Daily Comment (January 13, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a few words on the global bond sell-off, which so far this morning is still pushing yields higher. We next review several other international and US developments with the potential to affect the financial markets, including more signs that China is struggling with excess capacity in its industrial sector and new projections pointing to a boom in the construction of natural gas-fired energy plants in the US.

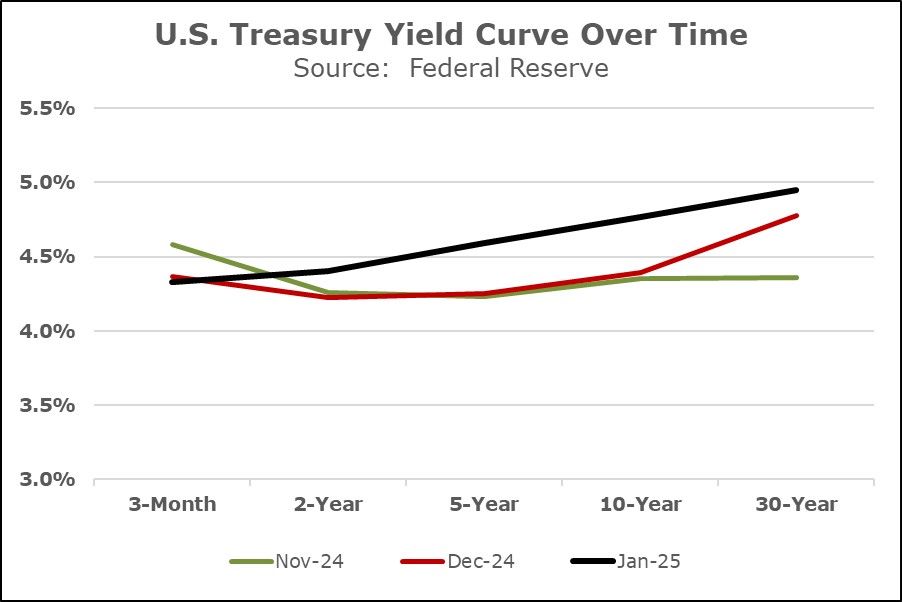

Global Financial Markets: Global bond yields continue to rise this morning, driven largely by outsized US economic growth and concerns about rising fiscal deficits. As we noted in our Comment on Friday, the strong December employment report has sparked speculation that the Federal Reserve may stop cutting interest rates. As a result, the US Treasury yield curve is decidedly upward sloping again, reflecting the current “bear steepening.”

- The prospect for continued fast economic growth and high interest rates in the US is also boosting the value of the dollar and punishing foreign currencies.

- For example, the euro so far today is trading down approximately 0.5% to $1.0202, while the British pound has plummeted 0.7% to $1.2121.

Global Uranium Market: The price for enriched uranium has hit a record $190 per separative work unit (the standard way to value the effort required to separate uranium into its various isotopes). That marks an enormous jump from $56 three years ago, mostly reflecting global plans to increase the use of nuclear power and looming Western sanctions against Russia, the main refiner of uranium.

- Enriched uranium is typically sold to nuclear generating firms under long-term contracts, so its value can diverge from spot prices for mined uranium. Indeed, while anticipated demand growth and looming sanctions drove up enriched uranium prices in 2024, spot prices were in a correction and fell some 28%.

- Importantly, the continuing rise in enriched uranium prices holds the prospect for a rebound in spot uranium prices. We continue to believe that spot uranium could offer solid investment returns in the coming years.

Eurozone: Philip Lane, chief economist at the European Central Bank, said in an interview that his institution should work to find a “middle path” to cutting interest rates further. According to Lane, the ECB policymakers need to find a rate-cutting path that would still push down price inflation but also support economic growth. Since Lane’s statement points to continued eurozone rate cuts, while investors now think US rates may be on hold, the news may be contributing to the euro’s weakness so far today.

