Daily Comment (December 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is processing the latest PCE price index data. In sports news, Tottenham Hotspur defeated Manchester United to make it to the semifinals of the Carabao Cup. In today’s Comment, we will discuss why the government may be headed for a shutdown, explain the reasons we remain confident that dollar strength will continue, and provide an update on Germany as it prepares for new elections. As usual, the report will conclude with a roundup of international and domestic data releases.

Government Shutdown: A government shutdown looms after President-elect Donald Trump and Elon Musk rejected a stopgap spending bill and called for the elimination of the debt ceiling.

- There is growing uncertainty about whether a shutdown can be avoided before the Friday deadline. Republican lawmakers met on Thursday to discuss an alternative spending package aimed at reaching broader consensus. The proposal would extend funding until mid-March, similar to the previous plan, but would exclude unpopular provisions such as a pay increase. It would also allow Congress to raise the debt ceiling twice through budget reconciliation. These adjustments are designed to give lawmakers greater flexibility next year to advance their agenda without negotiating with Democrats.

- This week’s dispute over government funding is likely a way to prevent a bigger fight over the debt ceiling, which expires January, from derailing Trump’s agenda. Typically, there are three budget reconciliation processes used for revenue, spending, and the debt ceiling. The purpose of these bills is to allow for government funding without the threat of a filibuster. While this measure has facilitated the passage of legislation to keep the government funded, it has also been used to push through major legislation like the Affordable Care Act, the Tax Cuts and Jobs Act, and the Inflation Reduction Act.

- The market’s best chance of replicating its 2024 performance hinges on confidence in the incoming administration’s ability to implement its agenda with minimal obstacles. While high expectations for growth (which have been driven by anticipated tax cuts and deregulation) create optimism, they also heighten the risk of a market pullback if complications arise. A comprehensive budget resolution that facilitates legislative progress and avoids another divisive debt ceiling debate could strengthen investor confidence and drive higher asset prices as 2024 concludes.

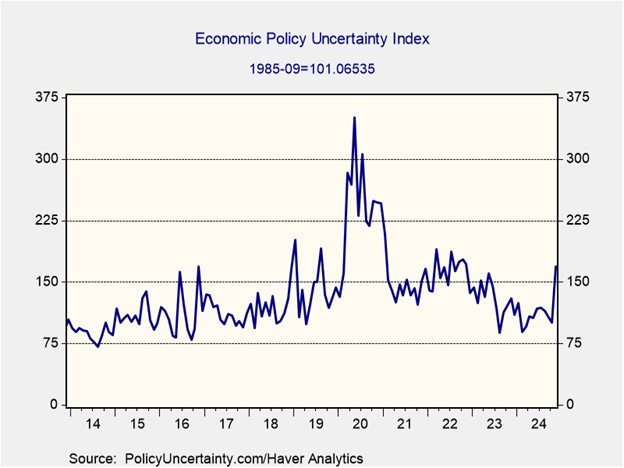

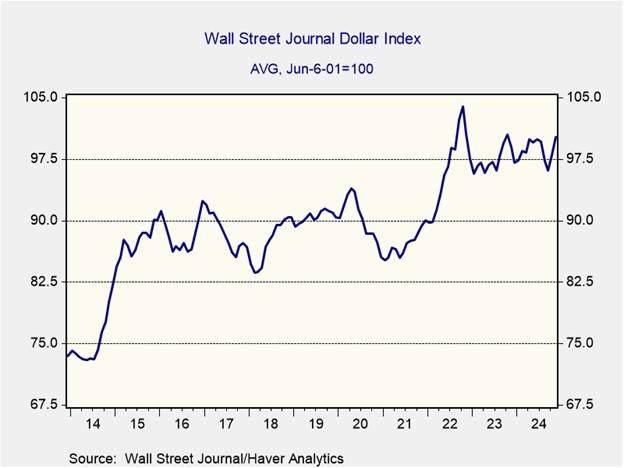

Greenback’s Rise: The US dollar is on track to have its biggest annual rally since 2015, and we think there is evidence that this could continue in the coming year.

