Daily Comment (January 23, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently awaiting President Trump’s remarks at Davos. In sports news, Aryna Sabalenka is one step closer to becoming the first woman since 1999 to win three consecutive Australian Opens. Today’s Comment will discuss Argentina’s unwillingness to take sides in the US-China rivalry, explain why tariffs are forcing firms to consider relocating, and provide the latest developments in the war in Ukraine. As usual the report will conclude with a summary of domestic and international data releases.

Argentina Has Options: Argentine President Javier Milei has explored the possibility of establishing trade deals with both the United States and China. This decision reflects his broader strategy to revitalize the economy during a challenging period.

- During an interview at the World Economic Forum in Davos, Milei hinted that his administration might be exploring a bilateral trade agreement with the United States. He even suggested a potential willingness to withdraw from the South American trade bloc, Mercosur, in order to secure a favorable deal with the US, if needed. However, he expressed confidence that existing mechanisms within the Mercosur trade arrangement would enable his country to maintain relationships with both trading partners.

- Furthermore, he appears to have significantly altered his stance on engaging with China. After previously characterizing Beijing as a group of assassins, he now believes that China is a valuable trading partner, and he has expressed a desire to cultivate a deeper relationship with the world’s second-largest economy. Milei and his team are expected to travel to China soon to discuss improving commercial ties.

- The Argentinian president’s willingness to engage with both China and the United States likely reflects a desire to maintain strategic autonomy, despite shared interests with the latter. This reluctance to fully align with the US may stem from concerns about potential economic disruptions caused by proposed flat tariffs, as well as the perception of the US as an exporting rival.

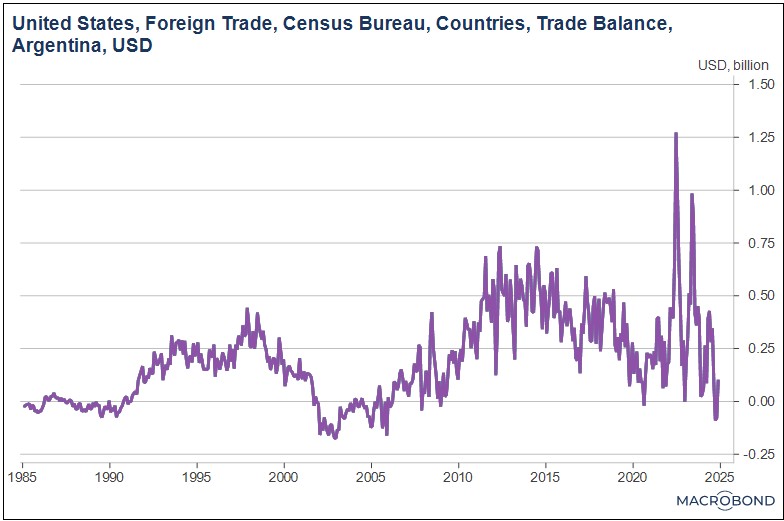

- Since taking office, Milei has focused on expanding Argentine exports, particularly in grains, oil, and gas — sectors where the country directly competes with the United States — as a strategy for economic growth. Last year saw the nation achieve a record trade surplus, largely attributed to strong energy exports, while simultaneously reducing its trade deficit with the US.

- Millie’s decision to engage with China signals how US trade threats may be driving other nations toward closer ties with Beijing, potentially creating a counterweight to American influence. This could compel the US to moderate its approach towards less security-dependent nations, potentially making these countries more attractive as investment destinations for those seeking to mitigate trade war risks.

Tariffs Headaches: Confronted with the looming threat of new tariffs, US companies in China are scrambling to explore all viable alternatives. A key concern is the relocation of operations with many reluctant to reshore to the US, raising the specter of renewed supply chain difficulties and potentially reigniting inflationary pressures.

- Nearly 30% of companies are considering relocation, according to a survey conducted by the American Chamber of Commerce in China. While the overall majority of firms plan on keeping their operations at their current location, the trend is showing that firms have started to take steps to hedge against rising trade tensions.

- That said, for most firms, the preferred destination for relocating operations appears to be other countries in Asia, rather than the US or its Northern American partners. Among respondents who plan to move operations, 38% indicated Asia as their preferred destination, with many companies specifically considering countries like Vietnam and the Philippines.

- The reluctance of firms to relocate from Asia to the US, despite policy incentives to do so, stems primarily from concerns about higher labor costs and difficulties in retaining skilled workers. This is particularly pronounced for labor-intensive industries such as wiring and optical fiber cable manufacturing, which often require specialized expertise.

