Daily Comment (December 5, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The markets have US jobs data in focus as they look to gauge the Fed’s next move. In sports, unranked Creighton pulled off an upset against No.1 ranked Kansas. Today’s Comment will explore why Republicans have postponed their push for tax reforms in favor of prioritizing border security. We will then analyze the Federal Reserve’s confidence in achieving a soft landing and provide an update on the no-confidence vote in France. As always, the report will include a roundup of key international and domestic data releases.

Trump Tax Doubts: Despite controlling both houses of Congress, Republican apprehension regarding the feasibility of comprehensive tax reform has led to a prioritization of border security.

- The decision to prioritize immigration over taxes came after a five-hour closed-door meeting, which included a phone call with incoming President Donald Trump. The Republicans plan to advance his agenda by passing a border security bill, along with legislation on defense and energy, within Trump’s first 30 days in office. They intend to achieve this through the use of budget reconciliation — a process that allows bills to pass with only a simple majority. After completing the initial legislation, the GOP intends to revisit and extend Trump’s tax cuts using the same procedure later in the year.

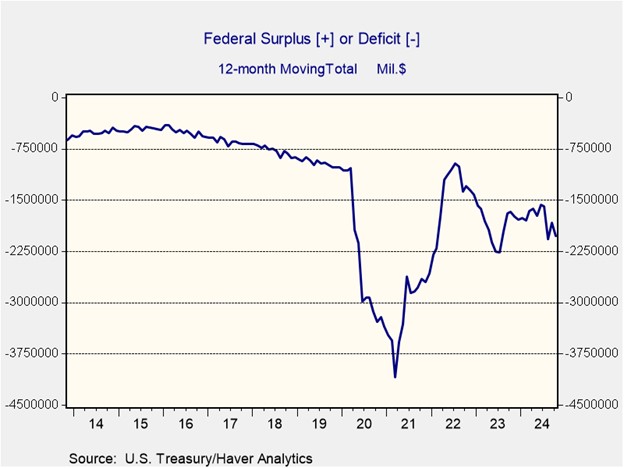

- Hesitation by the Republicans to address taxes likely stems from concerns that a budget battle could complicate efforts to raise the debt ceiling, which is set to be reinstated on January 2. Although the party controls both chambers of Congress, its majority is narrow, especially in the House of Representatives where it holds only a five-seat advantage. While the border security vote is expected to garner bipartisan support, passing tax cuts may require every Republican vote. This could prove challenging, as several Republicans voiced concerns about the impact that tax cuts could have on the deficit.

- Although delaying tax legislation in favor of border security entails certain risks, it may afford lawmakers an opportunity to secure an easy legislative win and build momentum before addressing the tax reform. One of the primary challenges will be ensuring the permanence of tax cuts, as this may necessitate offsetting measures to comply with budget reconciliation rules. Such measures could involve unpopular budget cuts. Nonetheless, the decision to postpone tax reform may alleviate pressure on Treasury yields, as it could mitigate concerns about the ballooning deficit.

Central Bank Confidence: Federal Reserve Chair Jerome Powell has doubled down on his view that the central bank will be able to achieve a soft landing.

- On Wednesday, the central bank head reassured markets that the Fed is in no rush to cut interest rates further. He added that the current economic outlook appears stronger than in September, when the Fed cut rates by 50 basis points. His comments suggest that the Fed is leaning toward a more gradual approach to future rate cuts and aiming to balance economic growth with inflation concerns. Powell emphasized that this year’s rate cuts were intended to provide insurance against potential economic weakness and to support the labor market but were not a declaration of victory over inflation.

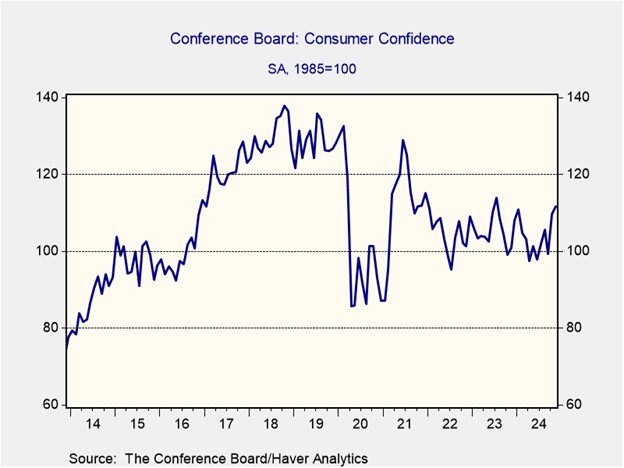

- Fed Chair Jerome Powell’s cautious stance on future rate cuts may be in response to a recent surge in optimism following Donald Trump’s election victory. The latest Beige Book reported that although economic activity has been relatively sluggish in recent months, many of the central bank’s business contacts are optimistic about a potential rebound in demand. This optimism was also reflected in the latest Conference Board Consumer Confidence Index, which showed that the gap between respondents saying jobs are “plentiful” versus “hard to get” has reached its highest level since June.

