Daily Comment (February 19, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are weighing the threat of new tariffs. In sports news, Bayern Munich secured a Champions League playoff spot with a dramatic last-minute goal. Today’s Comment covers the latest tariff developments, updates on the Ukraine-Russia peace talks, and other key market news. As always, we’ll also spotlight crucial domestic and international data releases.

Tariffs Are Coming? Howard Lutnick has been confirmed as the new Commerce Secretary, just in time to assist the president in imposing new tariff measures. He will oversee the implementation of the president’s tariff and trade policies, with direct responsibility for managing the Office of the US Trade Representative.

- On Tuesday, President Trump unveiled a plan to impose 25% tariffs on automobiles, semiconductors, and pharmaceuticals as part of his strategy to overhaul international trade. The tariffs will be rolled out in stages, with auto tariffs set to take effect on April 2, while tariffs on pharmaceuticals and semiconductors will follow at a later, yet-to-be-determined date.

- These new tariffs are designed to achieve two of the three key trade objectives — restriction and reciprocity — as the president aims to leverage reciprocal measures to pressure Europe into reducing its auto tariffs, which are currently four times higher than those in the US. Additionally, restrictive tariffs are intended to incentivize companies to reshore production of pharmaceuticals and semiconductors to the US, bolstering American manufacturing capabilities.

- As the president begins rolling out tariffs, early signs indicate growing unease among households and businesses. According to CreditCards.com, consumers have already started accelerating purchases in anticipation of the new tariffs. Meanwhile, the National Association of Home Builders has reported that the tariffs are dampening sentiment, driven by fears of rising costs associated with the increased duties on materials such as steel.

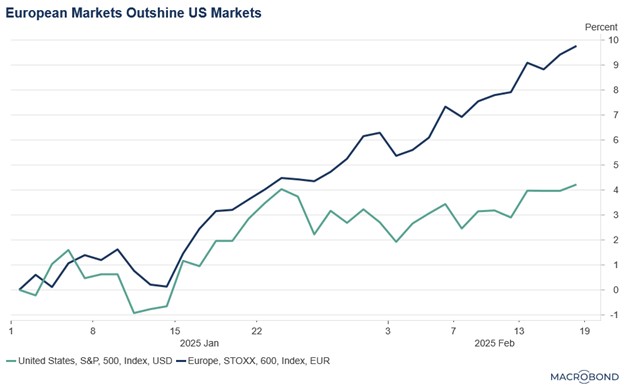

- So far, the tariffs have had little meaningful impact on the economy, and their influence on equities appears to be fading. As a result, US stocks may begin to demonstrate greater resilience, provided companies continue to deliver strong earnings. The real challenge, however, lies abroad. International markets, particularly in Europe, have had a strong start, with the Stoxx Europe 600 up 9.11% compared to the S&P 500’s 4.45% gain. US tariffs on EU exports could undermine this trend.

Trump Pressures Ukraine: As the US and Russia continue discussions aimed at resolving the conflict in Ukraine, speculation is growing about the potential terms of a deal. The Trump administration’s efforts to rebuild ties with Moscow have added further intrigue to the negotiations, raising questions about the direction of US-Russia relations and the broader implications for energy prices.

- President Trump has adopted a firm stance toward Ukraine, controversially suggesting that the country bears some responsibility for the Russian invasion. He has also insisted that Ukraine must hold elections before it can participate in peace talks, a position that has drawn scrutiny and raised questions about the administration’s commitment to the region.

- The development comes as the US weighs whether to lift sanctions on Russia’s energy sector. US Secretary of State Marco Rubio has emphasized that the sanctions are likely to remain in place until a final agreement is reached, signaling a cautious approach to any potential easing of economic pressure on Moscow.

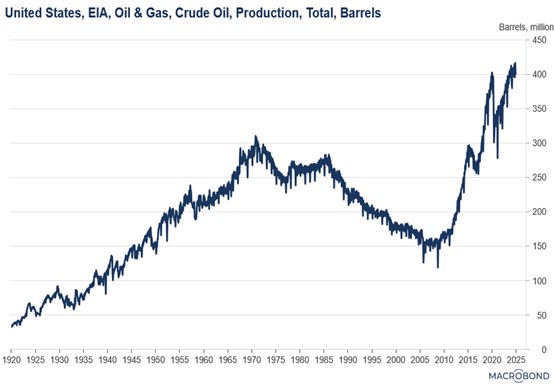

- His reluctance may be related to how the reintroduction of Russian energy will impact global markets. Discussions about ending the conflict were held in Saudi Arabia and included both Russia and the US, leading many to speculate that the location was chosen to align all parties on the potential market implications of resuming Russian energy supplies.

- The US would like to push oil prices lower to ease inflationary pressures. However, other key players, particularly major producers, favor keeping prices higher to protect profit margins, creating a delicate balancing act in the energy market. As a result, sanctions are likely to remain in place until all parties reach an agreement on how to reintegrate Russian energy into the global market in a way that balances economic and geopolitical interests.

ECB to Hold Steady? The European Central Bank is considering pausing further interest rate cuts after its next meeting as it evaluates whether its current policy stance is sufficiently restrictive following six consecutive rate cuts since June 2024.

- The ECB’s current rate stands at 2.75%, roughly 100 basis points above the estimated neutral rate or the level at which rates neither stimulate nor restrict growth. ECB officials have been gradually cutting rates in an effort to prevent further economic slowdown.

- The decision to reassess the pace of easing follows growing concerns over the central bank’s ability to achieve its 2% inflation target. Recent data from January showed overall price levels rising by 2.5% year-on-year, further complicating the path to reaching its goal of hitting its target by 2026.

- While the ECB is anticipated to announce another rate cut at its March meeting, a potential pause in further easing measures could lend some support to the euro against the dollar. This is because it would prevent the interest rate differential between Europe and the US from widening further.

BOJ to Pay for Schools? Japan’s opposition party is calling on the Bank of Japan to sell its exchange-traded funds (ETFs) to finance free high school education nationwide. The proposal emerges amid ongoing uncertainty about how the central bank plans to unwind its massive balance sheet.

- The focus on ETFs arises as the central bank nears the completion of offloading stocks acquired during the financial crisis. BOJ policymakers have proceeded cautiously with the sell-off, staggering the process to avoid potential market disruptions that could have occurred if stocks and ETFs were sold simultaneously.

- Under the proposal, the BOJ would sell its ETFs to the government in exchange for grant bonds, and the dividend income from those shares would be used to fund policy initiatives aimed at reversing declining birth rates and education.

- The Japanese proposal highlights how lawmakers are increasingly exploring unconventional methods to fund policy initiatives, particularly as they seek to manage the country’s substantial government debt burden.