Daily Comment (December 2, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with further evidence that the Bank of Japan is likely to hike its benchmark interest rate again later this month. We next review several other international and US developments with the potential to affect the financial markets today, including an effort by the European Parliament’s biggest political group to scrap the EU’s ban on selling autos with internal combustion engines by 2035 and President-elect Trump’s weekend threat to impose 100% tariffs against countries that try to stop using the US dollar for trade.

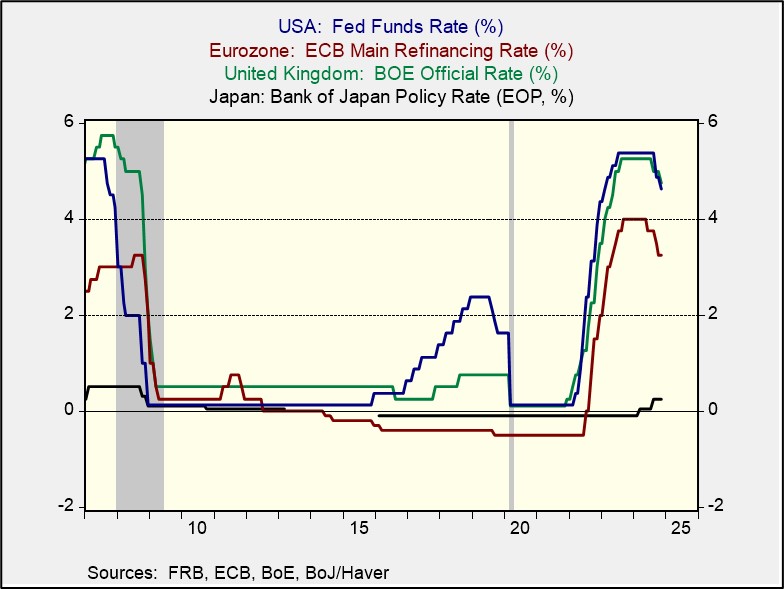

Japan: In an interview published Saturday, Bank of Japan Governor Ueda hinted that the central bank could hike its benchmark short-term interest rate again when its policy board next meets on December 18-19. According to Ueda, the timing of the next rate hike is “approaching” as the data on Japanese wage growth, consumer spending, and price inflation continues to move in line with the central bank’s forecasts. The statement will act as confirmation for the modest majority of market participants who already expected a rate hike this month.

- The BOJ’s benchmark interest rate currently stands at just 0.25%. If the central bank hikes rates in December, it would be the first policy change since a rate hike in July.

- The BOJ’s slow pace of rate hikes and the continuing wide disparity between Japanese rates and the major Western rates have weighed on the yen (JPY) over the last couple of months. Despite Ueda’s statement, the currency has weakened about 0.2% today and is currently trading at 150.00 per dollar ($0.0067).

China: The yield on long-term Chinese bonds fell below Japanese yields for the first time on Friday. China’s 30-year government bond declined to just 2.21% versus 2.27% on 30-year JGBs. The fall in Chinese yields reflects investor concerns that China faces years of slow economic growth, deflation, and ultralow interest rates similar to what Japan faced starting around 1990. The concern is generally consistent with our view that the Chinese economy has hit several big structural headwinds, such as high debt and poor demographics.

- Despite the Chinese economy’s unfavorable long-term outlook, the government’s recent modest stimulus program has given a small boost to the factory sector.

- The government on Saturday said its official November purchasing managers’ index for manufacturing rose to a seasonally adjusted 50.3, up from 50.1 in October. Like most major PMIs, the Chinese one is designed so that readings over 50 indicate expanding activity. The figures therefore suggest China’s factory sector has now grown modestly for two straight months. Before that, however, the index had shown that the sector had declined for five straight months.

European Union: On Friday, the Financial Times scooped that the largest political group in the European Parliament, the center-right European People’s Party, is working to scrap the EU’s planned 2035 ban on selling automobiles with internal combustion engines. Working with aligned national leaders, it also wants to reverse the EU’s interim rules imposing fines on carmakers that exceed certain emissions limits.

- The auto industry is a huge part of the EU economy, but it is struggling with challenges ranging from threatened US import tariffs and electric-vehicle dumping by China to high energy costs and the EU’s own stringent regulations.

- The new initiative to soften the regulatory burden likely stems at least in part from the recent political shift to the right in the US and the EU. Since the regulatory burden isn’t the only headwind for Europe’s automakers, the EPP initiative isn’t a silver bullet. However, if successful, it could ease some of the pressure on the auto industry.

