Daily Comment (December 19, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning. The market is digesting the latest GDP data. In sports, Real Madrid secured its fifth trophy of the year by winning the FIFA Intercontinental Cup. In today’s Comment, we’ll analyze the Federal Reserve’s latest rate decision, explore why long-term bond yields continue to rise, and review the Bank of Japan’s choice to maintain its monetary policy stance. As always, the report includes a roundup of key international and domestic data releases.

Fed’s Hawkish Cut: The Federal Open Market Committee voted to cut rates but also scaled back the number of projected rate cuts for 2025.

- In a widely anticipated decision, the Federal Reserve lowered its target range for the federal funds rate to 4.25%–4.50%. While most policymakers endorsed the move, Cleveland Fed President Beth Hammack dissented, advocating for no change. Alongside the rate cut, the Fed revised its economic projections, raising its 2025 inflation forecast from 2.1% to 2.5% and reducing its expected rate cuts from 100 to 50 basis points. During the press conference, Fed Chair Jerome Powell cautioned that the outlook for rate cuts could shift if inflation moderates further next year.

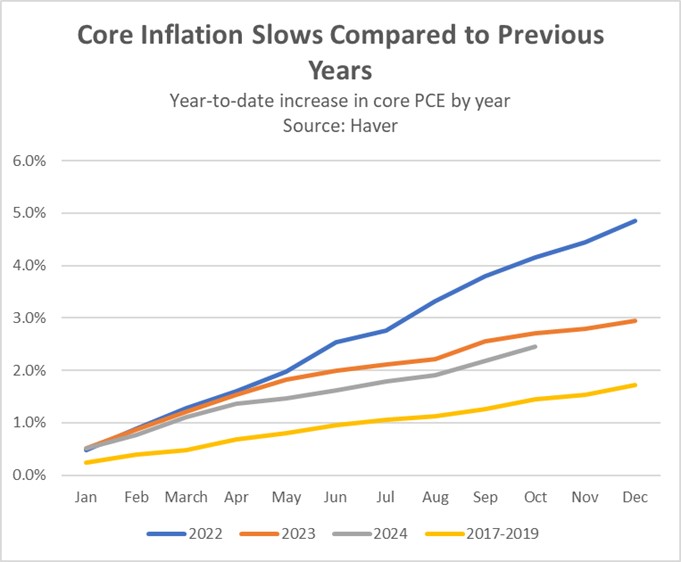

- The Federal Reserve’s ability to lower interest rates in 2025 will depend on inflation trends during the first quarter. In the first three months of 2024, monthly inflation peaked, driven by sharp increases in financial services, insurance, and housing costs. While the preceding months have moderated, the spike complicated the Fed’s efforts to meet its target inflation rate. The latest Personal Consumption Expenditure (PCE) price index indicates that while headline inflation was 2.3% year-over-year, underlying price pressures, excluding the surge from the first quarter, have moderated to an annualized rate of 1.9%.

- The Federal Reserve’s future policy rate decisions will hinge on inflation trends in the first quarter. If inflation moderates during this period, the Fed may adopt a more accommodative stance. Conversely, if inflation accelerates, a more restrictive policy may be necessary. This is because reducing inflation becomes more challenging after the first quarter, as spring and summer inflation trends have aligned with historical norms over the last two years. Consequently, we advise investors to remain cautious, as interest rates could move in either direction depending on how inflation unfolds.

Bond Market Roars: The 10-year Treasury yield has surged amid growing deficit worries and the Fed’s less accommodative policy stance.

- On Wednesday, the 10-year Treasury yield climbed to 4.5%, a level not seen since May. This rise was primarily driven by growing uncertainty about the Federal Reserve’s potential to cut interest rates in 2025. Since the Fed’s rate cut in September, Treasury yields have increased by nearly 90 basis points as investors became increasingly concerned that a widening budget deficit could exacerbate inflationary pressures. The Congressional Budget Office’s recent upward revisions to its forecasts for inflation, unemployment, and long-term interest rates have further fueled these concerns.

