Daily Comment (February 7, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently digesting the latest employment data, while in sports news, the NBA trade deadline officially passed. Today’s commentary will cover the latest developments in Trump’s tax plan, explore why investors are growing increasingly concerned about the spending levels of tech companies, and provide updates on other market-related news. As always, the report will also include a summary of key international and domestic data releases.

Tax Policy: The Trump administration has provided some insights into its strategy for fulfilling the president’s campaign tax promises. However, it remains uncertain whether the Republican Party will rally behind a legislative measure before the impending expiration of the tax cuts at the end of the year.

- The president has indicated his intention to eliminate tax breaks for carried interest, a loophole highly favored by private equity fund managers. He also proposed removing special tax breaks for billionaire sports team owners, which currently allow them to deduct expenses related to team purchases over a 15-year period.

- The elimination of these tax breaks is aimed at funding the president’s proposed expansion of state and local tax deductions, as well as introducing new tax incentives for products manufactured in America. Additionally, there is speculation that Republicans may consider ending the tax exemption for state and local government debt.

- These cuts could lead to major savings but not enough to offset increases in spending. Repealing the carried interest tax provision, estimated to cost $12 billion over 10 years, would primarily impact private equity funds. Meanwhile, state and local tax exemptions represented $27 billion in forgone tax revenue in 2022. The potential tax savings from targeting sports team ownership is less certain, as closing this loophole could decrease the frequency of team sales.

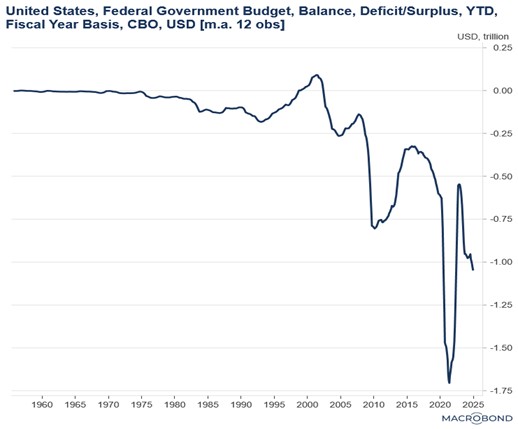

- While the savings help offset the cost of the president’s new tax plan, which includes eliminating taxes on tips, overtime pay, and Social Security, as well as lowering the corporate tax rate, additional funding will still be needed to prevent the plan from increasing the deficit. The latest estimate shows that his plan would add over $4 trillion to the deficit within the decade.

Big Tech Ramps Up Spending: Nearly two weeks after the release of DeepSeek’s latest update sent shockwaves through financial markets, Silicon Valley tech companies are facing mounting pressure to enhance profitability and validate their sky-high valuations. This week, three companies have come under intense scrutiny as investors closely watch whether they can meet heightened expectations.

- Amazon reported better-than-expected fourth quarter earnings and sales on Thursday but offered a weak outlook for the coming period. This pessimism stemmed largely from unfavorable exchange rate fluctuations, as a stronger dollar typically weighs on foreign revenues. Despite the cautious outlook, Amazon plans to increase capital expenditures to $100 billion in 2025, up from $83 billion the previous year.

- Two other companies that reported earnings this week also announced plans to ramp up AI spending. Alphabet, Google’s parent company, revealed that it intends to increase its capital expenditures from $57.5 billion to $75 billion. Similarly, Microsoft indicated it could spend up to $80 billion on AI data centers in the coming period.

- The focus on spending has intensified amid growing concerns that tech companies are diverting capital toward expanding AI capabilities at the expense of rewarding shareholders. These concerns were further amplified by the release of the Chinese-made DeepSeek, which was reportedly developed at a fraction of the cost and at a significantly faster pace compared to US tech companies, while still delivering comparable results.

