Daily Comment (February 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Equities are holding steady, and the NBA trade deadline is expected to end with a bang. In today’s Comment, we dive into the recent Treasury auction, explore why New York Community Bank is on investors’ watchlists, and analyze the potential for a US decoupling from the EU and China. As always, we wrap up with a summary of key domestic and international economic releases.

Auction Success: The US Treasury sold a record number of bonds as investors gear up for a Fed pivot; however, policymakers aren’t as confident.

- The US Treasury successfully auctioned $42 billion in 10-year notes at a slightly lower yield than anticipated, 4.093%. This strong demand marks a turnaround from recent auctions plagued by weak participation and “tail” outcomes, where low-priority buyers received bonds at significantly higher yields. The better-than-anticipated demand in the latest bond sale boosted bond prices slightly and fueled a surge in the S&P 500, pushing it closer to the 5,000 mark. This suggests growing investor confidence that the Fed might adopt a more dovish stance later in the year, but Fed officials continue to play down speculation that a policy pivot is imminent.

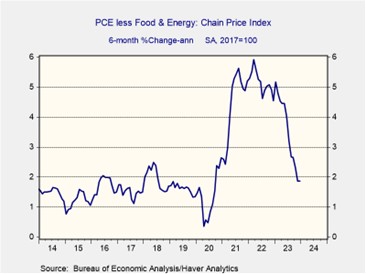

- Several central bank policymakers urged patience on rate cuts, emphasizing the importance of waiting for clearer signs of disinflation before considering adjustments. Fed Governor Adriana Kugler advocated for further evidence before the committee considers a rate cut. Meanwhile, Minneapolis Fed President Neel Kashkari projected the central bank could reduce rates 2-3 times this year, but acknowledged the need for inflation to remain near the 2% target for several months before action. Recent core PCE readings show that inflation dipped below the Fed’s target on a six-month annualized basis, suggesting a sustained downward trend.

- A successful Treasury auction of $25 billion worth of 30-year bonds today could spark market optimism, but demand for these bonds in the future could hinge on expectations of a Fed pivot. Robust payroll data coupled with persistent inflation appears to be preventing policymakers from acting more aggressively. Meanwhile, Chair Powell’s recent call for fiscal responsibility amplifies concerns within the Fed that Congressional inaction on the fiscal deficit debt could hinder their efforts to manage long-term interest rates. Given this uncertainty, investors should tread carefully and avoid premature exposure to duration risk, as these assets will most likely remain highly susceptible to volatility in the coming months.

Loss Provisions: Recent loan losses at New York Community Bank are fueling fears of a surge in real estate defaults this year.

- Faced with a surprise earnings loss and dividend cut, the New York lender is scrambling to regain investor trust by exploring asset sales, including offloading loans made during lower interest rates. This move reflects concerns about potential losses on real estate holdings in a challenging market. However, the firm’s efforts to shore up its balance sheet may be hampered by a lack of appetite for commercial real estate (CRE). Banks are struggling to value properties due to high vacancies and borrowing costs, making potential buyers wary. As a result, concerns linger that other banks might also face difficulties in managing their CRE.

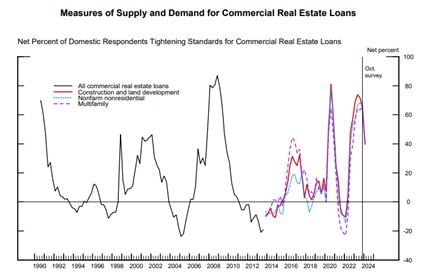

- Small and mid-sized banks face mounting concerns about CRE loans, according to the latest Senior Loan Officer Opinion Survey. While the report showed a slight easing in credit tightening for nonresidential properties, standards remain significantly stricter compared to pre-pandemic levels. Notably, large banks were less likely to tighten standards, highlighting a potential vulnerability for smaller lenders. Alongside stricter lending practices, banks are expressing growing uncertainty about the economic outlook, reduced risk tolerance, and worsening liquidity conditions, further amplifying concerns about the CRE market.

(Source: Federal Reserve)

(Source: Federal Reserve)

- While historical trends show real estate crashes to be major drivers of US recessions, exemplified by the downturns in the early 90s and the Great Recession, current indicators don’t necessarily point to imminent trouble. The latest Household Debt and Credit report reveals increased auto and credit card delinquencies in the final quarter of 2023, but defaults remain significantly lower than pandemic highs. Additionally, the labor market continues to show signs of tightness which is likely to make households more resilient. Hence, despite the gloom in CRE, financial markets still look good.

Trade Flow and Tension: Trade data shows that the US is steadily reducing its dependency on China; however, there are growing concerns that the European Union may be next.

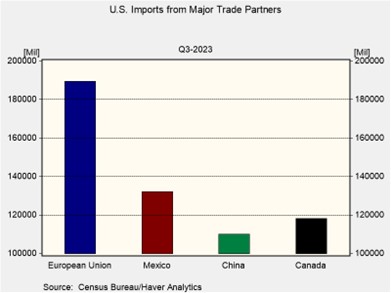

- For the first time in two decades, the US imported more goods and services from Mexico than from China, marking a significant shift in global trade dynamics. This trend is primarily driven by a decline in imports from China, falling from $575 billion to $431 billion in 2023, rather than a significant increase in Mexican imports, which dipped slightly from $459 billion to $448 billion. This shift reflects not only ongoing tensions and potential decoupling between the US and China, but also the growing trend of “nearshoring” as companies and investors seek geographically closer production and supply chains.

- However, a potential shift towards regionalization could strain relations with traditional allies. The European Union has voiced concerns about potential trade disruptions if former President Donald Trump were to be re-elected. Throughout his initial term, Trump publicly criticized the EU, particularly Germany, for its perceived reluctance to adopt a firmer stance against China, as well as its long-standing trade deficit with the United States. Trump is currently considering punitive trade measures against the EU if he regains office, prompting the EU to assess its response to potential actions by the Republican front-runner should he resume power.

- Escalating trade tensions create a complex landscape of uncertainty, presenting both challenges and potential opportunities. Recent price data hints at post-lockdown economic struggles in China, raising questions about whether cost advantages for US companies will be sustainable in the face of trade disputes. Additionally, a potential EU-US feud could prompt the bloc to diversify its imports, particularly in commodities, potentially impacting the US energy sector. However, the EU might also need to balance this with maintaining access to the US consumer market, potentially softening its stance on American tech firms.

Other News: Israel’s PM Benjamin Netanyahu rejected a deal to end the hostage situation, suggesting that the conflict will likely continue for the foreseeable future. The US killed the commander of an Iran-backed militia in Iraq as it looks to retaliate against those responsible for the Jordan attack in late January. The action risks a broader conflict in the Middle East. Lastly, the stock price for UK chip designer Arm surged on Thursday after it reported higher-than-expected earnings. Its strong performance reflects growing demand for AI-related technology.