Daily Comment (February 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the state of play between the US and China in the important new industry of generative artificial intelligence (AI). We next review a range of other international and US news with the potential to affect the financial markets today, including developments touching on global nickel and natural gas markets and some notes on the US financial markets.

China: Just a week after US generative AI firm OpenAI released its Sora text-to-video product, Chinese leaders and technology researchers are reportedly panicking over the realization that China has fallen years behind the US in the technology, rather than being the global leader as previously thought. In a sign of the panic, the government has already ordered 10 state-owned firms to serve as “national champions” to push forward Chinese progress in generative AI, although it has not yet released the names of those firms.

- Chinese researchers had long thought that the country’s vast trove of available data, engineering talent, and government support would give it a leg up in developing the large language models that underlie generative AI.

- It now appears that Western firms also have sufficient data and talent to make strides in the technology. Perhaps just as important, reports suggest the US government’s clampdowns on selling advanced semiconductors and other technology tools to China for national security purposes have also been impeding Chinese progress.

- Beijing’s frustration at falling behind in the AI race and facing ever more restrictions on US technology will likely continue to fuel US-China geopolitical tensions, with negative long-term consequences for firms doing business in China or trying to sell to China.

- Nevertheless, the growing US clampdown on sending advanced technology to China is having a positive impact for some companies in the near term. As the US clampdown is expected to further crimp the sale of semiconductor manufacturing equipment to China, it appears that Chinese firms are ramping up their purchases of chipmaking machinery, driving strong revenue and profit growth at companies like Dutch giant ASML and Japan’s Tokyo Electron.

Indonesia: The chief executive of French miner Eramet, Christel Bories, has warned that Indonesia’s low-cost nickel producers will wipe out their global rivals in the next few years, cementing the country as the world’s dominant producer of the metal, which is vital to electric car batteries. Importantly, Bories said Indonesia’s low costs, which in part reflect government policies, will lead to mines elsewhere being shut down and/or governments having to offer subsidies to keep them open and ensure alternative supply sources.

Qatar: Complementing recently announced investments aimed at increasing the country’s natural gas production, on Sunday the government announced new investments in its liquified natural gas export infrastructure. Taken together, the government said the investments will boost Qatar’s total LNG output capacity by some 85% by the end of the decade.

- The new export capacity mostly aims to feed the growing Asian market, where countries are shifting away from coal for electricity generation because of environmental concerns.

- Amid signs the US may cap its LNG export potential to bottle up fuel supplies and keep domestic prices low, Qatar’s new capacity cut has positioned it to boost its global market share in the lucrative trade in the future.

Israel: To fund the massive military spending associated with its war against Hamas in Gaza, the Israeli government has announced it will issue about $60 billion in sovereign bonds this year, freeze government hiring, and increase taxes. However, those numbers assume that the 300,000 or so troops mobilized at the start of the war last year will continue to be demobilized and can return to their civilian jobs. According to Finance Minister Rothenberg, the number of mobilized troops still serving has fallen to about 60,000 and should decline to 40,000 or less by late March.

- As we have argued frequently in the past, rising geopolitical tensions are likely to boost defense budgets around the world in the years to come. That process is already happening, albeit rather slowly.

- If tensions escalate further, as we think is possible, higher defense spending will require tradeoffs. For example, governments around the world will likely have to consider slashing civilian budget programs. Israel’s increased borrowing, hiring freeze, and tax hikes suggest those kinds of initiatives are also likely to be considered in other countries.

European Union: Thousands of farmers from Belgium and beyond have converged on Brussels today in a mass demonstration seeking more support from the EU. The protests, which have included blocking major streets and roads with farm equipment, have gotten enough attention that European Commission ministers are recommending an increase in funding for the EU’s Common Agricultural Policy subsidy program, which already costs some 60 billion EUR per year.

US Politics: In the Republicans’ South Carolina presidential primary election on Saturday, former President Trump handily beat former UN Ambassador and former South Carolina Governor Nikki Haley by approximately 60% to 40%. Based on those results, Trump takes all the state’s delegates to the Republican National Convention in the summer. Nevertheless, Haley vowed to stay in the race. The next primary is in Michigan on Tuesday.

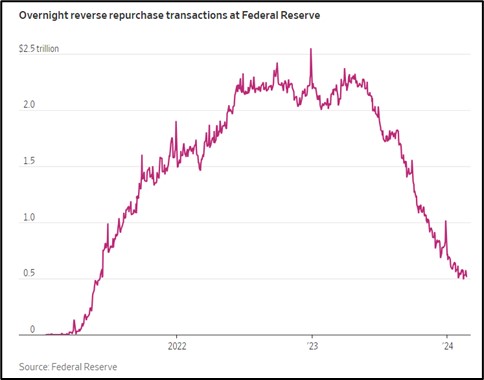

US Bond Market: An article in the Wall Street Journal today highlights just how sharply financial companies have pulled back from parking overnight funds in the Federal Reserve’s reverse repo facility. After hitting a peak of more than $2.5 trillion around the beginning of 2023, total positions have recently receded to only about $500 billion. The volume of funds parked in reverse repo is considered a ready pool of money available to buy Treasury bills, so the decline in participation has raised concern about waning bill demand and rising interest rates.

US Stock Market: As a reminder, Amazon.com joins the Dow Jones Industrial Average today, in a move precipitated by Walmart’s implementation of a 3:1 stock split to make its shares more accessible to small investors. The Walmart stock split will also happen today.