Daily Comment (December 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is digesting the latest data from Broadcom as it assesses the outlook for chipmakers heading into the new year. In sports, LeBron James’s son achieved a career-high 30 points during his first G League road game. In today’s Comment, we delve into the incoming Trump administration’s latest tax proposal, the impact of the automation debate on inflation, and the factors behind the British economy’s recent struggles. As always, our report includes a summary of key international and domestic data releases.

Tax Details: The Trump administration provided a glimpse of what may be included in a tax package on Thursday.

- Economic advisors within the administration have proposed doubling the State and Local Tax (SALT) deduction cap from $10,000 to $20,000. This measure is positioned as a compromise to address the concerns of residents in high-tax states, following the president’s campaign promise to eliminate the cap entirely. The proposal aims to improve middle-class living standards while mitigating perceptions of favoring the wealthy. The move also suggests that the incoming president may take a more pragmatic approach in office than he did on the campaign trail.

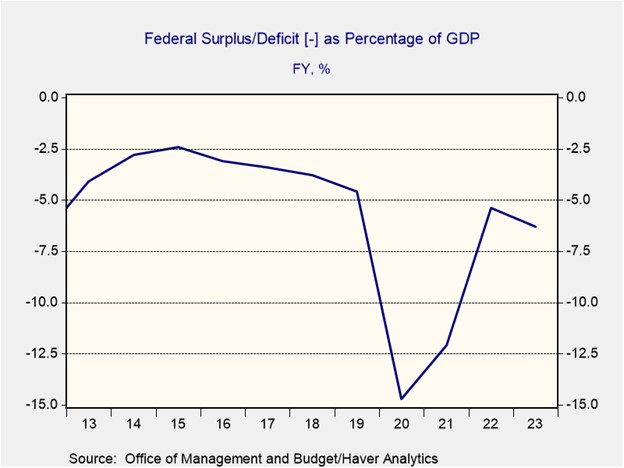

- The decision to increase the SALT deduction cap rather than eliminating it was driven by concerns over the growing national deficit. Before the election, Treasury yields rose as investors worried about an increase in government borrowing to finance additional spending. Initial estimates projected that these spending plans would add $7.5 trillion to the deficit over the next decade. While the administration expressed optimism that stronger GDP growth could potentially offset these costs, recent Congressional Budget Office estimates suggest a more mixed economic impact from the tax changes.

- The market’s assessment of the future US budget deficit may be overly pessimistic. As previously discussed, the Trump administration, like its predecessors, is likely to temper its campaign promises to make them more budget friendly. A potential compromise could involve extending the Trump tax cuts for an additional four years, rather than making them permanent. That said, we remain most optimistic about the proposed corporate tax rate cut, as it could be essential in securing continued corporate support while implementing potentially less business-friendly policies.

Labor Fights Back: The possibility of another port workers’ strike in January will likely test the new president’s ability to balance the interests of labor and capital.

- President-elect Donald Trump voiced support for the International Longshoremen’s Association, which represents over 45,000 union port workers on the East and Gulf coasts. In October, workers went on strike to oppose employer use of automation. Employers argue that automation is necessary to reduce costs and maintain competitiveness, while the union contends that it will lead to significant job losses. On Truth Social, Trump argued that “the amount of money saved [through automation] is nowhere near the distress, hurt, and harm it causes for American Workers.”

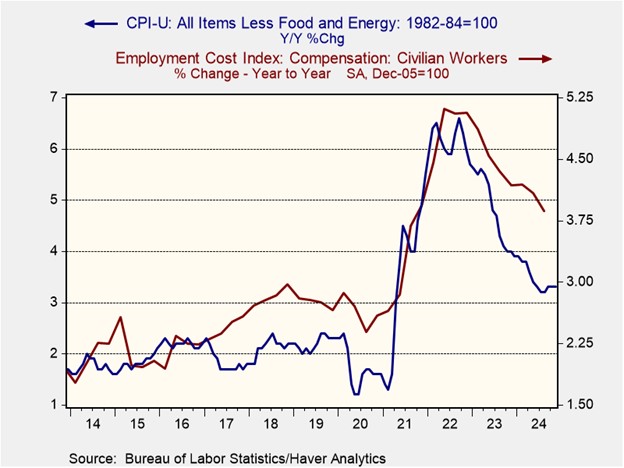

- The ongoing debate about automation and artificial intelligence (AI) carries significant implications for long-term inflation. Federal Reserve officials believe that productivity gains from technological advancements and increased efficiency could help lower inflation to the 2% target while supporting economic growth. As a result, the implementation of automation and AI will be important if the government would like to pursue tougher immigration and trade policies without negatively impacting inflation.

- Keeping a close watch on the dynamic between labor and capital will be crucial in assessing the president’s ability to navigate opposing factions within his coalition. His primary challenge lies in balancing his goal of bringing down inflation without hurting wage growth. As shown in the chart above, much of the inflation reduction over the past two years has come at the expense of workers. To rebalance this, the Trump administration may need to shift the wage burden away from consumers and onto corporations, possibly by encouraging firms to slow their adoption of certain disruptive technologies.

British Slowdown: The UK economy contracted again, marking the second consecutive month of decline and hindering the Labour government’s growth goals.

- Economic output dropped 0.1% in October, according to the Office for National Statistics. The weak performance was a surprise, as initial forecasts had predicted an uptick. Now, there are concerns that the economy may also contract in the fourth quarter. Following the report’s release, the pound sterling (GBP) weakened by 0.3% against the dollar to $1.26, as investors began to factor in a potential widening gap between UK and US interest rates and weakening GDP growth projections for 2025.

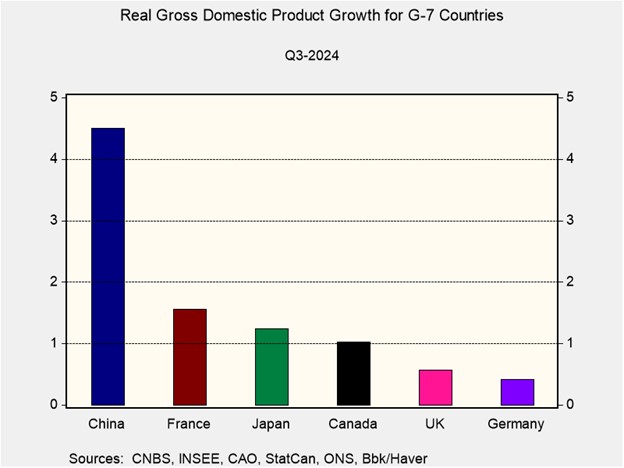

- The decline is a major setback for Prime Minister Keir Starmer’s Labour government, which has made economic recovery a cornerstone of its agenda. The party has pledged to deliver the fastest per capita GDP growth in the G7 for two consecutive years by the end of this parliamentary term — a feat last achieved in the 1970s. However, the goal remains far out of reach, with the UK’s economic growth ranking second to last among G7 countries in Q3.

- The weakness in growth is likely to prompt the Bank of England to lower interest rates more aggressively to prevent the economy from further deceleration. Recent forecasts from policymakers within the BOE projected 0.3% growth in the fourth quarter, leading the group to believe a more gradual approach to rate cuts would suffice. However, the latest negative economic data could necessitate more rapid rate cuts than initially anticipated. Assuming this is correct, we can expect downward pressure on the pound sterling and upward pressure on the US dollar.

In Other News: The Trump administration is reportedly aiming to curb the influence of bank regulators by placing them under the Treasury Department in a move that could have significant implications for the Federal Reserve’s independence. French President Emmanuel Macron has appointed François Bayrou as prime minister in a bid to ease concerns over political instability.