Daily Comment (December 4, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is processing the latest ADP employment change data. In sports news, MLB free agent Juan Soto is nearing a deal with a new team. Today’s Comment will discuss why uncertainty abroad has helped boost US mega cap tech companies, explain how a strengthening labor market will likely hinder the Fed’s ability to cut rates, and discuss the path of global interest rates and its implications for the dollar. As usual, the report will conclude with a roundup of international and domestic data releases.

Equities Shrug Off Turmoil: Despite rising geopolitical tensions in Asia, Europe, and the Middle East, the S&P 500 increased as investors sought safety in the US.

- Important news emerged from South Korea, where President Yoon Suk Yeol attempted to enforce martial law amid fears that the opposition was collaborating with North Korea. Although the order was ultimately rescinded, calls for his resignation or impeachment are increasing. In Europe, French President Emmanuel Macron pushed back against calls for his resignation as the nation approaches a no-confidence vote. Finally, there are rising worries in the Middle East that the recent ceasefire between Israel and Lebanon could fail, as well as concerns about a possible revitalization of the civil war in Syria.

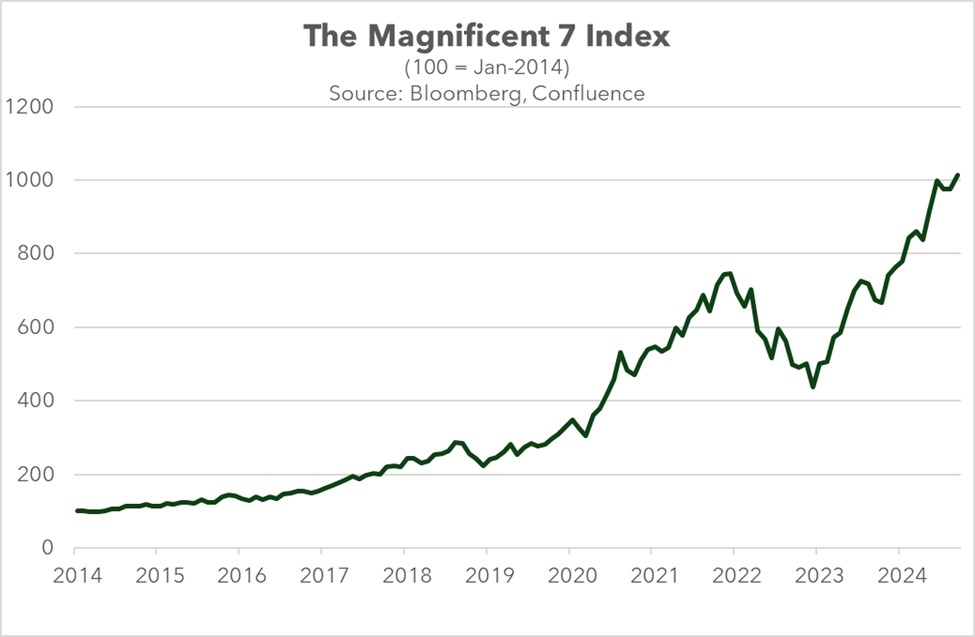

- Investors responded to the news by pouring money into US equities, particularly technology stocks. On Tuesday, the S&P 500 saw a modest 0.05% increase, while the Magnificent 7 gained 1.01%. The strong interest in large US tech companies likely reflects optimism about robust economic growth and investor aversion to bonds, given the significant deficit. This likely explains why 10-year Treasury yields rose 3 bps on the day, despite their traditional role as a safe-haven asset.

- Robust economic growth and a smooth presidential transition are expected to bolster the appeal of US assets for investors, especially amidst rising global uncertainty. Mega cap tech companies, well-positioned to capitalize on this trend, may continue to attract investors due to their capacity to sustain strong earnings, particularly in the short term. However, this trend may shift in favor of less valued stocks as the market gains confidence that the new administration will moderate some campaign promises, and the Federal Reserve will maintain its accommodative stance in 2025.

Job Market Heats Up: The Federal Reserve’s willingness to ease policy is being challenged by signs of a rebound in the labor market.

