Daily Comment (December 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest signs of economic weakness in the eurozone. We next review several other international and US developments with the potential to affect the financial markets today, including the naming of a new prime minister in France, disappointing economic data from China, and a few words on monetary and fiscal policy in the US.

Eurozone: In a speech today, European Central Bank Chief Lagarde signaled that she believes the ECB has re-established price stability in the region and can now continue to cut interest rates. According to Lagarde, “The direction of travel is clear, and we expect to lower interest rates further.” The statement confirms widely held expectations that the ECB will continue to cut rates to support the eurozone’s flagging economic growth. Reflecting that, the euro today is trading slightly weaker at $1.0503, near its lowest level in more than a year.

- In the latest evidence of the eurozone’s economic malaise, S&P Global and Hamburg Commercial Bank today said their December composite purchasing managers’ index came in at just 49.5, slightly higher than last month but still below the level of 50 that indicates expansion.

- The weakness stemmed largely from contracting activity in the manufacturing sector, while the service sector posted growth.

Germany: To set the stage for new elections, parliament is expected to hold a confidence vote today on Chancellor Scholz, who leads the center-left Social Democratic Party. If Scholz loses as anticipated, the elections would likely be held in mid-February, and the winner would probably be Friedrich Merz of the center-right Christian Democratic Union. However, the ascendant far-right Alternative for Germany party is considering tactically voting for Scholz to keep him in office and delay the rise of Merz, who wants to increase Germany’s support for Ukraine.

France: Days after his previous prime minister was deposed in a no-confidence vote, President Macron on Saturday named veteran centrist politician François Bayrou to replace him. Bayrou is expected to name his ministers in the coming days. However, Bayrou will face the same political problems that the previous prime minister faced, such as his proximity to the unpopular Macron and the fact that his coalition’s minority government can easily be toppled if parliament’s large left-wing and right-wing blocs decide on another no-confidence vote.

- Bayrou’s priorities now will be to pass a special law to roll over the 2024 budget and then to pass a formal 2025 budget that begins to address France’s yawning budget deficit, which has started to spook investors.

- The most likely scenario going forward will be for France to face an extended period of political and policy uncertainty, with negative implications for the French economy and financial markets.

- Underscoring the bleak prospects for France’s budget consolidation and improved economic competitiveness, Moody’s on Saturday unexpectedly cut the country’s sovereign debt rating to Aa3, three notches below its top rating. However, in a sign that France’s troubles are already priced into the markets, the yield on the country’s benchmark 10-year government bond is barely changed this morning at 3.029%.

United Kingdom: On Sunday, the UK officially joined the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, as originally announced last year. Acceding to the TPP marks Britain’s biggest trade deal since Brexit, granting lower tariffs and easier trade rules with countries including Japan, Australia, New Zealand, Canada, Mexico, Chile, and Peru.

- Since the US isn’t a member of the TPP, the economic benefits of accession are limited. London estimates that joining the TPP will only boost the UK’s annual economic output by about 2 billion GBP ($2.5 billion) a year in the long run — less than 0.1% of gross domestic product.

- The more important impact of Britain’s accession may geopolitical. As a full member of the trade pact, Britain can now influence whether applicants China and Taiwan may join the group.

United Kingdom-China: British authorities have banned a suspected Chinese intelligence agent from re-entering the country after discovering he had ties to Prince Andrew (the king’s brother). The authorities have reportedly discovered that the Chinese agent gave money to the prince, who then gave the agent access to Buckingham Palace, the Ministry of Defense, and meetings with former UK prime ministers.

- In response, King Charles is reportedly considering banning Prince Andrew from Buckingham Palace’s Christmas celebrations. The reports also claim the prince could be forced to move to the Gulf region for asylum.

- Both China and Russia have adopted aggressive, no-holds-barred approaches to their intelligence gathering and secret influence campaigns against the West. If the allegations against Prince Andrew are true, it would only be the latest example of how successful those intelligence operations have become. Western media and voters have been quite complacent about these attacks to date, but there is some chance that an especially egregious operation could spark pushback and ratchet up geopolitical tensions.

China: Official data from this weekend showed November industrial production was up 5.4% from the same month one year earlier, versus a rise of 5.3% in the year to October. Fixed-asset investment in January through November was up 3.3% year-over-year, versus 3.4% in the January-October period. In contrast, November retail sales were up just 3.0% on the year, after a 4.8% rise in the year to October. The data suggests Beijing’s recent economic stimulus program has boosted corporate activity, but consumers remain more skeptical.

