Daily Comment (February 14, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with new forecasts showing continued growth in the demand for liquified natural gas and how populist politics in the West could nix the resulting export opportunities. We next review a range of other international and US developments with the potential to affect the financial markets today, including surprisingly good industrial production figures out of Europe and a few words on yesterday’s market rout in the US.

Global Energy Market: In a report yesterday, oil-and-gas giant Shell said global demand for liquified natural gas will keep rising through at least 2040, when it will be more than 50% higher than it is today. According to the report, the continued rise in LNG demand will come largely from China, as that country’s industrial sector transitions from coal to gas, and from fast-growing countries in southern and southeastern Asia.

- Despite the projected demand growth, however, populist policies in the developed countries could limit the West’s export potential. One example of that is the Biden administration’s recent decision to pause approvals for new LNG export terminals. Besides appeasing the members of his political base who are against fossil fuels, Biden’s decision probably also aimed at bottling up gas supplies and keeping down energy prices in the US. A populist Republican administration could be tempted to do the same.

- In such a world, the natural gas and other key commodity markets could become fractured, with radically different prices between regions. The result would probably be a less efficient global economy and slower economic growth.

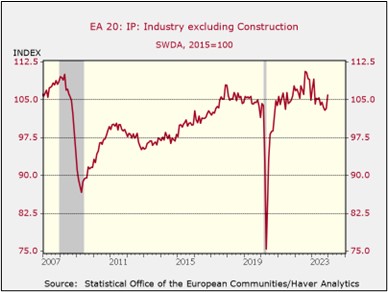

Eurozone: December industrial production rose by a seasonally adjusted 2.6%, beating expectations for a small decline and accelerating from the revised 0.4% gain in November. Output was up 1.2% from December 2022, marking its first year-over-year rise since last February. Along with surprisingly good purchasing managers’ index numbers recently, the production figures suggest the eurozone economy may be starting to bottom out, even if it is still struggling with issues such as high energy costs, elevated interest rates, and poor demand.

United Kingdom: Just a day after data showed continued strong wage growth that could discourage the Bank of England from cutting interest rates soon, a separate report showed the January consumer price index was up 4.0% year-over-year, matching its increase in the year to December instead of accelerating to the expected annual rise of 4.2%. The report will likely rekindle hopes of a near-term cut in interest rates despite yesterday’s data on wage increases.

India: With national elections coming up in just a few weeks, Prime Minister Modi’s government is scrambling to defuse mass protests by farmers demanding guaranteed crop prices and loan waivers. Negotiations yesterday between officials and protest organizers were unsuccessful, and thousands of farmers from across the country are marching on New Delhi, where the government is setting up roadblocks. To preserve his frontrunner status, Modi could well offer concessions that would expand the budget deficit and weigh on Indian asset prices.

Indonesia: In an election today, preliminary results show a big lead for controversial Defense Minister Prabowo Subianto, who commanded special operations forces when the country was a dictatorship decades ago and was accused of kidnapping democracy activists. Subianto has vowed that, if elected, he will continue the current government’s nonaligned foreign policy, as well as its economic policy focused on boosting nickel production to leverage the global shift toward electric vehicles.

Russia-Ukraine War: Kyiv today said it sank another large Russian navy ship in the Black Sea, this time using Ukrainian-made Magura V5 sea attack drones. Besides demonstrating Ukraine’s increasingly capable and sophisticated domestic defense industry capabilities, the sinking also illustrates how Kyiv’s most successful military efforts these days are in the maritime domain. Nevertheless, Ukraine’s military is increasingly on the defensive as it loses Western aid, and the Russians ramp up their military resources.

United States-China: In another piece of evidence that the Pentagon is preparing for a potential conflict with China in the Indo-Pacific region, the US Army has established its first overseas watercraft unit in decades. Based at Yokohama, Japan, the 5th Transportation Company will have 13 vessels (including landing craft, support vessels, and tugboats) and 285 Army mariners. While the Army remains focused on land warfare, the move shows how it is preparing to also fight in an Indo-Pacific maritime environment if needed.

US Stock Market: Following yesterday’s report that the January Consumer Price Index was up a stronger-than-expected 3.1% from one year earlier, and the core CPI was up 3.9%, a range of US assets sold off strongly yesterday. The S&P 500 stock price index dropped 1.4%, while the NASDAQ index fell 1.8% and the small-cap Russell 2000 price index plunged 4.0%. Bond prices also fell sharply, driving the yield on the benchmark 10-year Treasury note up to 4.32%. Most key commodity prices weakened, and the dollar surged.

- The selloffs reflected concern that sticky inflation will prompt the Federal Reserve to delay cutting interest rates. Indeed, market indicators showed that investors now expect policymakers to implement their first rate cut in June rather than May.

- The inflation data and the shifting expectations for rate cuts are consistent with our oft-stated view that investors have probably gotten ahead of themselves in expecting rate cuts in the near term. With egg on their faces for letting inflation get too high in 2021 and 2022, the Fed policymakers now want to be absolutely certain that price pressures have eased before they cut interest rates. As that continues to sink in with investors, the market could face further bouts of volatility.

US Politics: In a special election yesterday, voters in New York elected Democrat Tom Suozzi to replace ousted Republican Representative George Santos. Once Suozzi takes his oath, the Republicans in the House will be left with an even slimmer majority of 219 to 213 (three vacancies will remain). Suozzi’s healthy victory margin of 54% to 46% has also left Democrats optimistic that they can win despite being on the back foot on immigration issues as migrants continue to flow into the US across the border from Mexico.