Germany: Laying out the platform of the far-right Alternative for Germany (AfD) in next month’s election, party co-leader and chancellor candidate Alice Weidel stressed that an AfD government would push for the mass repatriation of immigrants. Specifically, Weidel used the controversial, expansive term “remigration,” which far-right politicians in Germany define as forcibly removing immigrants who either break the law or “refuse to integrate,” regardless of their citizenship status.

- Public opinion polls currently show AfD garnering about 20% of the February vote, second only to the center-right Christian Democratic Union, at about 32%. Nevertheless, AfD’s prospects for joining a government are in question, as Germany’s mainstream parties are all reluctant to strike a coalition deal with it.

- Nevertheless, the large chunk of the electorate that supports AfD illustrates the extent to which anti-immigration sentiment has risen in Europe. That suggests that European migration policy will continue to tighten going forward, despite the region’s falling birth rate and demographic challenges.

China: The China Photovoltaic Industry Association has complained that its new cartel aimed at curbing excess production and boosting prices is already being undermined by a Xinjiang solar energy project. In its search for solar panel suppliers, the project reportedly set a bidding limit far below the cartel’s price floor of 0.68 yuan ($0.09) per watt and awarded contracts to the firms with the lowest prices. The incident suggests that the Chinese solar panel industry will continue to struggle with excess capacity, falling prices, and vanishing profits.

- Along with electric vehicles, the solar energy industry is one of the best examples of how China’s industrial policies have created massive problems with excess capacity, high debt, and budding financial problems.

- Since China’s solar energy industry is mostly made up of relatively smaller private firms, it is proving hard to discipline. The government in 2024 issued new regulations to limit the investment in new capacity, but even the existing capacity is far more than enough to supply global demand.

- It now appears that the industry’s effort to build a self-regulating cartel also won’t stabilize prices or boost profitability. As producers export their excess production at fire sale prices in a desperate effort to survive, one result will likely be continued economic tensions between China and its trade partners.

Malaysia: In a Financial Times interview, Economy Minister Rafizi Ramli said Chinese technology companies are quickly ramping up their investments in Malaysia to get around the new US import tariffs that the incoming Trump administration is expected to impose against China. The government expects Chinese firms to invest billions of dollars in new production facilities in Malaysia in the coming years, giving a boost to economic growth.

United States-China: The outgoing Biden administration today unveiled new, expansive export controls on advanced computer chips for artificial intelligence. The rules aim to make it harder for China and other potential adversaries to acquire the chips, which can be used for both civilian and military purposes. Under the rules, 20 close US allies and partners will have uninhibited access to advanced AI-related chips with US technology, but most other countries will require licenses.

- The new rules tighten the Biden administration’s previous efforts to crimp Chinese access to advanced AI chips. The previous efforts have in some cases been undermined by loopholes and workarounds.

- At least temporarily, the new rules are likely to rile Beijing and the countries that will now be subject to US licensing requirements. However, it isn’t clear that the incoming Trump administration would maintain the rules. Given the strong influence that tech titans have in Trump’s circle, it would not be a surprise if they work to water down or reverse the Biden rules in order to preserve US tech firms’ access to the Chinese market.

US Energy Industry: Energy consultancy Enverus has issued a report saying the new data centers being built for the AI industry will spur the construction of some 80 new natural gas-fired energy plants in the US by 2030. The report builds on other analysis projecting the new data centers and their enormous energy requirements will also spur more nuclear power generation. However, gas-fired plants are cheaper and quicker to build, so it’s reasonable to expect they will satisfy much of the new electricity demand and potentially help drive gas prices higher.

US Insurance Industry: California Governor Gavin Newsom yesterday said the multiple wildfires that have destroyed some 40,000 acres of Los Angeles could be the costliest disaster in US history. AccuWeather estimates the total economic loss from the fires will be $135 billion to $150 billion, and early estimates suggest insured losses will be upward of $20 billion. Because of the high insured losses, property insurers are expected to suffer big losses and pull back from the California market, driving many property owners to the state’s backstop plan.