Daily Comment (December 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with positive news that China may adopt more economic stimulus, along with the negative news that it has also opened an antitrust probe against Nvidia. We next review several other international and US developments with the potential to affect the financial markets today, including the latest on South Korea’s political chaos, the fall of Syrian dictator Assad, and assurances by President-elect Trump that he won’t try to fire Federal Reserve Chair Powell.

China: The Communist Party’s Politburo today said China will adopt a “moderately loose” monetary policy and more proactive fiscal policy to counter economic downturns. The statement is being interpreted to mean that policymakers at the annual legislative session in March will approve a bigger fiscal deficit and increased spending to boost domestic demand. At the party’s Central Economic Work Conference in a few days, policymakers will start to discuss their policy priorities and growth targets for 2025.

- Press reports say the language used in the Politburo statement is the most aggressive in years. As a result, some investors are hoping for a massive government spending program that will re-ignite fast growth and boost Chinese stock prices.

- All the same, General Secretary Xi and other top Communist leaders will likely remain ideologically opposed to anything like the consumer-led economies of the West, so there is a significant chance that any new stimulus program will be disappointing. It therefore seems much too early to think that China will again become the world’s economic growth engine that it once was.

China-United States: Chinese media today said the State Administration for Market Regulation has opened an antitrust probe into US artificial-intelligence giant Nvidia. The regulator is also reviewing whether Nvidia met the commitments it made in its 2020 acquisition of Mellanox, an Israeli-American supplier of networking products. Meanwhile, four Chinese government-backed industry associations representing big semiconductor buyers issued a statement calling for firms to rethink their purchases of US computer chips, which they called “no longer safe or reliable.”

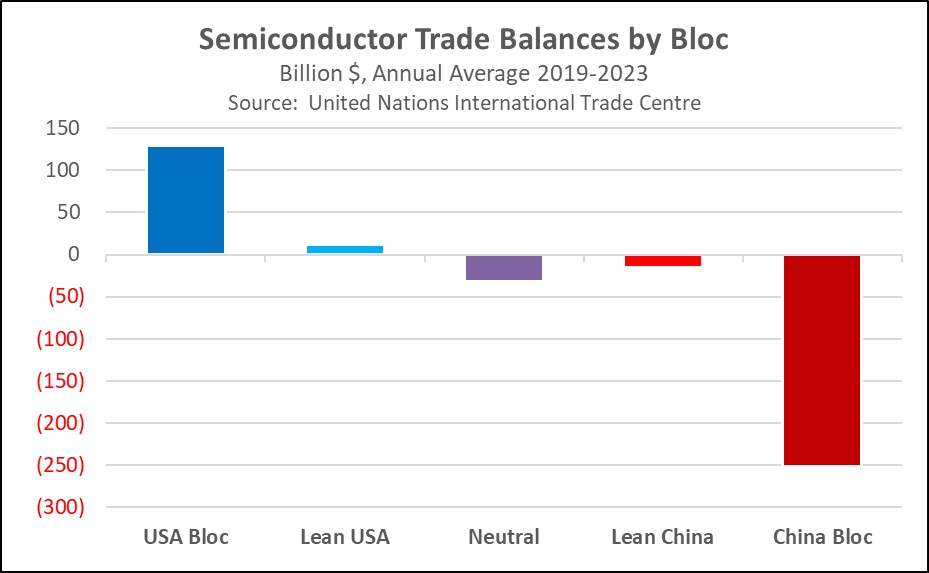

- As the US and its allies keep trying to crimp China’s military development by cutting off the country’s access to advanced US chips and related technology, the new Chinese actions suggest Beijing will push back by cutting US chipmakers out of the big, lucrative Chinese market.

- At one level, the US and allied strategy of blocking Chinese access to Western chips makes sense, as China and its bloc are heavily dependent on semiconductors from the US bloc. However, the flipside is that US and allied chipmakers derive lots of income from selling to China. The Chinese actions, therefore, will be threatening to big US technology firms. In response, stock prices for Nvidia and some other big US chipmakers are down sharply so far today.

