Daily Comment (February 5, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with an artificial-intelligence leader’s expectation for a future marked by national AI systems. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including signs that biotechnology will be a new source of friction between the U.S. and China and a range of news items related to migration policy in North America.

Global AI Industry: Nelson Huang, chief executive of artificial-intelligence darling Nvidia, said in an interview last Thursday that countries around the world should build their own “sovereign AI infrastructure.” According to Huang, a country’s data should be considered its own natural resource, so it should be collected, controlled, and refined within the country’s borders.

- Of course, Huang could simply be “talking his book,” in the sense that building national AI computing systems in each of the more than 200 countries of the world would vastly increase the demand for Nvidia’s AI semiconductors.

- On the other hand, his statement also reflects the growing sense that data is extremely valuable, and that it becomes even more valuable when used to train a powerful AI system. Who owns that data and who can capture its value will be increasingly important questions going forward, especially when one country’s government or companies try to capture and exploit data from another country.

United States-China: Signaling that biological engineering will be another technology of contention between the U.S. and China, the House Select Committee on the Chinese Communist Party has introduced a bill that would ban any entity receiving federal funds from buying equipment or services from companies in “adversary countries,” most notably China. Similar legislation has been introduced in the Senate. The goal of the legislation is to protect the U.S. biotech industry’s competitiveness in genomic sequencing, medicine development, and the like.

- One key target of the legislation is Chinese genomic-sequencing giant BGI Group, which has spawned concern because of its global genomic data collection efforts, its obligation under Chinese law to transfer data to the country’s government if requested, and its apparent links to the Chinese military.

- As with other advanced technologies such as 5G telecommunications and computer chips, it appears that the U.S.-China rivalry is about to lead to new restrictions in biotech trade, investment, and technology flows. As with those other technologies, the new restrictions will likely have big impacts on Western biotech firms that compete against the Chinese, rely on Chinese equipment or services, or hope to sell to the Chinese market.

- Of course, the U.S. has also clamped down on trade, investment, and technology flows with China in traditional industries as well. After former President Trump imposed punitive 25% tariffs on Chinese steel imports and 10% on Chinese aluminum imports, the Biden administration surprisingly maintained those duties. Over the weekend, Trump said that if he is elected again, he would impose tariffs of more than 60% on imports from China.

Philippines-China: Today’s riskiest international dispute may be the overlapping territorial claims of China and the Philippines over certain islands and shoals in the South China Sea. Nevertheless, a Philippine supply ship on Saturday successfully delivered fresh provisions to a grounded Philippine navy ship that serves as an outpost on the Second Thomas Shoal. Previously, Chinese coast guard and maritime militia vessels had tried to stop such resupply missions by using water cannons against the Philippine vessels or even ramming them.

- China’s efforts to stop the resupply missions are dangerous because accidentally sinking a Philippine vessel or killing Philippine sailors could theoretically bring into force the U.S.-Philippine mutual defense treaty, bringing the U.S. into direct confrontation with Chinese forces.

- China’s restraint this time around suggests it is looking to cool tensions, in large part because of the severe economic headwinds it is now facing.

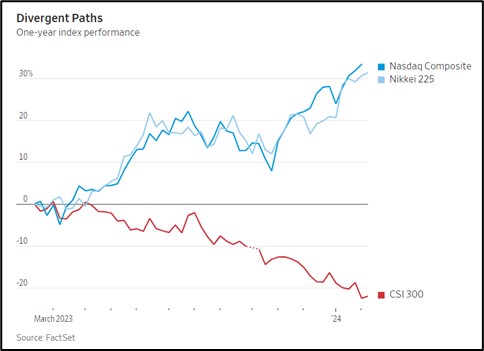

China: As Chinese stock values continue to slide amid the geopolitical tensions mentioned above and the country’s current economic headwinds, the China Securities Regulatory Commission today vowed that it will implement several measures designed to buoy prices. The proposed measures include cracking down on illegal trading and channeling more medium- and long-term capital into the market. Nevertheless, mainland stock indexes fell sharply again today, bringing their year-over-year losses to more than 20%.

Israel-Hamas Conflict: In the other major conflict that threatens a broader war, the U.S. bombed dozens of sites on Friday run by Iranian and Iran-backed forces in Syria and Iraq, and then continued striking Iran-backed Houthi militant sites in Yemen over the weekend. While the targeted militant groups have themselves conducted dozens of attacks on U.S. ships and troops in sympathy with the Hamas government in Gaza that is now subject to retaliatory strikes by Israel, the attacks are keeping alive the risk that the Israeli-Hamas conflict will expand regionally.

Canada: Reacting to concern that legions of international students are driving up housing costs, Ottawa is imposing a 35% cut in the number of foreign undergraduate students it will grant visas to in 2024 and 2025. The cap, which will not apply to students seeking masters or doctorate degrees, will reduce the number of foreign students in Canada by about 210,000.

El Salvador: Crime fighting President Nayib Bukele handily won re-election yesterday, setting the stage for him to continue aggressively incarcerating criminal gang members and cutting off their ability to communicate with enforcers outside of prison. Bukele’s policies have reportedly led to a significant reduction in violent crime and a resurgence of commerce in some areas. That could encourage similar policies elsewhere in the region, reducing the incentive for Central Americans to go to the U.S.

U.S. Immigration Policy: As we flagged in our Comment last week, leaders in the Senate yesterday released their big immigration-and-foreign-aid bill that aims to tighten immigration restrictions at the southern border in return for additional military aid to Ukraine and Israel. However, Republicans in the House have already declared the legislation dead on arrival, putting in limbo both new steps to deal with the surge of migrants at the border and additional assistance to Ukraine and Israel.

U.S. Monetary Policy: In a CBS interview yesterday, Federal Reserve Chair Powell said “almost all” of the members of the rate-setting Federal Open Market Committee supported cutting the benchmark fed funds interest rate three times in 2024, for a total cut of 75 basis points. However, he also stressed that economic conditions could lead the policymakers to cut rates more or less than currently planned. In any case, Powell’s statement was consistent with our view that bond investors expect more aggressive rate cuts than the Fed is likely to deliver.

U.S. Higher Education: In a post-pandemic first for the Ivy League, Dartmouth University said it will reinstate a requirement that applicants provide SAT or ACT scores starting next year. According to the university, the scores provide the best indication of how students will perform in their freshman year. Currently, providing the scores is optional at the school.