Daily Comment (January 10, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

In today’s Comment, we open with geopolitical news and a focus on Russia’s aggressive stance toward the countries surrounding it. Notably, we discuss today’s U.S.-Russian security talks seeking to de-escalate the situation in Ukraine. We next turn to other international news and a couple of notes related to U.S. monetary and regulatory policy. We close with the latest developments related to the coronavirus pandemic.

United States-Russia: U.S. and Russian officials today formally begin a round of high-level talks designed to de-escalate the situation on the Russia-Ukraine border, where President Putin has positioned over 100,000 troops as a way to pressure the U.S. and its allies into providing security guarantees for Russia. On Wednesday, Russian officials will sit down in Brussels to meet with officials from NATO. The following day, officials from the Organization for Security and Cooperation in Europe, which includes Russia and a host of regional countries, will gather in Vienna to begin a broad conversation on European security.

- Putin’s key demands include a commitment from NATO that it will not admit Ukraine or other new Eastern European members into the defense alliance, and it rolls back its military infrastructure and deployments in the former Soviet states. Ahead of today’s meeting with U.S officials, Russia’s Deputy Foreign Minister Sergei Ryabkov took an uncompromising stance on the Russian demands and expressed pessimism about striking an agreement.

- While the U.S. and its European allies have rejected Putin’s demands out of hand, reporting over the weekend said the Biden administration is prepared to discuss reciprocal limits on intermediate-range missiles in Europe as well as reciprocal restrictions on the scope of military exercises on the continent.

- If no agreement is reached and Russia invades Ukraine, the U.S. has threatened massive economic sanctions, including possibly cutting Russia off from the SWIFT system of international dollar payments. U.S. officials have also discussed more targeted measures, including erecting export barriers to block international sales to Russia of products with a certain percentage of American content, as well as preventing Moscow from getting access to cutting-edge microchips used in everything from aircraft to consumer electronics. Those options would likely impose steep costs on the Russian economy and financial assets.

Russia-Kazakhstan: Not only is Putin trying to make Russia safe for authoritarianism, but he is also doing the same for the other authoritarians ruling former Soviet states in the region. In a statement today on Russia’s deployment of troops to Kazakhstan to help put down popular protests there, he vowed Russia will protect its allies from “color revolutions” sparked by unnamed outside actors. Putin’s commitment will help solidify Russia’s influence over the many post-Soviet states led by authoritarians, such as Belarus and Kazakhstan.

- Press reports indicate at least 164 people have been killed in the Kazakh protests so far, including three children.

- Kazakh authorities say they have arrested almost 8,000 of the 20,000 “terrorists” they claim are behind the protests.

China: Illustrating the economic impact of China’s recent crackdown on high-flying technology companies, the chief executive of New Oriental Education & Technology Group (EDU, $1.86), one of the country’s top online tutoring firms, said the crackdown cost his firm $3.1 billion and forced it to lay off 60,000—more than half its workforce. He also said the new regulations cut his firm’s operating income by 80%.

U.S. Monetary Policy: Richmond FRB President Barkin said he supports the central bank’s hawkish outlook for monetary policy and is open to raising interest rates when its bond-buying stimulus effort winds down in March. Barkin isn’t a voting member of the policy committee this year, but his views likely reflect the body’s growing impatience to address inflation by tightening policy.

U.S. Financial Regulation: Concerned about the influence and risks arising from “unicorns” and other fast-growing private companies, the SEC has begun work on a plan to require more private firms to routinely disclose information about their finances and operations. It is also considering tightening the qualifications that investors must meet to access private markets and increasing the amount of information that some nonpublic companies must file with the agency.

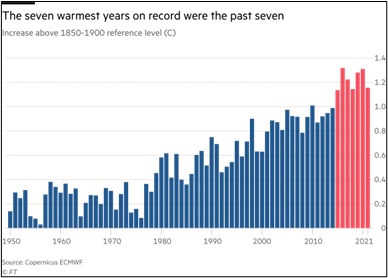

Climate Change: New data from Copernicus, the European Earth monitoring program, showed that global average temperatures in 2021 were 1.1-1.2 degrees Celsius above the pre-industrial average (1850-1900), making it slightly cooler than 2019 and 2020 but still much warmer than preceding decades. According to the data, the last seven years have been the hottest on record, with 2021 being the fifth warmest.

- Even though climate issues have become hopelessly politicized, it’s important to keep track of the data because the temperature figures will probably drive efforts to develop and implement climate stabilization policies.

- Climate fluctuations and policies to moderate them will likely result in substantial economic and financial opportunities as well as risks. For example, last summer’s disastrous floods in Europe are expected to boost sales of property catastrophe insurance on the continent.

COVID-19: Official data show confirmed cases have risen to 307,422,417 worldwide, with 5,490,247 deaths. In the U.S., confirmed cases rose to 60,090,637, with 837,664 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 246,812,939. The data show that 74.3% of the U.S. population has now received at least one dose of a vaccine, and 62.5% of the population is fully vaccinated.

- As the highly transmissible Omicron mutation continues to spread quickly, the U.S.’s official seven-day average for newly reported cases topped 700,000 for the first time. However, the official total likely reflects only a fraction of the true number, due in part to Omicron’s rapid spread and the difficulty many Americans have had getting tested.

- Fortunately, it still appears that Omicron is significantly less virulent than earlier variations of the coronavirus, so hospitalizations have not risen in tandem with new cases so far.

- While healthcare systems are under strain, the situation isn’t yet as bad as in some earlier waves of the pandemic.

- That could allow government officials to continue taking relatively muted steps to counteract the new mutation. If so, the economic and financial impact of Omicron could remain limited.

- The “Great Sickout” is now spreading to hospitals themselves. Rising numbers of nurses and other critical healthcare workers are calling in sick across the U.S. due to COVID-19, forcing hospitals to cut capacity, just as the Omicron variant sends them more patients.

- With Omicron spreading across the world faster than any previous variant, cases of reinfection among people who caught COVID-19 earlier in the pandemic are rising.

- Almost all reinfections so far are people who originally caught another strain of the virus. No evidence has yet been found of anyone being infected twice by Omicron itself, including from South Africa, where this latest variant of concern has been circulating longest—for at least two months.

- However, health officials worry that Omicron’s increased transmissibility and ability to evade immunity protection will lead to cases of reinfection with the same variant. They are also concerned about co-infection—simultaneous infection with Omicron and another variant—in this phase of the pandemic.

- In China, the first discovery of community-transmitted cases of the Omicron variant has prompted officials to strengthen travel controls, close schools, and institute a series of local lockdowns in Tianjin. The city with a population of approximately 14 million is only about 70 miles southeast of Beijing, where the Winter Olympic Games are scheduled to start in less than a month.

- The clampdown in Tianjin comes as imported cases of the Omicron mutation have already caused a crisis in Xi’an. That city has been under lockdown since December 22.

- Authorities in Xi’an have been criticized after residents in the city with 13 million people were left without access to medical resources and food.

- Novartis (NVS, $89.31) said it would seek expedited approval for its antiviral drug against COVID-19 after strong results from an early-stage trial showed it could help to treat the disease. In the trial, the drug cut the risk of emergency room visits, hospitalization, or death by 78% compared with a placebo.