South Korea: Parliament on Saturday failed to impeach President Yoon for his aborted effort to impose martial law last week, but the vote failed only because most of Yoon’s conservative People Power Party (PPP) lawmakers boycotted it and prevented a quorum. The PPP is now looking for a way to ease Yoon out of office without giving up power to opposition parties. That effort has angered South Korean voters, most of whom reportedly support impeachment.

- It remains to be seen whether the PPP can hold on to power. Prosecutors have reportedly opened a criminal probe into Yoon’s declaration, and they have already arrested former Defense Minister Kim Yong Hyun for advising Yoon to make it.

- South Korea is a key US ally in the Indo-Pacific region, so anything that weakens or distracts its military could conceivably tempt China, Russia, or North Korea to try to take advantage of the situation. As it turns out, South Korean military officers are reportedly livid at being drawn into politics and unsure about the chain of command now that the defense minister’s post is vacant.

- We therefore expect South Korea to face weeks or more of political instability. That, in turn, is likely to weigh on the country’s economy and financial markets. So far this morning, for example, the Korean won (KRW) is 0.4% weaker, trading at 1,431.98 per dollar ($0.0007).

India: The government today said Shaktikanta Das, head of the Reserve Bank of India, has been replaced by Revenue Secretary Sanjay Malhotra, who will serve a three-year term. The move comes after a period in which Das was seen as cutting interest rates too slowly, contributing to a slowdown in Indian economic growth. The move also could reflect political interference in India’s monetary policy by Prime Minister Modi.

Syria: Little more than a week after launching their surprise offensive, the rebels who have been battling the Assad government for 13 years swept into Damascus over the weekend and forced the dictator to flee. The rebels have reportedly taken over state television and are preparing to take control over eastern Syria as well. Assad’s prime minister, who remained in Damascus, has vowed to cooperate with the rebels to hand the government over to them.

- The rebels say they will set up a broad governing council to help transition to a new government, but a key risk now is that the rebels may start fighting among themselves, leading to continued instability.

- The strongest rebel group is Hayat Tahrir al-Sham (HTS), a globally designated terrorist group that was formerly an affiliate of al-Qaeda. That means Syria could end up as a fundamentalist Islamic state hostile to Israel, Saudi Arabia, and other key regional governments.

- In any case, the collapse of the Assad government is a stain on its key allies, Russia and Iran. Their unwillingness or inability to help Assad fend off the rebel offensive likely reflects the distractions and resource constraints they face because of their ongoing wars in Ukraine and Lebanon.

- Finally, the quick resolution to the war may preclude the chance of another major wave of destabilizing refugee flows to other regional countries or Europe. If peace really does come to Syria, leaders throughout Europe are likely to breathe a sigh of relief.

Germany: With the February elections looming, the leader of the leftist Greens has suggested a “green-black” coalition with the center-right Christian Democratic Union (CDU) and its partners to keep the surging far-right Alternative for Germany (AfD) party from forming a government. However, while the CDU and the Greens already govern together in some regions, national CDU leaders say they wouldn’t form a coalition with the Greens because they see the party as being responsible for Germany’s current economic stagnation.

Romania: The Constitutional Court on Friday annulled the first-round presidential election held on November 24 due to concerns that it was tainted by a Russian influence campaign. As a result, the second round of voting scheduled for Sunday was postponed. Rescheduling the votes is now in limbo until a new government is formed. The winner of the annulled first round, pro-Russia nationalist Călin Georgescu, has urged his supporters to rally around closed polling stations, raising the risk of mass protests that could destabilize the country.

- Western intelligence agencies and criminal investigators had turned up evidence of Russian election interference in the US, the European Union, and other countries. The Russian tactics include creating large numbers of fake social media accounts and paying off influencers to artificially amplify support for their favored candidates.

- Romania has now become the first democracy to cancel a national election because of the Russian interference. One key problem is that the cancellation will likely feed further distrust of the government among social groups that were already pre-disposed to support Russia over Western governments.

US Monetary Policy: President-elect Trump on Sunday said he would not try to fire Fed Chair Powell before his term expires in May 2026. The statement appears to be a firmer commitment to Powell after Trump said during the summer that he wouldn’t push him out if he did “the right thing,” presumably referring to cutting interest rates. Trump’s new statement suggests he is satisfied with the Fed’s recent rate cuts. That should help ease investor concerns about volatile changes in monetary policy under the new administration.