France: Prime Minister Barnier’s minority government today is on the brink of collapse after the far-right populist National Rally (RN) signaled it might trigger a no-confidence vote over the austerity policies in the proposed 2025 budget. Barnier is desperately trying to control France’s ballooning budget deficit, which has started to spook investors, but he responded to RN by dumping a proposed hike in electricity taxes. Now, RN insists that he restore cost-of-living adjustments for pensions and reverse other spending cuts, which may be a bridge too far for Barnier.

- On a more positive note, President Macron on Friday was given a tour of Notre Dame cathedral, which has finally been repaired and refurbished after its 2019 fire. Initial reports say the new stonework and cleaned older stone have brightened its interior, giving viewers a sense of what it must have been like when it first opened in 1260.

- The cathedral is due to be reopened to the public on December 7.

Ireland: After elections on Friday, centrist party Fianna Fáil appears on track to win the largest number of seats in parliament and continue its coalition with the center-right Fine Gael. To gain a majority, however, it will have to strike a deal with some small parties and independents after the Greens, a former coalition partner, suffered a dramatic loss of support. The results make Ireland a rare island of relative political stability in Europe.

Romania: In yesterday’s parliamentary elections, initial tallies suggest the center-left PSD party came in first with about 22.5% of the vote, while two center-right parties got about 15% each. The nationalist far-right AUR group garnered 18%, and another far-right group, SOS Romania, got about 5%. If confirmed, the results mean Romania will also continue to be governed by mainstream parties, despite a populist right-wing nationalist winning the first round of the presidential election last week.

- The parliamentary election came exactly one week after pro-Russia, NATO-skeptic candidate Călin Georgescu came out of nowhere to win the first round of the presidential election. Liberal candidate Elena Lasconi came in second.

- Under law, Georgescu and Lasconi would normally compete in the presidential run-off election scheduled for next Sunday. However, the run-off election is now in limbo after the country’s top court on Thursday ordered a recount of the first round.

- The court and election officials are suspicious of Georgescu’s sudden rise from obscurity after only campaigning on the Chinese-owned social media platform TikTok. The authorities are probing whether Georgescu’s first-round win was the result of a covert Russian interference operation utilizing thousands of fake TikTok accounts, perhaps with the connivance of TikTok’s Chinese owners and/or the Chinese government.

- There are also suspicions that widely followed social media influencers in Romania were paid off to channel viewers to Georgescu’s posts. Several influencers had reportedly admitted to being paid for those services. However, Georgescu’s campaign filings have shown no expenses whatsoever.

- Officials from the European Union have also been brought in to investigate whether TikTok violated its new Digital Services Act, which requires big social media platforms to take action against disinformation and electoral interference.

Georgia: In another sign that Russia is managing to bring some Eastern European countries back into its orbit, Prime Minister Irakli Kobakhidze on Thursday said he will suspend Georgia’s process of EU accession until 2028 and decline all grants from the bloc. The announcement has sparked mass protests and clashes with police in the capital of Tbilisi every night since then.

Russia-Ukraine: While it’s now widely acknowledged that the Kremlin’s forces are gradually reducing the Ukrainians’ salient in the Russian region of Kursk, new reporting shows the Russians have also suddenly started to take more territory in eastern Ukraine. The Russian momentum will likely put further pressure on Kyiv to start peace negotiations, even beyond the pressure that is likely to come from the US once President-elect Trump is back in office.

Syria-Russia-Turkey: The rebels who have been battling the Assad government for years staged a surprise offensive over the weekend, capturing much of the major city of Aleppo and wide swaths of western and northwestern Syria. Underlining the international dimension of the civil war, the rebels are reportedly being aided by Turkish-backed fighters. In return, the Assad government and its Russian allies are fighting back with airstrikes, and Iran has sent its foreign minister to Damascus in a show of support.

- The offensive is yet another spark that could lead to a broader conflict in the Middle East and threaten its energy output.

- Importantly, the meddling by outside powers such as Russia, Iran, and Turkey has the potential to spark fighting between major powers.

United States-China: The outgoing Biden administration today imposed new restrictions on sending advanced semiconductors and related equipment to China. Under the new initiative, the US’s previous export curbs will be extended to cover memory chips used in artificial-intelligence applications and certain types of chipmaking equipment. The move also adds 140 Chinese companies to the US export blacklist. Even though the administration has taken a flexible approach to applying the rules, the new move is likely to further exacerbate US-China tensions.

