Daily Comment (January 17, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Note: Due to the holiday, the Daily Comment will not be published on Monday, January 20.

Good morning! The market is currently digesting the latest economic data. In sports news, Manchester City striker Erling Haaland has signed a 10-year contract to stay with his current club. Today’s Comment will cover our key takeaways from the Senate confirmation hearing of Trump’s Treasury secretary nominee, explore why Fed officials are divided on whether to proceed with rate cuts, and discuss other market-moving events. As usual, the report will also include a summary of both domestic and international data releases.

Bessent Speaks: Treasury Secretary nominee Scott Bessent successfully navigated his confirmation hearing, offering the first insights into the priorities of President-elect Donald Trump’s administration. During his testimony, he addressed key issues including the federal deficit, Federal Reserve independence, tariffs, and Russian sanctions.

- Government Spending: Bessent stressed that extending the 2017 Trump tax cuts is essential to preventing another economic crisis. However, he also underscored the importance of tackling the growing deficit, suggesting that reductions in discretionary spending is a key area for budget cuts. Additionally, he expressed support for eliminating the US debt ceiling altogether.

- Federal Reserve: He also emphasized his respect for the central bank’s independence in making monetary policy free from White House influence. Additionally, he expressed confidence that the Trump administration’s tax policies could boost real wages without significantly driving up inflation.

- US Trade Tariffs: He has expressed support for the president-elect’s ideas, which include utilizing import duties to increase government revenue. This support extends to both blanket tariffs and those specifically designed to address unfair trade practices from other countries, as well as to influence geopolitical matters. Furthermore, he indicated an openness to exploring the possibility of implementing carbon-based tariffs.

- Russian Sanctions: Bessent proposed that the US could implement stricter sanctions on Russian oil to hasten the end of the conflict in Ukraine. He also suggested that increasing domestic oil production to lower prices could undermine Russia’s war efforts in Ukraine.

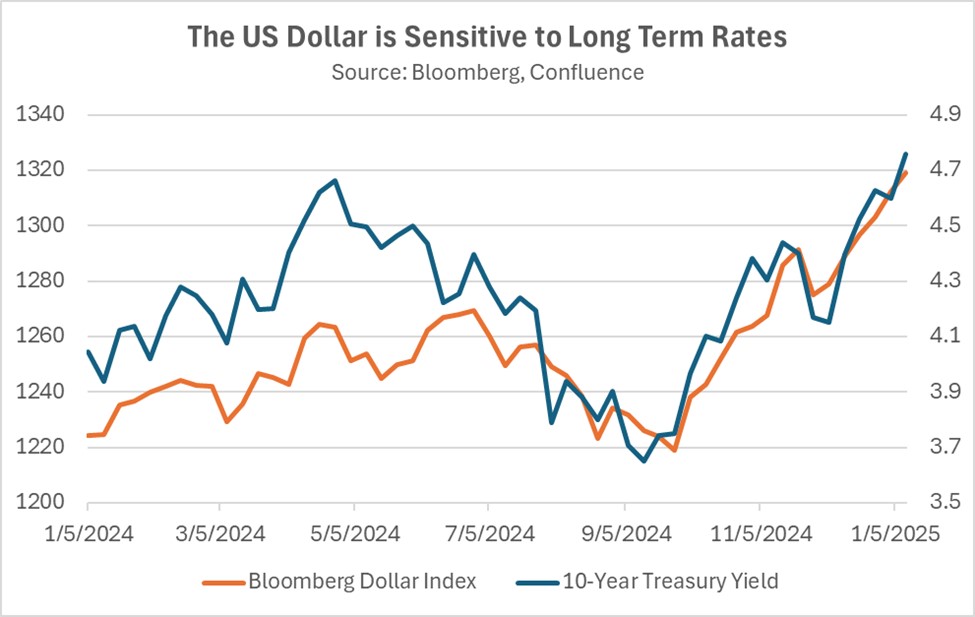

- Our key takeaway from the hearing is that Trump’s policies should be bullish for the US dollar and supportive of US equities. However, the market’s overall performance will largely depend on the incoming president’s ability to address concerns about rising inflation and the increasing of US government bond yields.

Central Bank Discord: While the Federal Reserve demonstrated remarkable unanimity during the rate-hiking cycle, a lack of internal cohesion is now evident as they contemplate easing monetary policy. This disunity has contributed to the recent rise in 10-year Treasury yields over the last few weeks.

- On Thursday, Federal Reserve Governor Christopher Waller expressed optimism that the central bank could implement multiple interest rate cuts this year, potentially beginning in the first half, provided that inflation continues to demonstrate substantial progress. However, he emphasized that the Federal Reserve does not feel compelled to initiate rate cuts prematurely.

- In contrast, Cleveland Fed President Beth Hammack, a non-voting member this year, maintains that inflation is still a significant concern. She argues that not only are current price levels elevated, but the rate of price increases remains problematic and is a challenge the central bank must actively confront. These remarks follow her dissenting vote against the Federal Reserve’s interest rate cut at the December FOMC meeting.

