Daily Comment (February 18, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a recap of the big diplomatic meetings on the Russia-Ukraine war that have taken place over the last two days. We next review several other international and US developments with the potential to affect the financial markets today, including surprisingly good economic growth in Japan in the fourth quarter, a sudden scandal for Argentina’s president, and a Federal Reserve official’s statement that further interest rate cuts should not be off the table.

US-Russia-Ukraine-Europe: At a meeting today in Saudi Arabia, high-level US and Russian officials agreed to establish diplomatic teams to work on wrapping up Russia’s war against Ukraine and improving US-Russian bilateral relations. According to the State Department, the teams will “lay the groundwork for future cooperation on matters of mutual geopolitical interest and historic economic and investment opportunities which will emerge from a successful end to the conflict in Ukraine.”

- Yuri Ushakov, the Russian president’s foreign affairs advisor, gave only a muted assessment of the talks, calling them “not bad” and insisting that it was too early to say that US-Russian relations were improving. Ushakov’s statements are consistent with other signs that Russia will take a tough line on negotiations.

- Indeed, the Kremlin today issued a statement that it would not accept any role for European countries in the Ukraine peace talks and is “categorically opposed” to a European peacekeeping deployment as part of any deal. The Kremlin also insisted that the North Atlantic Treaty Organization (NATO) rescind its open-ended 2008 invitation for Ukraine to join NATO.

- Meanwhile, Ukrainian President Zelensky, who was not allowed to attend the meeting, warned that Kyiv will not abide by any agreement negotiated between Russia and the US without its involvement.

- Finally, we note that the US-Russia meeting today followed a Monday summit of leaders from NATO, Germany, France, Italy, Spain, Denmark, Poland, and the UK, in which the leaders discussed how they should respond to being frozen out of the US-Russia talks on Ukraine and how they should help end the war. At the meeting, France and the UK supported sending European peacekeeping troops to help guarantee Ukraine’s security, but the other attending countries pushed back on the idea.

Israel-Hamas: Israeli Foreign Minister Gideon Sa’ar today said Tel Aviv will start negotiations with the militant Hamas government in Gaza to end the war there, despite a two-week delay because of disputes over the ceasefire constituting the first phase of the talks. Those disputes had called into question the peace process itself. The foreign minister’s statement is likely to be taken as reassurance that the war can wind down and the energy-rich region can be stabilized.

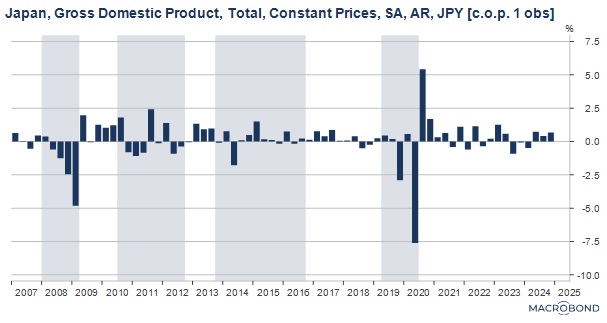

Japan: Data yesterday showed gross domestic product grew at a seasonally adjusted, annualized rate of 2.8% in the fourth quarter, almost three times the expected rate and enough to mark the third straight quarter of healthy expansion. The key contributor to growth in October through December was international trade, while consumer spending came in on the soft side. The data will likely encourage the Bank of Japan to consider more interest rate hikes in the near term, prompting a modest appreciation in the yen over the last day.

China: New reports say the Chinese government has transferred its stakes in five national investment firms from the country’s sovereign wealth fund to Central Huijin Investment, a subsidiary of the fund with experience in arranging mergers and workouts for underperforming companies. The move suggests that creating big, consolidated “national champion” investment firms will be the next step in Beijing’s effort to make China a “financial superpower.”

Australia: The Reserve Bank of Australia today cut its benchmark short-term interest rate by 25 basis points to 4.10%, marking its first rate cut since November 2020. Although the central bank has come under pressure to ease rates ahead of national elections, RBA chief Bullock warned after the decision that policy will have to remain restrictive in the near term because of continuing inflation. Nevertheless, the Australian dollar so far this morning is trading down 0.2% at $0.6343.

Argentina: Libertarian populist President Milei today is caught up in a snowballing scandal after he went on X to promote a new cryptocurrency called $LIBRA on Friday night, apparently prompting the price to surge. The price then plunged suddenly, leaving investors in the lurch. Milei claims that he was not a part of any effort to defraud investors and has said he will cooperate with any investigation. Nevertheless, the scandal may undermine the trust Milei has earned by helping bring down Argentina’s consumer price inflation.

US Monetary Policy: In a speech today, Fed board member Christopher Waller said US monetary policymakers shouldn’t be reluctant to keep cutting interest rates if price pressures start cooling again, despite uncertainty about new policies from the Trump administration. While some observers have called for the Fed to stay on the sidelines until the administration has rolled out more of its economic program, Waller’s statement is a reminder that some Fed officials are still looking for an opportunity to cut rates further.

US Labor Market: Utah’s governor has signed into law a bill that bars public employee unions from negotiating wages and other terms of employment. Pushed by Utah’s Republican-led legislature and signed by its Republican governor, the new law shows how the populism of today’s Republican Party doesn’t necessarily align with traditional populist economic policies, such as protecting organized labor. From President Trump downward, the form of populism pursued by today’s Republican leaders often focuses more on cultural issues.