- Powell’s comments highlight the prevailing belief that the Fed is prioritizing maximum employment over price stability. As a result, the central bank may hold off on rate cuts if Friday’s payroll report significantly exceeds expectations, with the consensus projecting a gain of 215,000 jobs for November. According to the latest CME FedWatch Tool, markets currently assign a 74% probability of a rate cut at the Fed’s meeting in two weeks. A stronger-than-expected jobs report, however, could spoil those expectations.

French No-Confidence Vote: The political crisis in France deepened as right- and left-wing lawmakers joined forces to topple the government.

- French Prime Minister Michel Barnier lost a no-confidence vote on Wednesday after he bypassed the lower house of parliament to push through an unpopular portion of the budget. This is the first time in nearly 60 years that a prime minister has been ousted, raising significant uncertainty about how the government will tackle its budget challenges. Barnier is expected to tender his resignation later today but will remain in office until French President Emmanuel Macron appoints a successor.

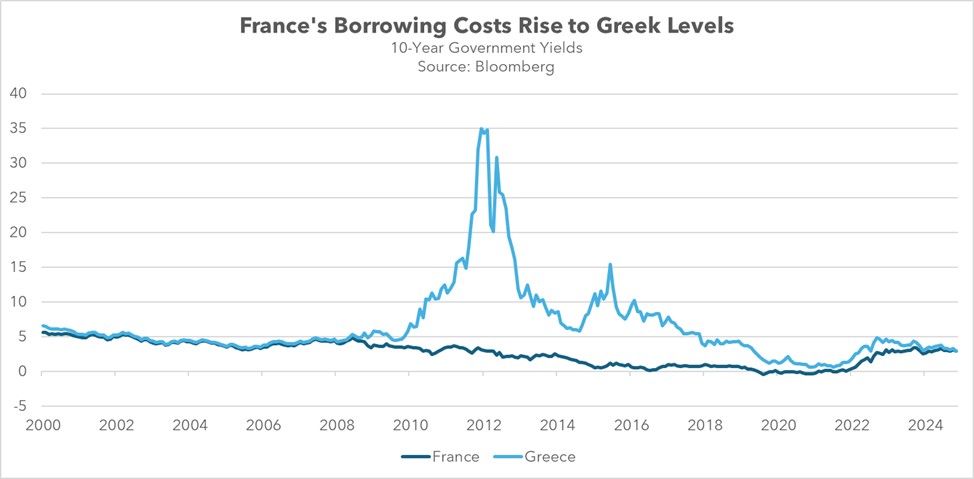

- Barnier’s ouster leaves the French government without a functioning budget or stable leadership as it heads into 2025. This instability has created significant uncertainty in the markets, with investors increasingly reluctant to hold French assets due to the country’s growing deficit and slowing economic growth. While the market exhibited relative indifference to Wednesday’s no-confidence vote, underlying concerns remain. France’s benchmark stock market index has declined by 11% since its 2024 peak in May, and its borrowing costs have converged to parity with Greece’s for the first time in 16 years.

- The muted response from investors following the government’s collapse suggests that the market had anticipated the outcome. However, significant uncertainty remains about France’s future after the no-confidence vote. President Macron has limited options for appointing a Prime Minister, given the deeply divided parliament, which is likely to prolong political gridlock. If Macron remains in office, this stalemate could persist, adding to the uncertainty. We believe these developments may weigh on the euro (EUR) in the coming months.

In Other News: Bitcoin surged past $100,000 for the first time, as crypto investors celebrated Trump’s decision to appoint a pro-crypto advocate to lead the SEC. Meanwhile, in South Korea, the People Power Party leader has pledged to vote against impeachment proceedings but called on President Yoon Suk Yeol to step down from the ruling party. In the US, projections from the Congressional Budget Office suggest that Trump’s tax cuts are unlikely to generate sufficient economic growth to offset the resulting increase in the budget deficit.