- The US dollar spot index has surged 7% year-to-date, primarily driven by market expectations of increased US GDP growth and relatively restrictive monetary policy. Despite concerns about a potential economic slowdown in 2024, the US economy managed to outperform other G-7 nations. This robust economic performance has enabled the Federal Reserve to exercise greater restraint in easing monetary policy compared to its peers, ensuring that inflation continues to progress toward its target.

- Tariffs are likely to have a positive impact on the US dollar. The possibility of a universal tariff regime has led investors to flock to the dollar as a safe-haven asset. This is because if the US were to implement such tariffs, it could have significant negative consequences for the global economy, particularly for major exporters to the US. In response to these potential economic risks, central banks such as the Bank of Japan, European Central Bank, and People’s Bank of China have recently shown reluctance in maintaining tight monetary policies.

- The continued strength of the US dollar will likely persist as long as investors maintain confidence in the stability of the US economy and the Federal Reserve’s cautious approach to reducing its policy rate. However, the dollar may become vulnerable to changes in market expectations, particularly if global economic growth begins to accelerate or if there are doubts about the severity of potential tariffs. For the time being, we believe that the US dollar will continue to strengthen throughout the coming year.

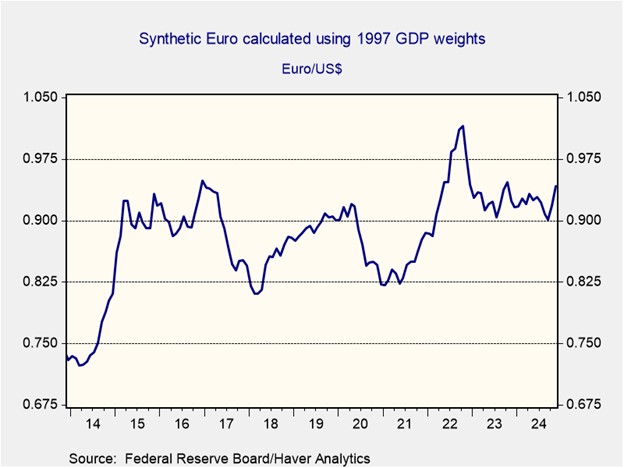

German Elections: Europe’s largest economy is heading for early elections in February as voters seek a party capable of reversing the country’s economic slump.

- Current polls indicate that voters are likely to shift to the right in the next election, with the center-right Union parties (CDU/CSU) and the far-right Alternative for Germany (AfD) projected to secure 32% and 18% of the vote, respectively. While this would theoretically give them enough support to form a government, ideological differences make a coalition between the two unlikely. This could create opportunities for left-leaning parties to play a role in the next government. Despite declining popularity, the center left Social Democratic Party’s expected 16% share could prove pivotal in forming a centrist coalition.

- A stronger-than-expected victory for the AfD party could significantly impact European markets. The party advocates for Germany’s withdrawal from both the European Union and the shared currency system. In its place, it proposes a “Europe of Fatherlands,” emphasizing cooperation among sovereign states without forming a unified superstate. If victorious, AfD plans to push for a Brexit-style referendum, allowing voters to decide whether Germany should remain in the EU. A poll earlier this year revealed that only 29% of Germans saw more advantages than disadvantages in EU membership.

- Although the chances of AfD gaining power remain slim, its new platform is likely to pressure other parties into resisting some of the EU’s stricter regulations. This could lead to a softening of the country’s unpopular climate goals as it seeks to bolster its weakening manufacturing sector. Additionally, there may be efforts to limit the number of asylum seekers accepted. A strong performance by AfD, however, could weigh on the euro and potentially drive-up bond yields across Europe.

In Other News: Amazon workers have gone on strike at several locations, indicating that labor still has leverage to demand higher wages. Senators are urging President Biden to extend the deadline by 90 days for ByteDance to sell the US assets of TikTok, in a sign that law is facing renewed pushback.