Daily Comment (December 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently digesting the latest inflation data. In sports news, two-time All-Star left-handed pitcher Max Fried inked a $218 million deal with the New York Yankees. Today’s Comment will delve into our thoughts on Trump’s pick to head the Federal Trade Commission, the potential for a stronger dollar in 2025, and the latest developments in South Korean politics. As always, we’ll conclude with a roundup of key domestic and international economic data releases.

Trump Anti-Trust Busting: The president-elect has chosen Andrew Ferguson to lead the Federal Trade Commission (FTC), signaling the administration’s intent to moderate the agency’s stance on monopoly power.

- The new agency head is set to continue the FTC’s oversight of Big Tech, but will likely leave other sectors alone. He is also expected to adopt a softer approach to AI regulation and take a more lenient stance on merger standards compared to his predecessor, Lina Khan. His primary focus will be safeguarding free speech on social media platforms. In this role, which does not require Senate confirmation, he will oversee ongoing cases against tech giants, which could pave the way for the breakup of companies like Google and Meta.

- Ferguson is expected to limit the regulatory body’s authority as he looks to create the pro-innovation environment pushed by the president. He has publicly opposed measures like judicial job protection, challenged the agency’s rule-making authority, and argued against regulations that could stifle AI innovation. His appointment will likely bolster business optimism, as evidenced by the recent spike in the National Federation of Independent Business’s Small Business Optimism Index. In November, it surpassed its long-term average of 98 for the first time in 34 months.

- A less stringent FTC could boost the broader equity market, as industries like finance, energy, and pharmaceuticals face reduced regulatory scrutiny. These industries have traditionally been focal points for regulatory actions concerning consumer protection. However, the outlook for tech stocks remains uncertain, as they are likely to remain under heightened scrutiny due to concerns about monopoly power and perceived biases against conservative speech. While we see some potential upside in tech, we believe investors may find better value opportunities in other industries as well.

Super Greenback: Hawkish trade policy and relatively restrictive monetary policy are expected to support the dollar in the coming year.

- Reports surfaced Wednesday that Beijing may allow its currency to depreciate next year as a potential response to a looming US trade war. The new measure along with additional stimulus from the government is intended to bolster the competitiveness of Chinese exports and revitalize its ailing manufacturing sector. Later today, Beijing is expected to outline its economic plans, including measures to stimulate growth, at its annual economic policy meeting.

- The looming threat of a US trade war has strengthened the dollar significantly against major currencies. Since September, the dollar has appreciated by 4.2% versus the Chinese yuan (CNY), 4.6% versus the Mexican peso (MXN), 6.0% versus the Canadian dollar (CAD), and 6.7% versus the euro (EUR). As trade tensions intensify, growth prospects for these economies may deteriorate, potentially pushing them towards more accommodative monetary policies. Meanwhile, the Federal Reserve’s stance on interest rate cuts remains uncertain, which could also exacerbate the dollar’s strength.

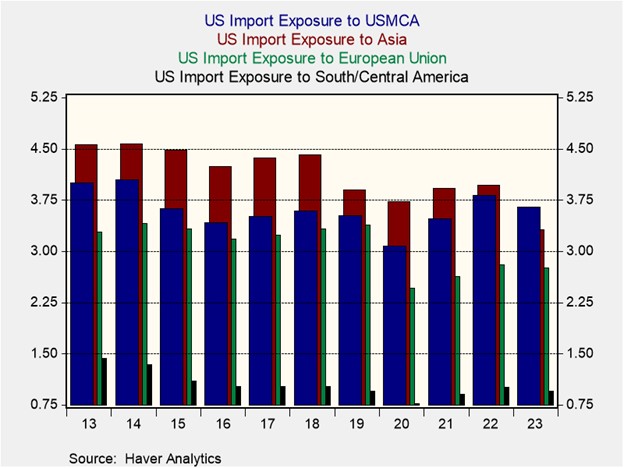

- The strengthening dollar poses a significant risk to the global economy, especially for nations with substantial US dollar-denominated debt. This trend could make the US an increasingly attractive investment destination, particularly if the incoming administration implements its promised tax cuts. For investors seeking international exposure, a prudent strategy would be to prioritize countries with low debt levels and minimal trade exposure to the US. This could involve focusing on nations within the European Union and South/Central America, given their relatively limited import exposure to the US.

Korea’s Turmoil: South Korea is currently looking to pave the way forward as it tries to move past the recent attempt by its president to impose martial law.

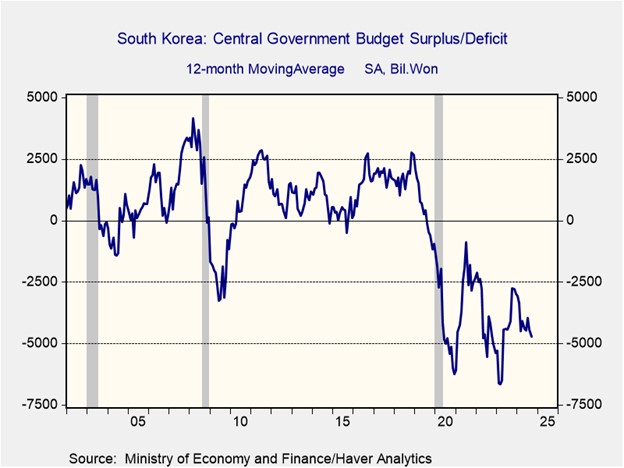

- On Tuesday, in a historic move, South Korea’s opposition-controlled parliament approved a government budget without the consent of government ministries. South Korea’s budget has been a major point of contention with proposed cuts clashing with the president’s desire for increased spending. This tension escalated to the point where the president attempted to declare martial law last week. However, South Korea’s unique legislative system allows its lawmakers to implement budget cuts without presidential approval, which is likely to weigh on an already struggling economy and exacerbate political tensions.

- The budget dispute highlights a strategic move by the opposition party to leverage its position and impose austerity measures to both balance the nation’s finances and weaken the ruling party. While the potential economic slowdown could aid in removing the ruling party from power, this questionable approach mirrors global trends as South Korea (like many other countries) navigates the transition from pandemic-era deficit spending to fiscal sustainability. Despite a relatively low debt-to-GDP ratio of 45% compared to Western nations, the country still faces its largest-ever budget deficit.

- While the new budget may not significantly boost economic prospects, it could provide some level of certainty amidst the country’s ongoing crisis. The opposition party is poised to hold a second impeachment vote on Saturday, following the failure of the first attempt due to a lack of quorum. This second attempt may prove more successful, as the head of the ruling party has distanced himself from Yoon following his decision to impose martial law. However, the political uncertainty within the country is likely to persist, as it remains unclear who would succeed Yoon if the impeachment proceeding is successful.

In Other News: Two major mergers faced setbacks as President Biden moved to block the sale of US Steel to Nippon Steel, and a judge halted Kroger’s acquisition of Albertsons. Meanwhile, French President Emmanuel Macron is working with moderates to select a new prime minister within the next 24 hours. President-elect Donald Trump has pledged to fast-track permits for a $1 billion US investment initiative.