Daily Comment (December 6, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning on the Feast of St. Nicholas! It’s actually a rather quiet morning after yesterday’s risk-off day. U.S. equity futures have been vacillating this morning, mostly trading inverse the dollar. Gold is higher this morning, but oil is trading lower. Equities have been taking on a tone of bad news is good news. Yesterday’s ISM services index, coming in well above the expansion line of 50, raised fears that monetary policy won’t be as easy as hoped. We note that the WSJ’s latest “Fed whisperer,” Nick Timiraos, published an article yesterday reiterating Chair Powell’s recent comments about moving to slower rate hikes but also signaling that tightening was far from over. Last week, when that speech occurred, the financial markets viewed the talk as dovish. The Timiraos article suggests that isn’t the narrative that the FOMC preferred.

In today’s Comment, our coverage begins with China news. Economics and policy are up next, and an update on the North Carolina substation attack follows. Our war in Ukraine briefing comes next, and we close with the international roundup.

China News: The state funeral for Jiang Zemin has begun, as the CPC does its best to project unity. We also update the COVID situation.

- It is becoming clear that China’s Zero-COVID policy is evolving, but we hesitate to call it a full reopening. Instead, policymakers seem to be moving along three tracks.

- There appears to be a concerted effort to change the narrative on the disease from something to be feared into more of an inconvenience. COVID has exhibited a wide array of effects with most people seeming to survive it just fine, but it is clearly a risk to the elderly and to those with several preexisting conditions. Also, the mystery of “long COVID” remains an issue. Most nations have generally developed a strategy of trying to open as much as possible while simultaneously protecting the most vulnerable. Finding that balance can be tricky.

- As part of this narrative change, public health authorities are said to be close to announcing less strict quarantine and testing measures.

- Expanding immunizations is also being promoted. Unfortunately, Beijing doesn’t want to accept Western vaccines, which have proven to be more effective. Thus, immunizations may have only a limited effect on reducing risk.

- Opening is risky, and the use of substandard vaccines coupled with a population that hasn’t had much exposure to the virus further raises the risk that a bout of infection could strain the medical system. However, it has become clear, for economic and social reasons, that the Zero-COVID policy can’t be maintained. Beijing is adjusting, but it isn’t completely certain how well this will work out.

- The fiscal response by the U.S. to COVID was extraordinary, and the speed that policy stimulus was deployed opened the potential for abuse. Reports of identity theft when applying for unemployment insurance and the abuses of PPP payments were widespread. Turns out the abuses were also international in nature—the Secret Service reports that Chinese hackers clipped at least $20 million of COVID relief payments.

- As General Secretary Xi starts his third term among expectations of market-unfriendly policies expanding, we are beginning to see reports of capital flight as wealthy Chinese citizens begin moving funds offshore. Singapore appears to be the most prominent beneficiary. The city-state has a large ex-pat population and is a natural destination for such funds.

- Canada is joining other G-7 nations in conducting freedom of navigation operations in the Taiwan Strait.

Markets, Economics and Policy: The economic picture is mixed. Business leaders are worried but still see a soft landing. Supply chains are improving, but layoffs are rising.

- Recent CEO surveys suggest that business leaders are becoming more concerned about the economy, but still expect a soft landing. It’s not obvious if these leaders have a great track record on forecasting the economy (to be fair, no one else is all that good either) but their attitudes likely reflect present business activity. Thus, we see it as confirmation that we are not currently in a recession.

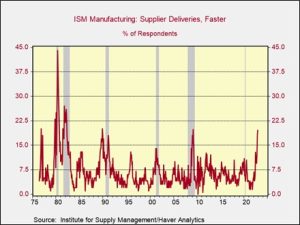

- At long last, supply chains appear to be improving. Freight rates have been easing, and we note that in the recent ISM data, there is growing evidence of improvement.

- The number of purchasing managers reporting faster deliveries is rising rapidly, although history would suggest some of this improvement is likely coming from slower economic activity.

- Taiwan Semiconductor (TMSC, $81.62) announced it is increasing its investment in its Arizona facility.

- Pepsico (PEP, $183.12) announced layoffs from its corporate headquarters.

