Daily Comment (December 15, 2017)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST]

Tax bill update: Although the conference committee has finished its work, it’s going to be something of a nail-biter to passage. Sen. Rubio (R-FL) has indicated he will vote against the current version unless the child tax credit is increased. It is unclear if Sen. Corker (R-TN) will oppose this measure as he did when the Senate version was passed. Sen. Flake (R-AZ) may not be on board and Sen. Lee (R-UT) has now indicated concerns. In addition, Sen. McCain (R-AZ) is in the hospital due to complications tied to his cancer treatment and Sen. Cochran (R-MI) has been undergoing treatment for a variety of maladies and has missed a few votes recently. VP Pence has changed his travel plans; he was scheduled to visit the Middle East but is staying around in case his vote is needed to break a tie. Although the financial markets appear confident that a bill will pass, the chances for delay are probably higher than acknowledged. If the votes aren’t there, negotiators could wait until next year but the GOP’s loss of Alabama earlier this week would further complicate passage. This isn’t a done deal yet and if the bill fails we would expect a pullback in equities.

EU agrees on Brexit: The EU has confirmed that “sufficient progress” has been made on Brexit talks to proceed to the next stage of negotiations. This news should be considered a boost for PM May, although the praise she was given by EU leaders may make her less popular at home. Interestingly enough, the GBP has been steadily weakening on this news which isn’t what we expected. It is possible this outcome was already discounted and with that confirmation we are seeing liquidation (buy rumor, sell fact). If this is the case, the weakness should be short-lived.

A Chinese satellite ground station in North America: China has quietly built a satellite ground station in Nuuk, Greenland, which is on the southwestern coast of the large island.[1] China is building an alternative to the U.S. GPS system called “Beidou.” Although both are used by civilians, the primary reason for their existence is for military purposes. The new station will be used for gathering military data. China has designs on the Arctic; as the polar caps melt, it allows for faster shipping over the pole and China clearly doesn’t want to be dependent upon Canadian and U.S. forces for navigation. China has promised Greenland, Denmark and the Faroes “full access” to the data, but we have serious doubts that sensitive information will be shared.

It should be noted that China has been investing in Greenland for some time; Jiangxi Copper (SHA, CNY 16.97) has had an exploratory project there since 2009. However, it wasn’t until 2013 that Western media realized this investment had occurred. Anne-Marie Brady, a leading expert on Chinese polar aspirations, says that China tends to domestically boast of its Arctic activities but downplays them to the foreign press. This sort of encroachment shows China’s increasing reach and also America’s diminishing influence.

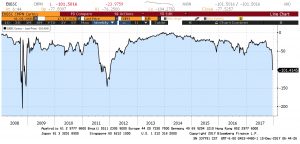

The curious case of EUR/USD basis swaps: Recently, the swap rate between the EUR and USD over three months has widened significantly.

This chart shows the swap rate between euros and dollars for three months. These swaps are generally used to hedge against currency moves. Thus, if European borrowers need dollars, they issue dollar-denominated commercial paper. The buyer who buys the paper now has dollar risk. The swap eliminates that currency risk. The borrower servicing the debt in dollars may decide to also hedge. The sudden shift is probably due to two factors. First, if there is a dearth of dollars at year-end, when some buyers want to hedge, it can drive up the rate (negatively widening the swap). Note that there were squeezes in 2011, 2015 and 2016, although the current one is much stronger than the last two, which suggests something is in play other than seasonal factors. The second reason this may be happening is that U.S. firms with dollars offshore may have been the usual buyer of this dollar-denominated paper. They would have less need to hedge and thus could absorb the paper without pressuring the swap rate. But, if those firms are expecting a repatriation holiday from the tax bill, they may be reluctant buyers and thus there is a dollar-funding squeeze.

Interestingly enough, for European buyers, U.S. 10-year T-notes are now carrying a negative yield if the paper is fully hedged. If they borrow U.S. dollar three-month LIBOR at +1.61%, plus local LIBOR (-39 bps) plus the EUR/USD swap rate, the hedged rate is around -63 bps.

We watch this rate because it can signal financial stress. As the chart above shows, in 2008, the spread widened dramatically as global borrowers tried to secure dollars. Paradoxically, the Treasury downgrade in 2011 caused similar worries. We think the current widening is probably due to seasonal factors and tax concerns, but we will continue to monitor markets to see if there is some other factor affecting the swap rate.

Another North Korean execution: It has been confirmed that Vice Marshall Hwang Pyong-so, a senior DPRK military figure, has been executed. He was in charge of the General Political Bureau, which oversees the military. South Korean intelligence indicates the bureau is under “audit”; Hwang was said to have been punished for an “impure attitude” toward the Kim regime. What is important here is that there could be growing dissent between Kim and the military. It should be noted that Kim’s father, Kim Jong-il, strongly supported the military. His successor son has been trying to rebalance the relationship to boost the civilian economy, which could be leading to tensions within the regime.

In addition, it should be remembered that military leaders everywhere are acutely aware of the weaknesses and limitations of their forces. There is a natural tendency for military leaders to overestimate the strength of an opponent. On the other hand, civilian leaders, charged with selling military action to the populous, tend to overestimate their own forces and underestimate the enemy. Very few civilian leaders indicate at the onset of war that the conflict will be long and bloody with an indeterminate outcome. That’s why PM Churchill’s promise of “blood, sweat and tears” was so remarkable. Instead, civilian leaders typically promise quick and painless victories. It is quite possible that the North Korean military views Kim Jong-un’s actions as impetuous[2] and was trying to encourage him to lower the tone of his rhetoric or maybe even entertain talks with the U.S. Kim may be trying to rid the military of these “impure thoughts” because he doesn’t trust them or because he doesn’t want to hear words of caution. At the same time, this execution may signal internal dissent within North Korea. If Kim continues to march toward a conflict, especially if there is another nuclear test, the military may decide a coup is in order.

[1] https://tools.wmflabs.org/geohack/geohack.php?pagename=Nuuk¶ms=64_10_30_N_51_44_20_W_region:GL_type:city

[2] This trait may run in the family. See WGRs: North Korea and China: A Difficult History, Part 1, 10/16/17; Part II, 10/23/17; and Part III, 10/30/17. Note how Chinese military leaders viewed the military “prowess” of the current leader’s grandfather, Kim Il-sung.