Daily Comment (December 3, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a provocative new operation by the Russian navy that may reflect the increased coordination and cooperation of the countries in the China-led bloc. We next review several other international and US developments with the potential to affect the financial markets today, including the impending downfall of the French government and new signs that the Federal Reserve is likely to cut US interest rates again later this month.

Russia-Philippines: New reports say the Russian navy surfaced an advanced attack submarine off the western Philippines late last week. Such a surfacing isn’t necessarily outside the ordinary, and the sub’s crew properly responded to a Philippine navy request for identification. All the same, we think the incident may have been designed to show Russian support for Beijing’s territorial claims against Manila in the region.

- If so, the incident would be more evidence of increasing coordination and cooperation among the key countries of the China-led geopolitical bloc. On a separate note, NATO General Secretary Rutte said in an interview yesterday that he has warned President-elect Trump about the increasingly close coordination among the China-bloc countries. Rutte said he also advised Trump that an overly generous peace deal for Russia in its war against Ukraine would further incentivize greater cohesion in the China bloc.

- If China, Russia, Iran, and North Korea really are coordinating and cooperating more, global tensions would likely increase. In turn, that would likely spark further fracturing of the world into separate blocs, increased global defense spending, and higher and more volatile inflation and interest rates in the West.

Russia-Ukraine: In recent interviews and public statements, Ukrainian President Zelensky has shifted from his previous stance that Kyiv would keep fighting against the Kremlin’s invasion forces until all Russian troops have been pushed out of the country. In his new statements, Zelensky has signaled that Ukraine would stop fighting to regain its Russian-held territory in exchange for membership in the North Atlantic Treaty Organization.

- Zelensky’s new stance is consistent with our long-held view that the heavy losses on each side would eventually lead to peace negotiations, rather than any clear-cut victory for either Russia or Ukraine.

- Still, Zelensky’s statements don’t mean peace talks are imminent. We suspect the Ukrainians still have some fight left in them, while the US and its NATO allies also remain far from ready to bring Ukraine into the alliance.

- Perhaps most important, a Russian oligarch close to the Kremlin says President Putin will reject the peace plan President-elect Trump is working on, which reportedly would let Russia keep the territory it has seized in Ukraine in return for a truce supported by European peacekeepers.

- Emboldened by the support of his China-bloc allies, his recent successes on the Ukrainian battlefield, and the fact that he has gotten away with his recent sabotage campaign against NATO, Putin will reportedly seek maximalist goals in any peace talks involving Trump, such as broad, regional spheres of influence for Russia and its China-bloc partners.

France: Faced with resistance from opposition lawmakers, Prime Minister Barnier yesterday used a special constitutional provision to push his austere 2025 social security budget into law. However, the maneuver set the stage for far-left lawmakers to request a no-confidence motion, which is likely to pass with the support of the far right when it takes place as early as Wednesday. The French government would then fall, creating a political and economic crisis that could shake the European Union and its markets.

- The chaos yesterday pushed the yield spread of 10-year French government bonds over German government bonds to nearly a 12-year high of 0.87%.

- The crisis also pushed the value of the euro (EUR) down sharply. As of this morning, the currency is trading at $1.0523, up 0.2% from yesterday but down approximately 5% since the end of September.

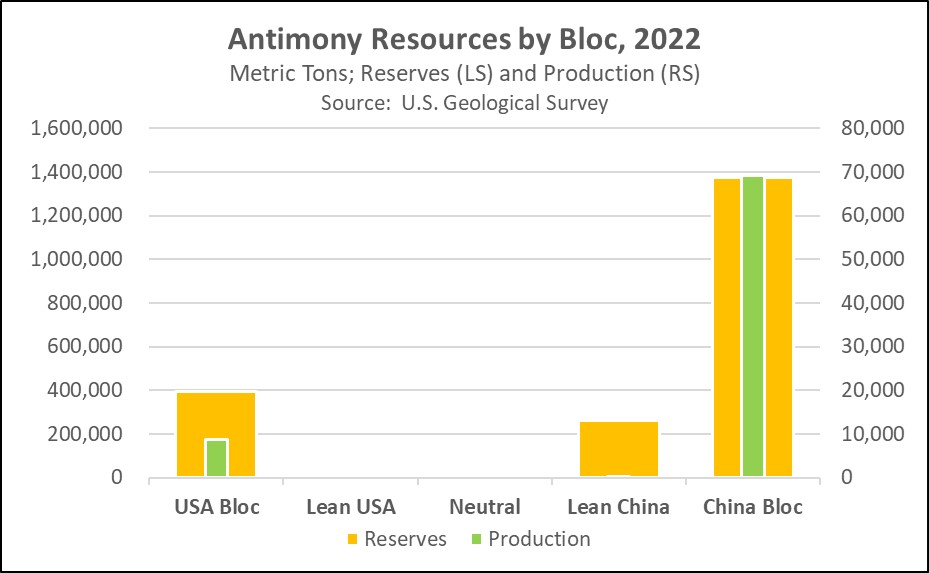

China-United States: The Chinese Ministry of Commerce today said it will ban exports to the US of gallium, germanium, antimony, and certain other dual-use minerals with both military and civilian uses. The ministry also said it will conduct stricter end-user and end-use reviews for graphite going to the US. The ban is consistent with our past warnings that China and its bloc will likely weaponize their dominance of key mineral markets amid growing tensions with the US and its bloc.

- The new ban is likely in retaliation for the Biden administration’s new curbs on sending advanced memory chips and related technology to China, which was announced on Monday.

- The ban could disrupt supply chains in US industries ranging from semiconductors to defense.

United States-China: The outgoing Biden administration has imposed new anti-dumping tariffs on solar panels and components made by Chinese firms in Malaysia, Thailand, Cambodia, and Vietnam. To get around the existing US tariffs on solar energy goods shipped directly from China, the targeted firms have been setting up production facilities around Southeast Asia. The new tariffs likely aim to signal that the US won’t tolerate this back-door entry of low-cost Chinese goods into the US market.

US Monetary Policy: Fed board member Christopher Waller said yesterday that he expects to support another cut in the benchmark fed funds interest rate at the central bank’s next policy meeting on December 17-18. However, he warned that he would switch to supporting a pause if the economic data between now and then point to rebounding economic growth or reaccelerating price inflation.

- Waller’s statement has helped increase investor confidence that the Fed will cut rates again this month. So far this morning, pricing in the fed-funds futures market suggests investors are putting a 73% probability on the policymakers cutting rates by 0.25%, up from a probability of 59% one week ago.

- Nevertheless, we think Waller’s caution on the data is evidence of how the continued strength in the economy and remaining price pressures could keep interest rates from falling as fast as investors expect.

US Construction Industry: The Wall Street Journal today carries a story on the challenges that the construction industry could face under the tariff and migration policies of the incoming Trump administration. The article claims increased tariffs could raise the cost of the industry’s many imported inputs, while mass deportations would reduce its labor supply. Nevertheless, it’s important to remember that the policies put into place next year are likely to be adjusted and/or watered down from current discussions, so it’s still too early to predict their exact impact.

US Agriculture Industry: Cargill, the privately held agricultural commodity giant, today said it will cut 5% of its global workforce and restructure to improve profitability. The move reflects softer agriculture markets over the last couple of years as the supply shortages and high prices associated with the coronavirus pandemic and the Ukraine war recede into memory. Now, ample supplies, modest demand, and lower prices are challenging major commodity traders such as Cargill, Bunge, and Archer Daniels Midland.