- For years, tech firms have been news aggregators as they give users the ability to find articles and, for a long time, avoid paying subscriptions. Clearly, this content model can’t work indefinitely. If the content providers can’t get paid, they will eventually stop providing the content. Congress is apparently working on legislation that would facilitate the providers’ abilities to negotiate fees from the tech firms. Facebook (META, $122.43) announced it may stop providing news feeds on its platform if the legislation passes.

- Commercial property private REITs are seeing redemption notices.

- Influenza hospitalizations are rising rapidly. The spike in infections may be a hangover from the COVID restrictions, which also reduced flu infections but have lowered resistance.

- The head of the PBOC is making the argument that the dollar has peaked. Although we are not sure that we won’t see one more recovery in the greenback, (especially if Nick Timiraos is right) we do think that we are in the very late innings of this dollar bull market.

North Carolina: Although authorities are not calling the weekend attack on substations in North Carolina domestic terrorism, the actions were clearly targeted, suggesting that it wasn’t just a random attack. Utilities are steadily bringing power back online, but it probably won’t be until Thursday before power is fully restored. Our worry is that if similar attacks become common, not only will it cause disruptions, but mitigation efforts (backup generators, diesel stocks, extra food, etc.) will tend to be costly and could boost inflation.

War in Ukraine: Ukraine strikes inside Russia which could expose divergences in goals among allies.

- Although Kyiv hasn’t fully accepted responsibility, it appears that Ukrainian drones attacked three Russian airfields inside of Russia proper, including one that houses some of Russia’s strategic air assets[1]. A drone also hit a Russian oil depot. Ukraine’s ability to strike inside Russia is a new development, and one that the U.S probably isn’t pleased about. We note that the U.S. “modified” its HIMARS systems given to Ukraine to reduce its range and lessen the likelihood that Ukraine could strike within Russia.

- This development could mark a serious escalation of the war. First, if Ukraine now has the ability to strike targets deep inside Russia, then Putin’s conduct of the war will come under further scrutiny. Second, Ukraine’s Western allies are mostly willing to support this war as long as it stays contained, since the West has no interest in seeing this conflict expand. Attacking Russia proper changes the nature of the war and could prompt Russia to take more aggressive steps, such as engaging tactical nuclear weapons.

- We will wait to see the U.S./allied response. Since the drones appear to be of Ukrainian origin, the U.S. and its allies can argue that it wasn’t Western arms that attacked Russia. We doubt the Kremlin will accept this argument. We look for the West to restrict weapons sales further to discourage this development.

- Meanwhile, polls show some reduction in support among Americans for “indefinite” aid to Ukraine. And Germany is balking on sending the arms it promised earlier.

- As the war continues, the Kremlin is increasing its commandeering of private companies to support the war effort. This action will tend to reduce available supply; if money supply isn’t restricted, then inflation will worsen.

International News: The EU awakens to the change in U.S. policy.

- The Inflation Reduction Act, in IOHO, is the opening salvo in U.S. industrial policy designed to kick start the reindustrialization of America, but at the expense of our trading partners, mostly Europe. For the Europeans, who have maintained export promotion far beyond just the recovery from WWII, this is a massive threat. When French President Macron was in Washington recently, he warned that the new law could “fragment the West.” Perhaps, but given that Europe can’t defend itself, it probably is better described as the U.S. subjugating Europe. The EU is expected to react, and there is talk of it creating its own energy subsidies and maybe giving up on free trade as a policy[2]. However, we don’t expect the U.S. to change its policies all that much, and if anything, we expect more of the same.

- Although Turkey has thrust itself into global geopolitics in a robust fashion, and is getting some economic benefits, it still faces an ugly inflation problem.

- South Africa’s President Ramaphosa is facing a corruption scandal, but it appears he will escape impeachment.

- Not so for Peru’s President Castillo, who is facing a third attempt to remove him from office.

- Mount Semeru has erupted in Indonesia. The volcano is situated on Java, where, at the other end of the island, sits the city of Jakarta. Major volcanic eruptions can cool the earth for a time, as volcanic ash spews into the upper atmosphere.

- Papua New Guinea may have underestimated its population by half.

[1] In other words, it houses an element of its nuclear weapons delivery.

[2] Which is a bit rich, given that numerous policies, such as regulations on food, are clearly protectionist.