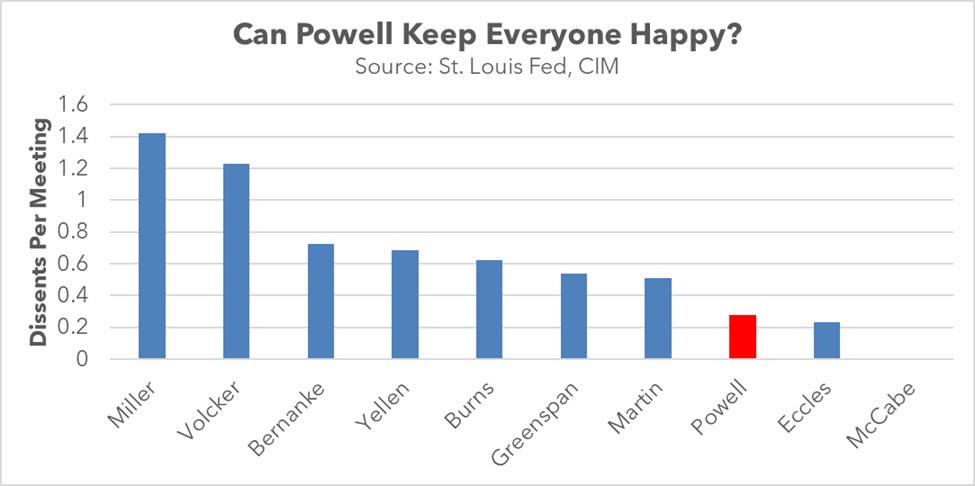

- The diverging views are likely to make it more challenging for Fed Chair Powell to align the Fed officials and maintain a unified stance as they work to manage market expectations through forward guidance. During his tenure in office, Powell has near-record low number of dissents per meeting, with only Marriner S. Eccles and Thomas Bayard McCabe having fewer.

- Additionally, President-elect Trump may be influencing the Federal Reserve’s hesitancy to ease monetary policy. Some Fed officials appear to believe — justified or not — that his policies could contribute to inflationary pressures. A few weeks ago, Richmond Fed President Thomas Barkin and Fed Governor Adriana Kugler noted that the incoming administration’s policies have complicated efforts to forecast the trajectory of inflation and the economy.

- Assuming continued progress in taming inflation towards the 2% target, we anticipate that the implementation of the incoming president’s economic policies, which may prove less radical than his campaign rhetoric, could embolden Federal Reserve officials to demonstrate greater openness to easing monetary policy.

German Elections Focus on Ukraine: Chancellor Scholz has faced criticism for his reluctance to provide additional military aid to Ukraine. German Foreign Minister Annalena Baerbock, a member of the Green Party, accused Scholz of withholding approval for 3 billion EUR ($3.08 billion) in support for Ukraine to secure “a few votes.” This remark highlights the significant impact the war is expected to have on Germany’s upcoming elections on February 23.

- Support for Ukraine is emerging as a significant point of contention within Germany, Europe’s largest economy. Public opinion on the government’s role in aiding Ukraine remains nuanced and somewhat contradictory. While a recent poll indicates that 57% of Germans favor continued financial and humanitarian assistance, another survey reveals that over 60% oppose the provision of more advanced military equipment to Ukraine, such as the Taurus cruise missile.

- A significant factor contributing to this divide is the prevalent fear that Germany could be drawn into a direct war with Russia. This anxiety is particularly acute among residents of former East Germany, with a poll indicating that 76% of respondents in that region fear a potential conflict, compared to only 44% in the western part of the country.

- The divide over support for the war has already sparked a pushback in local elections, with the populist parties Alternative for Germany (AfD) and the Sahra Wagenknecht Alliance (BSW) finding success by campaigning to end funding for Ukraine. The AfD, in particular, has seen its polling improve recently. The rise of populist parties within the German government could complicate efforts to sustain current levels of financial and military aid to Ukraine.

- The outcome of the German election will likely have significant repercussions for the continuation of support for Ukraine. Reduced funding from key Western allies, including Germany and the United States, would likely hinder Ukraine’s ability to continue its war effort against Russia. Any potential resolution to the conflict, regardless of its terms, would likely exert downward pressure on global oil prices.

Crypto National Priority: President-elect Donald Trump is expected to issue an executive order to promote the increased adaptation of cryptocurrency. This order would facilitate collaboration between government agencies and industry stakeholders to develop a more comprehensive regulatory framework. Key provisions include the establishment of a dedicated crypto advisory board to provide guidance and insights on policy development.

TikTok Ban: The Supreme Court is expected to rule on whether the government has the authority to ban or force the sale of the social media platform later today. President Biden has stated that if the court moves forward with this decision, he will leave it to his successor to determine the next steps.