Daily Comment (December 13, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Note to readers: The Daily Comment will go on holiday after Friday’s comment and return on January 3, 2022. From all of us at Confluence Investment Management, have a Merry Christmas and Happy New Year!

Good morning and happy Monday! Risk markets are higher this morning as the traditional equity rally into Christmas (the “Santa Claus rally”) appears to be shaping up. It’s central bank week; coverage of the Fed leads off our coverage this morning. Economics and policy come next as inflation dominates the news. We then move on to the international roundup followed by China news, and we close with the pandemic update.

Central banks: The FOMC meets this week in what is widely expected to be a hawkish meeting. However, it isn’t the only central bank meeting this week. The BOE, BOJ, and ECB, along with a plethora of other banks[1] around the world, are gathering amidst rising inflation. The Fed is being pushed by the markets, pundits, and, surprisingly, the political class as well. And, among the latter, there are moderate Democrats pressing the FOMC to tighten policy as worries about inflation mount. We doubt left-wing populists share this desire, but so far, their voices have not risen; their voices will likely rise as tightening begins.

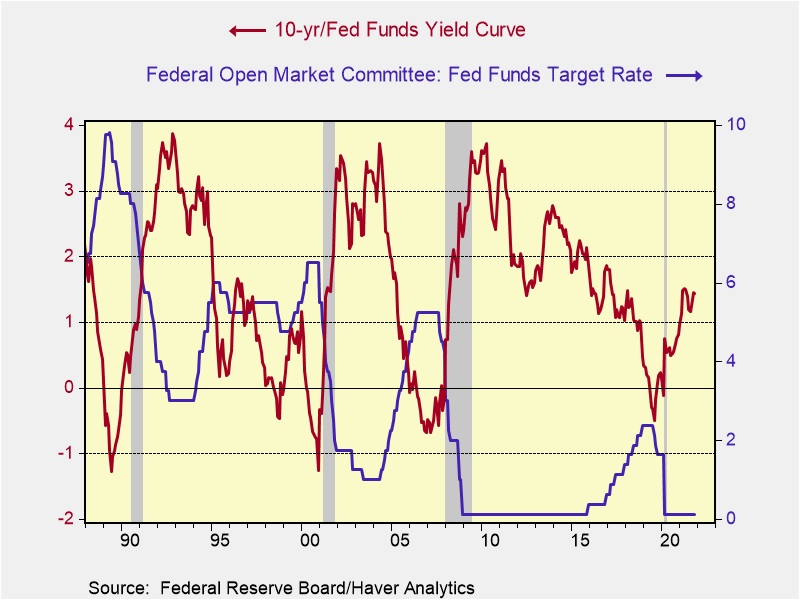

So far, equity markets are showing little concern about policy tightening. It is not unusual for markets, at the early stages of tightening, to expect a “soft landing,” a rate hike cycle that doesn’t result in a recession. This position highlights that equity markets are generally driven by optimists, because the track record shows that soft landings are rare. The item to watch is the 10-year T-note/fed funds spread.

This chart shows the spread along with the policy rate target. In general, recessions tend to occur when the spread inverts. In the mid-1990s, Greenspan engineered a soft landing by cutting rates as the spread approached zero. But, note that in every cycle over the past 30 years, a recession occurred when the spread inverted.

So, what does the spread tell us now? First, the Fed can take the fed funds target to 1.25% to 1.50%. For now. But if 10-year yields fall as the fed funds rate rises, the FOMC may not be able to raise rates that high without inverting this spread. Second, even with this policy tightening, monetary policy will still be easy; we expect CPI inflation to fall to the 3.0% to 3.5% range next year, and so there is little chance that we will get a positive real fed funds rate. To achieve that outcome, a recession would be almost a certainty. For now, financial markets are putting odds that the first rate hike will occur at the meeting on May 4, 2022.

- Although the ECB will likely end its bond-buying program sometime in the next year, Greece still wants the bank to keep buying its bonds.

- Expectations that Turkey will cut interest rates again sent the TRY lower. The bank reportedly intervened to slow the decline.

Economics and policy: Build Back Better looks like it won’t get passed in 2021 and inflation worries remain elevated.

- Although congressional leaders continue to bravely talk about moving the Build Back Better plan through the legislature before year’s end, it looks increasingly likely that the bill will be on next year’s agenda. The president is talking to Sen. Manchin (D-WV) to sway him to move on the bill, but the senator’s worries about inflation will likely lead him to delay his support.