South Korea: On Saturday, Parliament impeached President Yoon for his attempt to declare martial law on December 3. Fully 204 of the chamber’s 300 members voted in favor of the measure. Prime Minister Han Duck-soo will now be acting president until the Constitutional Court decides whether to affirm the impeachment, which could take as long as 180 days. If the court affirms, new presidential elections would have to be held within 60 days.

- The court is currently short-handed due to recent resignations and a stalemate over their replacements. Therefore, all six of its current members would have to vote to affirm the impeachment before Yoon can be thrown out of office.

- Yoon therefore probably still has a chance to keep his position. Nevertheless, because of his deep unpopularity and the strength of the political forces against him, South Korea could be in political limbo for some time, which will likely weigh on the country’s economy and financial markets.

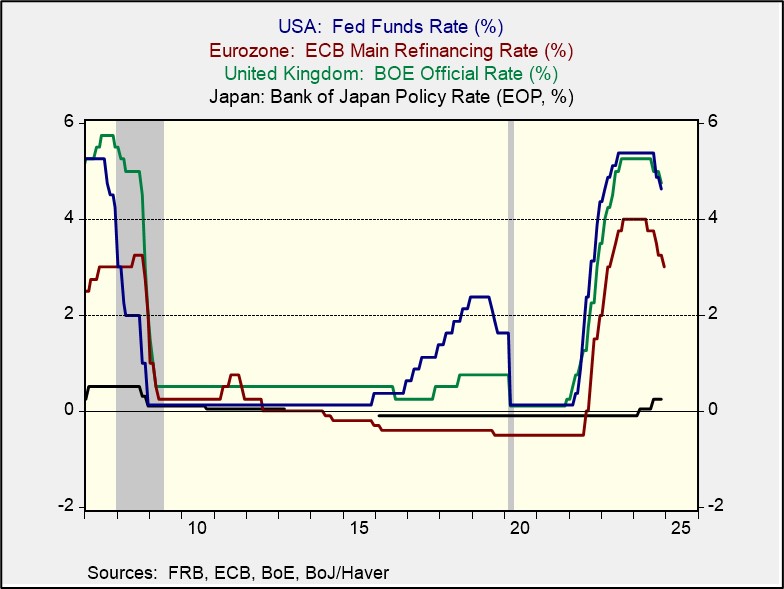

US Monetary Policy: The Federal Reserve will hold its latest monetary policy meeting this week, with its decision due on Wednesday at 2:00 PM ET. Based on current futures trading, the policymakers are widely expected to cut the benchmark fed funds interest rate by 25 basis points to a range of 4.25% to 4.50%. The bigger question is what their updated economic and financial market forecasts will look like.

- In their September projections, the policymakers expected to cut the fed funds rate by another 1.00% over 2025, to a range of 3.25% to 3.50% at year’s end. They expected perhaps another couple of small rate cuts in 2026.

- Given the US economy’s continued growth and sticky price pressures, we would not be surprised if the new projections this week call for fewer future rate cuts and a terminal rate higher than what investors currently expect. That could set the stage for some financial market volatility when the decision is released on Wednesday.

US Fiscal Policy: The Wall Street Journal today reports that Republican leaders in Congress are leaning toward prioritizing tax cuts over measures to reduce the federal budget deficit when the new legislative term starts next year. To mask the impact of extending the 2017 tax cuts, some of the leaders reportedly advocate changing the official methodology for calculating how their decisions affect the budget. The debate suggests at least some Republicans are looking to do whatever it takes to extend the tax cuts, despite the impact on the deficit.

- Under current budget rules, the baseline deficit in future years is the estimated shortfall assuming today’s legislation is in place or expires as currently written. The 2017 tax-cut law expires at the end of 2025, so under today’s rules, the baseline deficit for 2026 and beyond would reflect a snap-back of tax rates to the higher levels prevailing before 2017, i.e., tax revenues would likely rise, and the baseline deficit would be smaller.

- The proposal being considered would assume the 2017 tax cuts don’t expire, even though extending them would require an act of the new Congress. Under this methodology, baseline tax rates would stay low, and the assumed deficit for comparison would remain large. In other words, extending the tax cuts would be “free,” and deficit impacts would be calculated only for new measures, such as President-elect Trump’s promise to eliminate taxes on workers’ tips.