- Several Fed officials spoke on Tuesday about the central bank’s current policy outlook. San Francisco Fed President Mary Daly and Chicago Fed President Austan Goolsbee argued that while a December rate cut is not guaranteed, conditions still favor further easing in the future. Meanwhile, Fed Governor Adriana Kugler echoed this sentiment but dismissed criticism that incoming President Donald Trump’s policies could impact the Fed’s decision at the upcoming meeting. She argued that it is too early to assess the impact of potential tariffs and immigration restrictions on inflation.

- While the Fed has assessed the risks to employment and inflation as balanced, mounting evidence points to a strengthening labor market. In October, job openings surged by 372,000 to 7.74 million, significantly exceeding market expectations of 7.48 million and the downwardly revised prior reading of 7.37 million. Also, layoffs declined at their fastest pace in over a year and a half. The surge in labor demand suggests that businesses may again turn to wage increases to attract workers. The ratio of job openings to unemployed rose from 1.08 to 1.11.

- Friday’s job report and next week’s CPI report will likely be pivotal in determining the Fed’s rate-setting decision at its next meeting. An upside surprise in both reports could force the Fed to pause rate cuts indefinitely. However, if only one report surprises to the upside, a December rate cut remains on the table with the Fed possibly opting to reduce the number of expected rate cuts in its updated projections for 2025. Currently, the market is pricing in a 74% probability of a rate cut later this month and two rate cuts for next year, which we suspect is relatively high given the risks to inflation.

Global Rate Uncertainty: While the Fed’s future policy direction is unclear, other G-7 rate setters seem to be maintaining their current course.

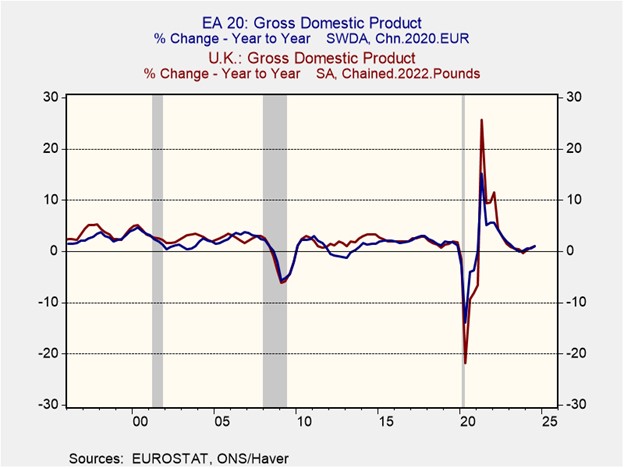

- The European Central Bank (ECB) and the Bank of England (BoE) are expected to continue cutting rates this year and next. European policymakers are poised to implement a 25 basis point rate cut next week and signal a commitment to further easing measures next year to avert a recession. Meanwhile, BoE Governor Andrew Bailey has indicated a willingness to cut rates four times next year, with the assumption that inflation will continue to make progress toward the central bank’s 2% target. On the other end of the spectrum, the Bank of Japan has signaled a potential rate hike later this month.

- Changes in policy rates are likely to continue influencing dollar movements, although growth expectations will also be a significant factor. The US is expected to maintain a tighter monetary policy relative to many of its peers, and the interest rate differential with several G-7 countries is projected to widen. Additionally, the US economy appears to be better positioned to lead global growth. This combination of factors should make the US an attractive destination for capital flows, which should drive up the value of the dollar going into 2025.

- The dollar’s strength in the coming months is contingent on investors maintaining a weak outlook for the rest of the world. The economies of the eurozone and the UK are showing signs of growth despite fears of recession. At the same time, inflation in these regions appears to be stalling. As a result, these central banks may not ease as much as investors expect which could slow the dollar’s upward trajectory. That said, given the potential for positive economic surprises abroad, international equities may present attractive investment opportunities.

In Other News: President-elect Donald Trump is considering selecting Florida Governor Ron DeSantis as a replacement for Pentagon nominee Pete Hegseth. This move suggests that he may be shifting toward more traditional choices for positions in his administration. Meanwhile, there are growing labor strikes in Germany to protest Volkswagen’s decision to close plants in a sign that growth in the country could slow further. Lastly, A Chinese state newspaper suggested that the country may not need to achieve 5% annual growth to meet its long-term objectives. This signals that the country does not anticipate a rapid improvement in its economic challenges.