Daily Comment (February 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a considerable rebound in the Chinese stock market after the government implemented a number of strong support policies. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including more signs of pushback against climate stabilization policies in Europe and encouraging forecasts of U.S. consumer price inflation from a key international research group.

Chinese Stock Market: The Chinese government today seems to have finally gotten some traction in its effort to boost the country’s sliding stock market. Following a series of actions by the stock market regulator, the country’s $1.2-trillion sovereign wealth fund, and General Secretary Xi, stock indexes on the mainland and in Hong Kong have jumped sharply today. Nevertheless, it isn’t clear whether the upward momentum will continue going forward, especially considering that earlier efforts weren’t effective. Included in the moves today:

- The China Securities Regulatory Commission said it will “coordinate and guide various institutional investors” into the stock market to prop up values, including making it easier for the sovereign wealth fund to buy shares;

- The CSRC also advised listed firms to take stronger steps to ensure investor confidence and market stability, including conducting share buybacks, boosting major shareholders’ stakes, and declaring regular dividends;

- Following the CSRC’s statement, sovereign wealth fund unit Central Huijin Investment said it would buy more exchange-traded funds, expand its holdings, and take steps to ensure “the stable operation of the capital market”; and

- Finally, news reports today say Xi will soon meet with market regulators to discuss market conditions and recent policy moves, indicating he will pressure them to ensure the stock market keeps rebounding.

Chinese Military: As a reminder that both geopolitical tensions and economic headwinds have been weighing on Chinese asset values, on Sunday the New York Times published a detailed article on China’s massive program to expand its strategic nuclear weapons arsenal, which we have described in our past writings. Based on previously unavailable documents, the article shows that General Secretary Xi ordered the expansion just 19 days after assuming power in 2012, saying China needed a major arsenal to truly be a Great Power.

- Now, the article says, Chinese military strategists are looking at how to use the arsenal not only to deter U.S. attacks, but also to bully other nations.

- As more Western policymakers and voters come to realize the aggressiveness of China’s military buildup, we think they will demand pushback against Beijing and even stronger efforts to rebuild Western defenses. Tensions between China and the West are therefore likely to keep deteriorating over time.

- We continue to believe that spiraling geopolitical tensions, along with China’s own structural economic challenges, will continue to weigh on Chinese assets going forward.

Australia: The Reserve Bank of Australia has cut its forecasts for economic growth in 2024 and 2025, citing slower demand growth from China and the impact of its own interest-rate hikes. The central bank now sees Australian gross domestic product rising just 1.4% in 2024, versus its previous forecast of 1.8%. Nevertheless, like many other major central bank chiefs, RBA Governor Michele Bullock is resisting calls for aggressive rate cuts in the near future.

- It’s important to remember that central banks outside the U.S. may have even greater incentives to resist near-term rate cuts than the Fed does.

- If the Fed slow-walks its rate cuts as we expect, leaving U.S. rates relatively high, any country whose central bank cuts rates aggressively would risk a sharp depreciation in its currency, potentially fueling a rebound in consumer price inflation.

European Union: Faced with massive farmer protests across the EU, the European Commission has scrapped plans to implement a 30% reduction in agricultural greenhouse gas emissions by 2040. Scrapping the planned cut probably reflects EU officials’ concern that farmer anger over EU agricultural policies might fuel further political gains for far-right populist parties ahead of the European Parliament elections in June.

Germany: Siegfried Russwurm, head of Germany’s biggest industry association, has slammed the government’s climate policies as “more dogmatic than any other country I know.” He especially complained about the government’s decision to phase out nuclear energy and coal and switch to renewables, saying the decision has put German firms at a disadvantage to those in other industrialized countries. Russwurm’s strong statement is further evidence of growing pushback against climate stabilization policies in Europe.

Turkey: After the resignation of central bank chief Hafize Gaye Erkan on Friday, President Erdoğan has named Fatih Karahan to be her successor. Karahan is a former economist at the U.S. Federal Reserve, as well as a former deputy governor at Turkey’s central bank. Finance Minister Mehmet Şimşek praised Karahan for his experience and knowledge, but his appointment nevertheless may prompt concern that Erdoğan is backing away from the more orthodox economic policies he has pursued since his re-election.

Mexico: Ahead of the presidential and legislative elections this summer, President Andrés Manuel López Obrador has proposed almost two dozen major constitutional amendments that would dismantle many of the good-governance and free-market reforms of recent decades. Although the president’s Morena Party doesn’t currently hold enough seats in Congress to pass the changes, the proposal allows Morena to set the terms of debate for the coming campaign. If Morena wins enough seats, it could then pass the changes later. The proposals include:

- Reducing the size of Congress;

- Directly electing the Supreme Court;

- Dismantling an agency that enforces government transparency;

- Outlawing hydraulic fracturing (fracking) in oil and gas production; and

- Giving workers a pension equal to their final salary.

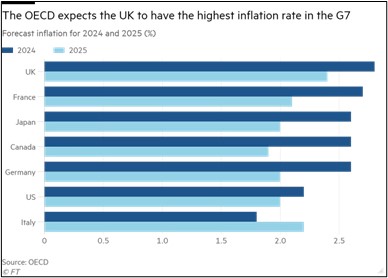

U.S. Monetary Policy: The Organization for Economic Cooperation and Development issued new forecasts showing the U.S. should have the second-lowest rate of consumer price inflation among major developed countries in 2025, at 2.2%, and the lowest rate in 2025, at 2.0%. According to the OECD, the good progress on U.S. inflation could allow the Federal Reserve to start cutting interest rates as early as the second quarter of 2024.

- Nevertheless, we still think investors are expecting the Fed to cut rates more aggressively than it really will. Following Chair Powell’s interview over the weekend, in which he basically said the same thing, stock and bond values fell sharply yesterday.

- With the Fed likely to take its time cutting interest rates, and with economic growth relatively weaker in many other large, developed countries, the dollar in recent days has appreciated sharply. The U.S. Dollar Index now stands at its highest level since early December, having risen approximately 4% over the last five weeks.

U.S. Weather: Southern California today continues to be battered by torrential rains resulting in extensive flooding, mudslides, disrupted business activity, and property damage. Portions of downtown Los Angeles have already received 9 inches of rain, and outlying areas have received even more, with the downpours expected to continue until Thursday. Besides the potential for a noticeable hit to economic activity in the country’s most populous state, we’re also watching for any future increases in insurance rates or insurer withdrawals from the market.