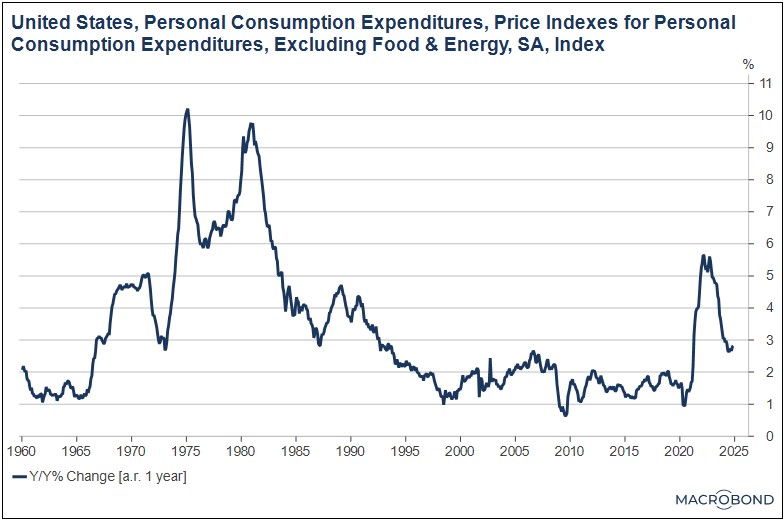

- As a result, proposed tariffs on goods from Mexico and Canada pose a significant threat to the US economy by disrupting supply chains and dampening consumer demand. Deutsche Bank research estimates that the 25% tariffs implemented on February 1 could increase the core PCE price index by 80 basis points, assuming a 50% cost pass-through to consumers. This figure rises to 110 basis points if 75% of costs are passed through.

- If Deutsche Bank’s research proves accurate, it could hinder the Federal Reserve’s efforts to lower interest rates further this year, potentially keeping rates elevated. However, the inflationary impact of these tariffs may be transitory, which could mean the pause could be somewhat limited.

Ukraine-Russia Deal: The US president has demanded that Vladimir Putin quickly agree to a deal to end the war in Ukraine or face tariffs, taxes, or more sanctions. Trump’s threat comes as he is expected to talk to the Russian president later this week to discuss the war.

- Trump remains confident that Zelensky is open to negotiations but questions whether Putin is genuinely committed to ending the conflict. Earlier this week, he uncharacteristically criticized Putin, accusing him of destroying Russia by refusing to make a deal. His remarks come amid growing concerns that Russia has prolonged the conflict with support from North Korean troops.

- Moscow responded to Trump’s remarks by expressing interest in meeting with the US for discussions while downplaying the president’s threats as nothing new. Although some within the Kremlin reportedly support continuing the war, sources suggest that Putin believes the war’s objectives have been achieved, indicating that Moscow may be open to a deal.

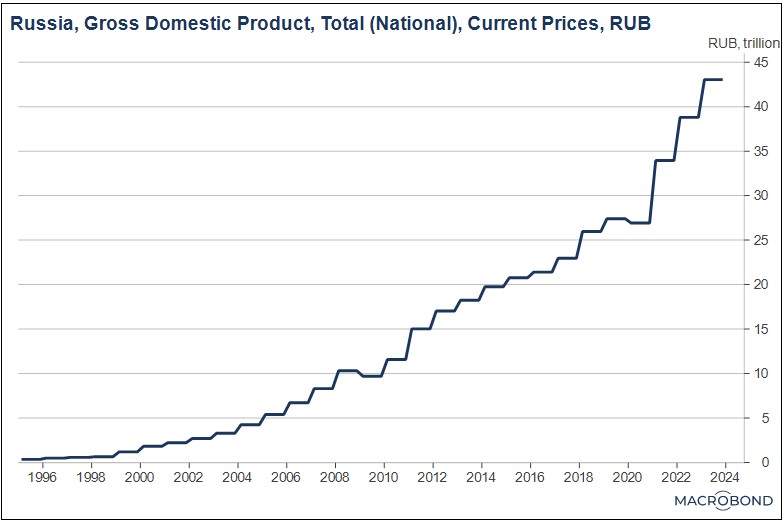

- The possible end of the war comes at a time when the Russian economy is facing increasing distress, with concerns that the war effort may be leading to some distortion. To mitigate fears of a possibly worsening economic outlook, Russian officials have suggested the rest of the world is also facing some form of economic difficulties.

- A potential peace agreement ending the war would likely be met with enthusiasm by financial markets, as a ceasefire could significantly reduce geopolitical tensions. Commodity prices, particularly energy, are expected to be the most immediate beneficiaries. The prospect of lifting sanctions on Russian oil and gas exports would likely exert downward pressure on energy prices.