Daily Comment (December 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is processing the latest jobs data. In sports news, the Detroit Lions pulled off an impressive comeback against the Green Bay Packers, continuing their historically strong season. In today’s Comment, we’ll delve into the highly anticipated task force led by Elon Musk and Vivek Ramaswamy and its budget-cutting plans. Next, we’ll examine the future of US chip manufacturing. Finally, we’ll analyze Brazil’s fiscal policies and the renewed tensions they’ve caused with the military. As always, we’ll conclude with a roundup of key domestic and international data releases.

Trump Budget Cuts: The Department of Government Efficiency is beginning to unveil its strategy to reduce government spending by over $2 trillion.

- Elon Musk and Vivek Ramaswamy met with lawmakers to advocate for cost-cutting initiatives aimed at “reducing the federal deficit. The newly appointed group seeks to dismantle government bureaucracy, curtail government regulations, eliminate wasteful expenditures, and restructure federal agencies.” The Trump appointed commission’s outline plans to reduce the number of federal agencies from 428 to 99 and mandate a return to the office for all federal employees. Most changes will require congressional approval, but the duo will seek to implement some reforms through executive order.

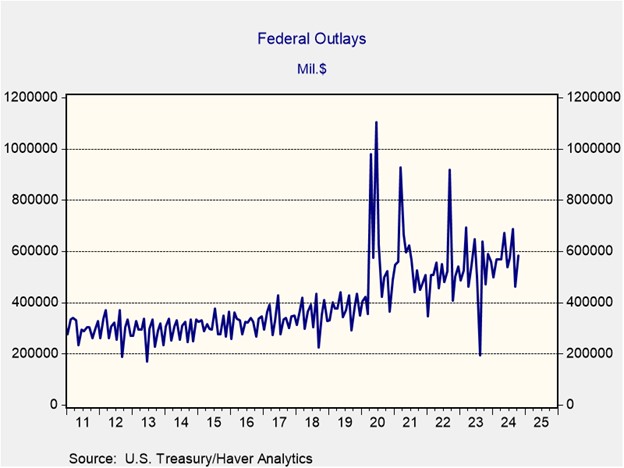

- While reducing the government workforce could alleviate some budgetary pressures, deeper spending cuts will likely be necessary to achieve significant savings. Federal employee compensation, including wages, salaries, and benefits, has been declining as a percentage of the federal budget since 2005, dropping from a peak of 11.7% to 8.7% in 2023, according to the Bureau of Economic Analysis. Although, even if all federal employees were eliminated, there would still be approximately $1.5 trillion needed annually in order to meet the deficit reduction goal.

- The push for government efficiency might be little more than a distraction as Republicans concentrate on addressing the budget deficit and securing funding to make the Trump tax cuts permanent. While the group can recommend spending cuts, it lacks the authority to enact them without approval from Congress. However, the creation of the task force indicates that the incoming administration may be more mindful of the fiscal deficit than markets anticipated in the run up to the election. Consequently, we remain optimistic that prior deficit projections for the Trump budget are higher than what the reality will be.

CHIPS Act: While achieving US self-reliance remains a long-term objective, many firms are reluctant to make the necessary investments due to prevailing uncertainty.

- Intel’s recent dismissal of its CEO Pat Gelsinger highlights the challenges faced by US chipmakers in reshoring manufacturing operations. The company failed in its ability to grab market share from its competitors AMD and TSMC. Also, the financial losses incurred by its independent foundry have raised significant concerns about the future of its manufacturing initiatives. Despite securing contracts with Microsoft and Amazon, the Intel foundry’s primary customer remains Intel itself. As a result, the possibility of a pivot has led to concerns that it may lose out on the $7.9 billion it was granted by the CHIPS Act.

- Reshoring chipmaking is poised to evolve under the next administration, which has traditionally prioritized tariffs over subsidies to bolster American manufacturing. While incoming President Trump has criticized the CHIPS and Science Act as inefficient, he is widely expected to preserve much of the funding for semiconductor factories initiated by his predecessor. Furthermore, he is anticipated to push for supply chain restructuring by introducing component-based tariffs, which tax products based on the origin of their components rather than their final assembly location.