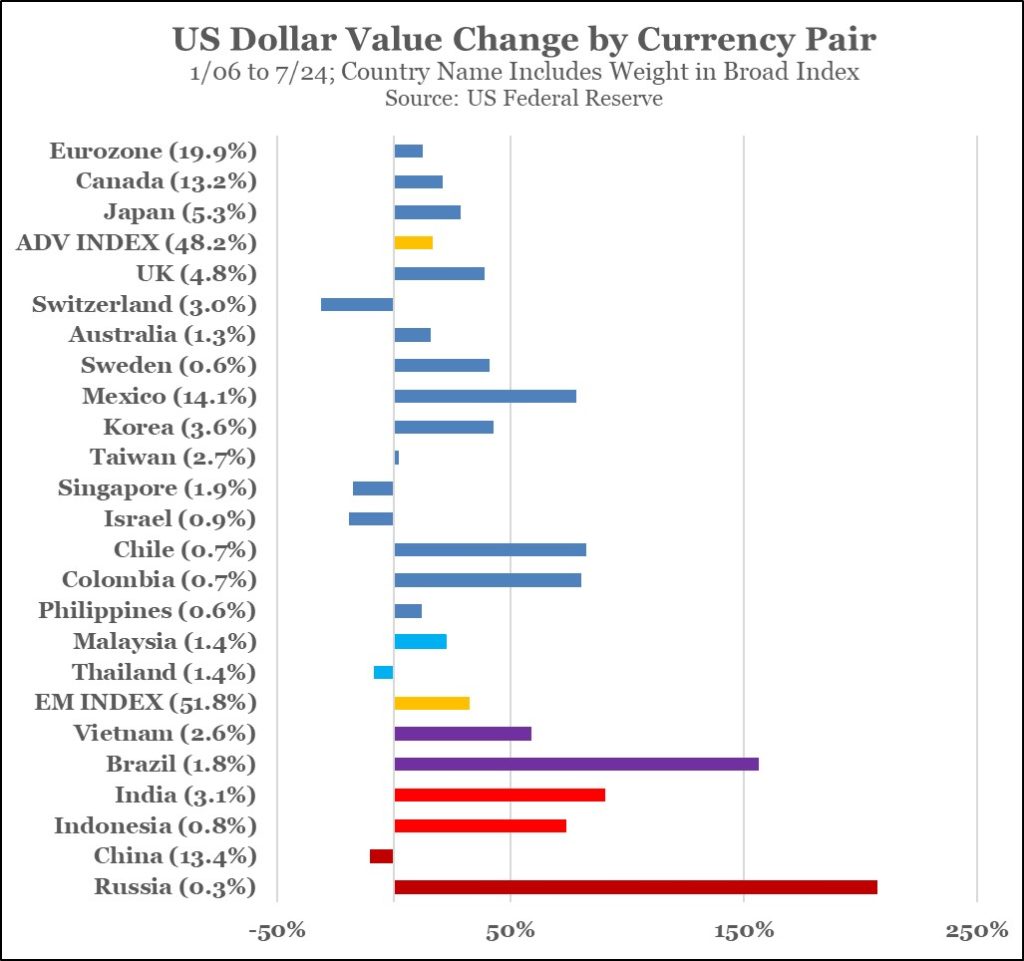

US Trade and Currency Policy: President-elect Trump on Saturday warned the BRICS group of developing countries that he will impose 100% import tariffs against them if they keep trying to create their own currency to use in place of the dollar. The warning appears to reflect concerns that reduced use of the greenback for trade would undermine its value or its role as the world’s reserve currency. However, Trump and his advisors have also floated the idea of weakening the dollar to help eliminate the US trade deficit.

- As we noted in our Bi-Weekly Geopolitical Report from September 9, 2024, the dollar’s share in global central bank currency reserves has been falling gradually for more than two decades as countries make greater use of non-dollar currencies in trade. Nevertheless, the dollar remains in a bull market and is trading close to a record high. It has appreciated the most against major BRICS currencies, even as those countries try to reduce their use of the greenback.

- In our view, the value of the dollar is more driven by international capital flows than by its use in trade. Given the US economy’s superior growth, deep and well-regulated financial markets, and better protections for private property, capital flows into the US are likely to keep supporting the dollar in the near term.

- All the same, some public policy observers note that the strong dollar exacerbates the US trade deficit by making US exports more expensive and imports less expensive. That’s probably why some politicians have suggested taking steps to weaken the dollar, perhaps by imposing a tax on foreign capital inflows. Trump now appears to be siding with the strong-dollar advocates, which may make it harder to achieve his goal of bringing US trade back into balance.

US Postal System: The US Postal Service has finally started rolling out its new delivery trucks, and initial reports suggest mail carriers are happy with them. The new trucks, which will replace the current boxy vehicles introduced in the 1980s, are not only electrified, but they also finally have air conditioning and are designed for better access to parcels stored in the back. Sadly, however, they’re also being panned as extremely ugly!

(Source: US Postal Service)