- Uncertainty surrounding next year’s policy direction, particularly the potential inflationary impact of tariffs and tax cuts, may be driving up bond yields. A recent study underscores the inflationary risks associated with these policies, estimating that a 10% tariff increase could raise the PCE price index by 0.6%, a 60% tariff on Chinese goods could add 0.4%, and a combination of both could increase it by 1%. Additionally, the proposed tax cuts, which are expected to boost aggregate demand, could further exacerbate inflationary pressures.

- Long-term Treasury yields are likely to be highly sensitive to fiscal policy changes in the year ahead. If the Trump administration proposes sufficient spending cuts or scales back some campaign promises, the bond market is likely to respond favorably. Moreover, tariffs, which are likely to face legal challenges, could prove less inflationary than currently anticipated. While we recognize the potential for upside risk in Treasury yields, we remain cautiously optimistic that market fears may not fully materialize.

The BOJ Holds: Japanese central bankers opted to maintain the current monetary policy stance, indicating a strategic pause before potentially implementing a third interest rate hike.

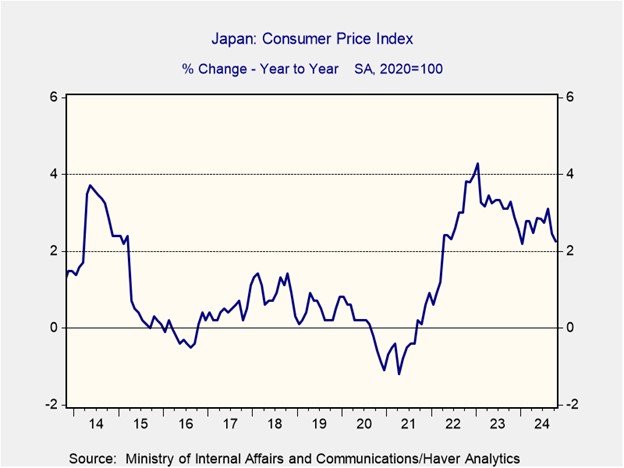

- The Bank of Japan (BoJ) held its benchmark interest rate steady at 0.25%, aligning with market expectations. However, one policymaker dissented, advocating for a rate hike to 0.5%. While policymakers expressed concerns about potential wage pressures, the decision to maintain the current rate likely reflects worries about the potential economic impact of US tariffs. During the press conference, BoJ Governor Kazuo Ueda hinted at the possibility of a future rate hike, possibly in January or March, when the central bank has a clearer understanding of wage pressures.

- Japanese policymakers’ persistent adherence to accommodative monetary policy has exacerbated concerns about their ability to effectively control inflation. This sentiment was reflected in the yen’s (JPY) depreciation following the central bank’s decision, surpassing the key 155 JPY level against the dollar. While overall inflation appears to be moderating, core inflation, excluding volatile energy prices, remains above the 2% target, signaling persistent price pressures. Notably, service sector inflation has accelerated, indicating that businesses are increasingly capable of passing on rising labor costs to consumers.

- The Bank of Japan’s decision to maintain low interest rates underscores the potential for countries to employ accommodative monetary policy to mitigate the potential negative impact of tariffs. By keeping their currencies relatively weak, these countries aim to maintain export competitiveness. However, this approach may lead to higher inflation within their own economies. As tariff tensions escalate, the dollar is likely to strengthen due to increased demand for a safe-haven currency. Furthermore, a lack of progress in global inflation could boost the appeal of commodities as investments.

In Other News: Russian President Vladimir Putin has expressed an openness to meeting with Donald Trump, a discussion that could potentially pave the way for resolving the conflict in Ukraine. Meanwhile, the US government is facing an increased risk of a shutdown as Elon Musk and Trump oppose a continuing resolution to prevent it.