials in South Korea last week said they are increasingly considering the possibility that top North Korean leader Kim Jong-Un is grooming his 10-year-old daughter, Kim Ju-ae, to be his eventual successor. The assessment is based on the girl’s increasingly flattering coverage in North Korean state media and apparent efforts to make her look older than her age. Since North Korea is a highly conservative and patriarchal society, analysts think Kim would prefer a male heir, but if Kim has a son, he hasn’t shown any public preference for him.

India: The World Federation of Exchanges said the Indian stock market at the end of October had total capitalization of $3.7 trillion, putting it on track to soon overtake Hong Kong, currently the world’s seventh-largest market with capitalization of $3.9 trillion. We think India’s stocks will keep benefitting from the country’s good economic growth and warming relations with the U.S., but investors continue to sour on Chinese-related investments amid geopolitical and economic concerns.

Argentina: After his official inauguration as Argentina’s president yesterday, populist libertarian firebrand Javier Milei reiterated his general goal of rebuilding the country’s economy and slashing government involvement in it. However, it appears that the only concrete detail he offered was a promise to cut government spending by 5%. He is expected to offer further detailed proposals in the coming days.

U.S. Monetary Policy: The Federal Reserve will open its latest policy meeting tomorrow, with its decision due on Wednesday at 2:00 pm ET. The policymakers are widely expected to keep their benchmark fed funds interest rate at today’s range of 5.25% to 5.50%. The question is what they’ll say about future policy moves. While many investors are hoping for a signal of near-term rate cuts, we think officials remain focused on rebuilding their inflation-fighting credentials and are more likely to repeat their “higher for longer” mantra.

U.S. Financial Markets: The Treasury will issue a combined $108 billion of three-year, 10-year, and 30-year bonds today and tomorrow along with $213 billion of shorter-term bills. Since the 30-year bonds issued in early November were so poorly received, investors will likely focus heavily on this week’s auctions. If the supply again appears to overwhelm the demand for new U.S. obligations, the result could be a rebound in yields and volatility across asset classes.

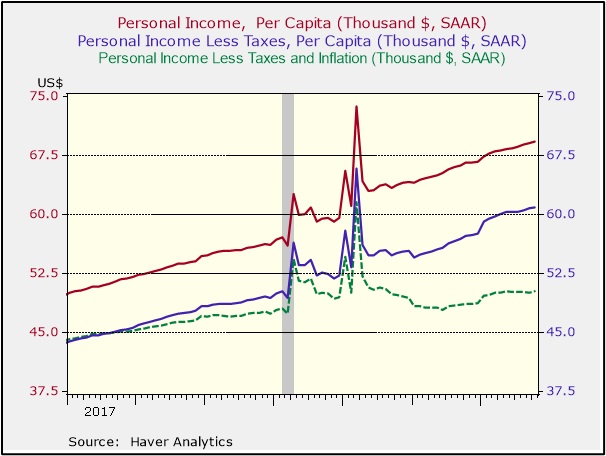

U.S. Consumer Spending: As we look out to 2024 and try to forecast where the economy and financial markets will go, we’re paying close attention to consumer spending—by far the biggest driver of U.S. economic growth over the last few years. We find the chart below to be especially instructive.

- The top line, in red, tracks overall personal income on a per-capita, annualized basis over the last several years. The next line, in blue, tracks per-capita disposable personal income (personal income less taxes) on an annualized basis. Both measures have been trending up smartly, suggesting consumers have had a lot of buying firepower.

- However, we think the dashed bottom line, in green, is more instructive. It shows how personal income has grown after stripping out both taxes and price inflation. Essentially, it captures consumer purchasing power from income (excluding borrowing and dipping into savings). The line shows the big jump in consumer purchasing power when the government released trillions of dollars of stimulus in the middle of the coronavirus pandemic. However, the line clearly shows how purchasing power fell once price inflation took hold and has only partially recovered since then. Overall, per-capita purchasing power is flat-to-down since the start of 2021.

- In 2017 prices, disposable income stands at $50,169 per person. If real disposable income per capita had continued to increase at its growth rate from mid-2017 to the end of 2019, it would now stand at $50,462.

- The relative shortfall in per-capita purchasing power goes far toward explaining consumer pessimism about the economy and low opinion of President Biden. Since spending has continued to increase, the figures also suggest consumers have been borrowing or spending down their savings to buy. There is likely a limit to how far they can take that strategy, which suggests consumer demand and the economy could well slow in 2024.

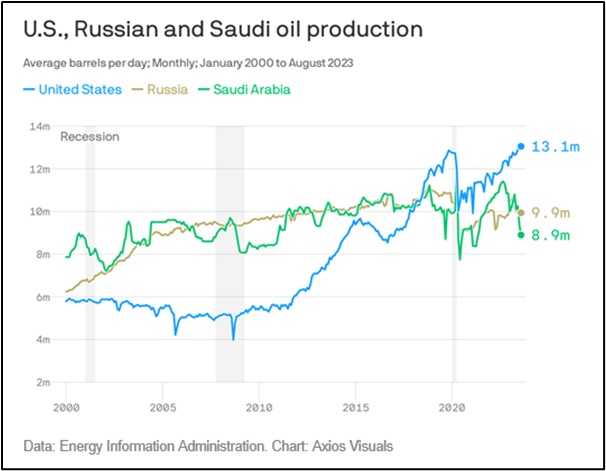

U.S. Oil Industry: Following up on a chart we included in a Comment last week, we couldn’t resist the version below, which shows that not only has U.S. oil production now risen to a record high, but it’s done so while mighty Saudia Arabia and Russia have seen their output decline. As mentioned above, rising U.S. production and slowing economic growth around the world are key reasons for the recent decline in global oil prices.