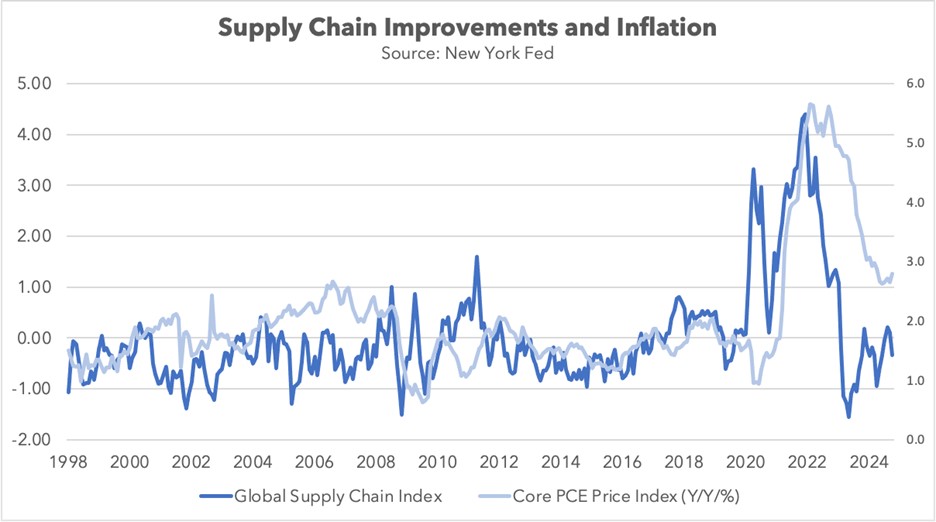

- The shift toward a more aggressive trade policy to support the reshoring of chipmaking is likely to have both positive and negative effects on the US economy. On the positive side, it could reduce the need for additional subsidies, making the approach more cost-effective, while generating increased revenue through tariffs. However, this strategy may also trigger a costly restructuring of supply chains, raising domestic costs for firms, dampening global growth, and potentially fueling inflationary pressures and weighing on equity prices.

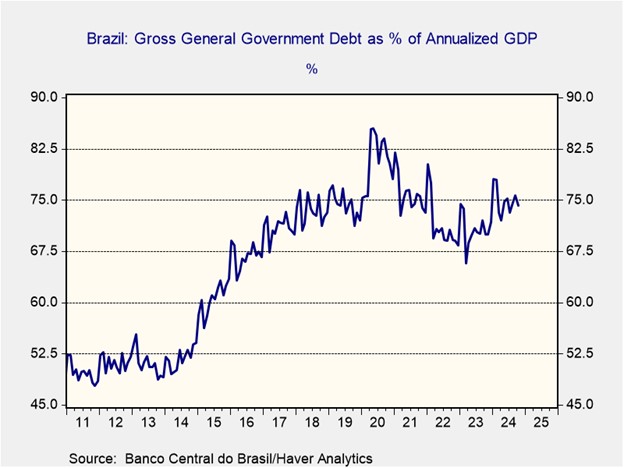

Brazil’s Military Austerity: Brazilian President Luiz Inácio Lula da Silva has targeted defense as a way to reduce the country’s ballooning debt problem.

- Lula’s administration is proposing a mandatory minimum retirement age for its military personnel. This decision, part of Lula’s broader plan to curb the country’s spending, would cap the tenure of those serving in the armed forces. So far, the proposal has faced significant pushback, with officials urging for a less stringent approach. This has led to the idea being put on hold. However, it is likely to further strain relations between Lula and the military, particularly in light of recent revelations about a plot to overthrow the government in favor of the former president Jair Bolsonaro.

- The decision comes as Lula’s administration seeks to make constitutional adjustments and complementary laws to control public sector salary spending. Under the new arrangement, only salaries explicitly authorized by supplementary law will be exempt from the salary cap. Additionally, the country’s new fiscal framework has been amended to allow for expenditure growth of 0.6% to 2.5% above inflation, which is also expected to change the minimum wage.

- The Lula administration’s comprehensive approach to addressing the country’s deficit challenges is expected to face significant obstacles, as various groups may resist these changes. The complexities of establishing a stable fiscal framework could hinder efforts to reduce inflation, which, in turn, may negatively impact the country’s currency. Given the country’s history of military dictatorship, we will be paying closer attention to the ongoing rift between the military and Lula, as there clearly appears to be a divide between the two.

In Other News: OPEC+ has again delayed its plan to increase oil production for the third time, aiming to stabilize prices at current levels. Meanwhile, French far-right leader Marine Le Pen has signaled a willingness to support the government’s budget proposal if President Macron agrees to a slower pace of deficit reduction.