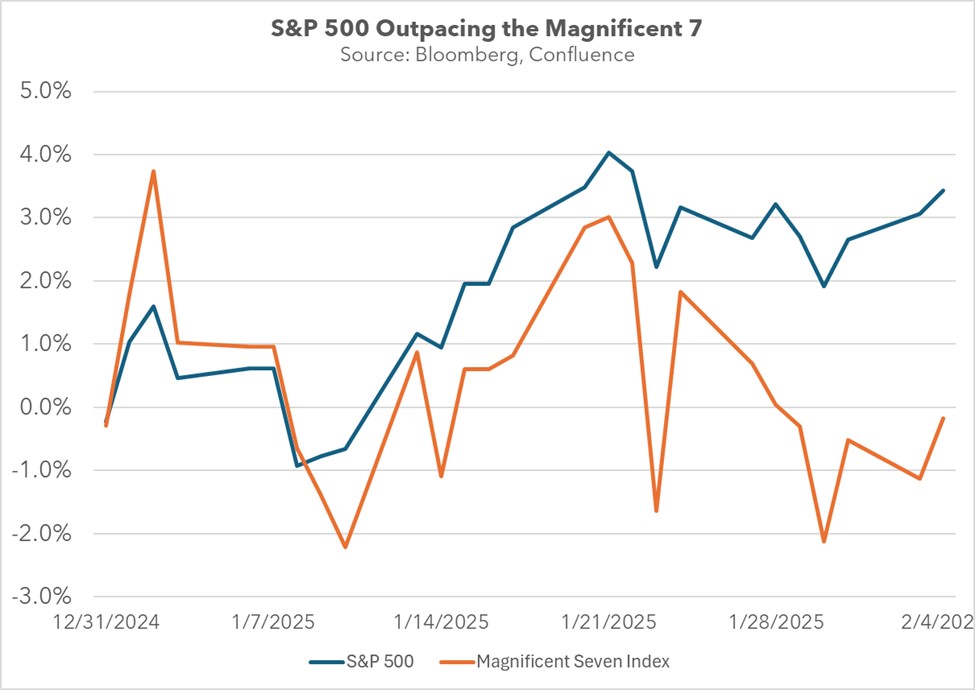

- Growing skepticism about the already elevated valuations of mega cap tech stocks has begun to weigh on their performance this year, with the so-called Magnificent 7 underperforming the S&P 500 year-to-date. As a result, we anticipate that earnings and profitability will likely play an increasingly critical role in determining the trajectory of tech stocks for the remainder of the year.

The Indo-Pacific Seeks Assurances: The Trump administration is scheduled to meet with Asian leaders in the coming days to discuss ongoing security and economic relationships. In his first few days in office, President Trump has adopted a more assertive stance in advancing his trade agenda, signaling a shift toward a relatively expansionist foreign policy.

- President Trump is set to meet with Japanese Prime Minister Shigeru Ishiba on Friday. During the discussions, Japan is expected to commit to purchasing more American weapons and energy, investing in artificial intelligence, and sharing a greater portion of the defense burden. Japan’s ability (as an export-oriented economy) to avoid a trade war with the US will likely provide support to its equity markets.

- On the same day, US Secretary of Defense Pete Hegseth is scheduled to meet with his Australian counterpart, Richard Marles. Ahead of the meeting, Australia made its first $500 million payment to the US as part of the AUKUS nuclear submarine deal. This payment is expected to foster goodwill, as the two leaders are likely to focus on strengthening the ongoing relationship between their nations, which are already aligned through both the QUAD and AUKUS alliances.

US Policy Close to Neutral? As the Federal Reserve prepares to review its first inflation data of the year, concerns are emerging that views within the Federal Open Market Committee (FOMC) are beginning to diverge. While some members believe the central bank could cut rates this year, others remain more skeptical.

- Dallas Fed President Lorie Logan suggested that the Federal Reserve may be nearing a neutral interest rate, the point at which monetary policy is neither stimulative nor restrictive. Her comments follow similar observations from several other policymakers.

- As we have mentioned in previous reports, inflation in the first few reports of the year will likely play a major role as to whether the Fed is actually making progress toward its 2% inflation target.