Daily Comment (February 14, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Note: Due to the holiday, the Daily Comment will not be published on Monday, February 17.

Happy Valentine’s Day! The market is currently processing the latest retail sales data. In sports news, the US dominated Finland in the NHL 4 Nations Face-Off. Today’s Comment will explore the shifting landscape of US foreign policy, examine the possibility of gold revaluation, and cover other market-related news. As usual, our report will include a summary of domestic and international data releases.

DIY Foreign Policy, We Can Help: President Trump has increasingly downplayed the US’s traditional role as the “world’s policeman,” and instead is emphasizing its position as a leading defense supplier. This shift reflects a deliberate strategy to scale back America’s global security responsibilities while encouraging other nations to enhance their own defense capabilities.

- On Thursday, President Trump raised the possibility of convening a meeting between Russia and European nations to discuss a joint agreement to reduce their defense expenditures. While it remains uncertain whether Putin or Xi would be open to such a proposal, the suggestion underscores President Trump’s broader inclination to scale back US global influence.

- Additionally, this move reflects President Trump’s broader strategy of engaging with rival powers to ease global tensions. By excluding the European Union from discussions on the Russia-Ukraine conflict and proposing the inclusion of China in future negotiations, the administration signals a willingness to bypass traditional allies in favor of direct diplomacy with major geopolitical competitors.

- This shift in US priorities has prompted Europe to reevaluate its security framework. French President Emmanuel Macron has been a vocal advocate for greater European self-reliance, urging EU member states to take more responsibility for their collective defense, particularly in supporting Ukraine.

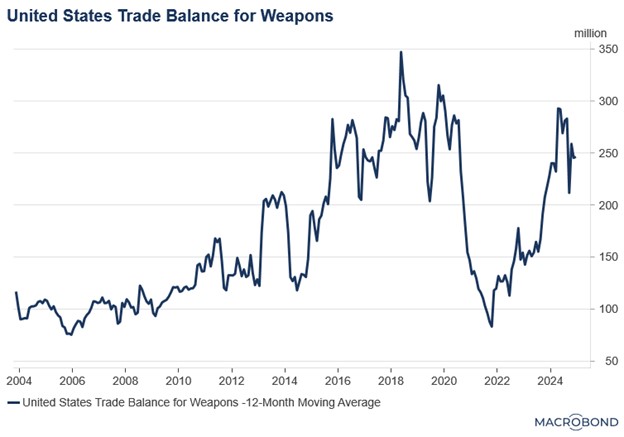

- That said, President Trump has been actively pushing US allies to buy more American-made weapons, framing arms sales as a key tool for addressing trade imbalances and making countries more self-reliant for security. On Thursday, he underscored this strategy in talks with Indian Prime Minister Narendra Modi about a potential F-35 fighter jet deal. The announcement came as Defense Secretary Pete Hegseth pledged to accelerate arms sales to EU nations.

- The shift from being a global security provider to a leading defense supplier represents a calculated, albeit tactical, adjustment for the US as it seeks to balance its international influence with domestic economic priorities. By encouraging allies to take on greater defense responsibilities, the US aims to reduce its direct military burdens while maintaining its geopolitical clout. While there are some concerns about the impact this shift will have on defense stocks, we remain cautiously optimistic about the sector.

Gold As a Policy Tool? Despite disinterest from the Trump administration, a controversial proposal to revalue US gold reserves at the current market price of approximately $3,000 per ounce is gaining traction as the government seeks additional funding.

- Changing the book value from the fixed rate of $42 per ounce could generate a one-time windfall of roughly $760 billion, which could be used to support the president’s agenda. This revaluation could allow the government to sell gold on the open market to help achieve some of its policy aims.

- One potential application would be to sell gold and use the proceeds to purchase other currencies, thereby weakening the US dollar. Alternatively, the revenue from gold sales could be used to fund government spending, potentially facilitating the passage of budget legislation.

- Two obstacles could impede the revaluation of gold. Because the price is fixed by law, congressional approval would be necessary. Also, significant gold sales could depress global prices, posing political risks and potentially harming the global financial system, given that many central banks hold gold as a reserve asset.

- While the revaluation of gold is not currently under consideration by the Trump administration, the idea could gain traction if the administration struggles to achieve its agenda, particularly in the realm of trade policy. In such a scenario, revisiting the revaluation of gold as a fiscal tool may become a viable option. Given this potential, gold remains an attractive investment for many, although future policy moves — such as revaluation — could significantly influence market sentiment.

Axis of Evil: The Pentagon’s Indo-Pacific chief, Admiral Samuel Paparo, has expressed growing concerns that China may be preparing to assert control over Taiwan. This warning comes at a time when the US is actively encouraging allies and partners to reduce their reliance on American military protection and instead bolster their own defense capabilities.

- Speaking at the Honolulu Defense Forum, the Pentagon chief cautioned that the scale and frequency of China’s military exercises could serve as a pretext to mask an actual offensive against the island. By conducting extensive drills, China might create a veil of ambiguity, making it difficult to distinguish between routine training and a genuine threat.

- Paparo also pointed to the deepening cooperation among Russia, China, and North Korea as they increasingly coordinate efforts to counter US influence and power projection worldwide. These nations have been actively sharing intelligence and technology, strengthening their strategic alignment to challenge American dominance.

- His message likely explains why the Trump administration is shifting its strategic focus toward the Indo-Pacific region, prioritizing efforts to counterbalance China’s growing influence, while reducing its emphasis on protecting Europe.

- A major threat to the global economy is large-scale warfare, particularly involving major powers. Increased assertiveness by China and its partners in the Indo-Pacific, coupled with the US pivot to the region, raises the risk of confrontation, especially as the two economies decouple. While an immediate military conflict is unlikely, the risk within the next decade may be increasing.

The Big Beautiful Bill Progresses: Conservative lawmakers have finally reached an agreement on a budget resolution aimed at advancing the president’s initiatives through a single bill. The breakthrough came after fiscal hawks within the Republican Party insisted on guarantees for budget cuts to ensure that the proposed initiatives would not exacerbate the deficit.

- The bill passed out of committee on Thursday, moving one step closer to becoming law. The proposal would authorize $1.5 trillion in spending cuts to help fund the president’s tax initiatives, increase the defense budget, and provide funding for border security.

- One of the more controversial elements of the proposal includes potential cuts to Medicaid, a move supported by many Republican lawmakers who argue that the program is plagued by fraud and inefficiency. However, such reductions are likely to render the bill politically contentious, as critics warn the cuts could harm vulnerable populations who rely on the program for essential healthcare.

- While we anticipate that tax cuts will likely be enacted by the end of the year, we remain skeptical that the final bill will achieve the budget neutrality that current lawmakers are aiming for. That said, we believe the proposed tax reductions could provide a boost to equities and may also support bond markets if the administration successfully avoids significantly increasing the budget deficit in the process.