- Inflation is the dominant concern in the economy. There are growing worries that inflation expectations are rising, which could force the FOMC to take more aggressive policy actions. We do expect inflation to moderate next year from base effects alone. However, there is also a rising chance that the inflation that develops will be lasting as real estate inflation begins to filter into the economy.

- Nevertheless, don’t call it stagflation. Economic growth in Q4 still looks robust.

- We continue to monitor the supply chains. So far, the preponderance of the evidence suggests they remain snarled. Toyota (TM, USD, 182.35) announced it will be closing four plants in Japan due to supply chain disruptions.

- The labor market remains a puzzle. Depending on the metric being used, either the labor market is struggling to recover from the pandemic, or it is so tight that wages will need to rise to balance the market. One area we have noted is the exit of workers aged 65+ from the labor force. Although we expect those workers to remain retired, there are anecdotal reports that some may be considering a return to work because the support money has dried up or because the cost of living is rising fast enough that they need the additional cash. Another area causing tighter labor markets is the decline in immigration; the foreign born population appears to be falling. Deteriorating health seems to be keeping people out of the labor force as well.

- Climate policy has been a point of political division. Increasingly, financial regulators are changing regulations on financing fossil fuel companies. However, the area to watch is insurance; the national flood insurance program is looking to lift insurance costs on seaside residential properties.

- Bank overdraft fees are coming under scrutiny.

- One reason crypto volatility is high is due to the lack of liquidity.

International roundup: The G-7 warns Russia.

- The G-7 has warned Russia that any military action against Ukraine will lead to “massive consequences,” or very heavy sanctions. We do note there is growing skepticism that Russia will be denied access to the S.W.I.F.T. network, but we could see Russia denied access to Western energy technology.

- Ukraine has accused Germany of blocking military sales to Kiev; Berlin worries that arming Ukraine may provoke Moscow.

- The White House is reviewing military options against Iran if the current nuclear talks fail. We doubt the U.S. will take military action, but other states in the region might act.

- Iran is deporting refugees from Afghanistan.

- SoS Blinken is making a tour of Southeast Asia. Although the U.S. is trying to woo these nations, American resistance to supporting trade in the region will hamper Washington’s influence.

- South Korea has applied to the CPTPP, the successor to the TPP.

China news: The diplomatic boycott may be mostly an Anglo-Saxon affair.

- So far, the U.S. diplomatic boycott of the Winter Olympics has not fostered widespread adoption. The EU is considering a boycott, but several European nations have ruled it out (although Lithuania, which has sided with Taiwan, has decided to join the boycott). For the boycott to be effective, it needs widespread acceptance; if only a few nations participate in the boycott then the action won’t have much impact.

- It isn’t just the West that is struggling to find high-tech workers; so is Beijing.

- In our series on central bank digital currencies, we noted that such currencies would give governments the power to gather data on spending habits. British intelligence agencies warn that China will almost certainly exploit this feature.

- The EU has been working to implement a carbon adjustment tax, which would be a form of tariff that would lift import prices based on their carbon footprint. This development could lead to much higher tariffs on Chinese imports.

COVID-19: The number of reported cases is 270,252,555, with 5,308,651 fatalities. In the U.S., there are 49,921,422 confirmed cases, with 797,348 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The CDC reports that 594,475,575 doses of the vaccine have been distributed, with 484,190,896 doses injected. The number receiving at least one dose is 239,008,166, while the number receiving second doses, which would grant the highest level of immunity, is 201,975,235. For the population older than 18, 72.1% of the population has been fully vaccinated, with 60.8% of the entire population fully vaccinated. The FT has a page on global vaccine distribution.

- Cyril Ramaphosa, the president of South Africa, has tested positive for COVID-19. His case is said to be mild.

- There are increasing worries that the low level of booster injections in the 65+ U.S. population could lead to another surge in hospitalizations as the omicron variant expands. A U.K. study suggests that the booster is up to 75% effective against omicron.

- Omicron may become the dominant variant in Europe by next week.

- Covax, the program to distribute vaccines to the emerging economies, is falling far short of its goals.

[1] Turkey, Chile, Indonesia, the Philippines, Egypt, Switzerland, Norway, Mexico, Colombia, and Russia