Daily Comment (January 25, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Wall Street is evaluating the latest GDP data and Jim Harbaugh’s return to coach the L.A. Chargers is expected to electrify the NFL. Today’s commentary dives into the bond market’s potential tantrum after another disappointing auction, discusses the ECB’s recent policy decision, and explores how escalating national security anxieties may slow the rally in chip-related stocks. As usual, our report concludes with the latest international and domestic data.

Clouds on the Horizon? Another poor showing at a Treasury auction could foreshadow a drop of enthusiasm for equities.

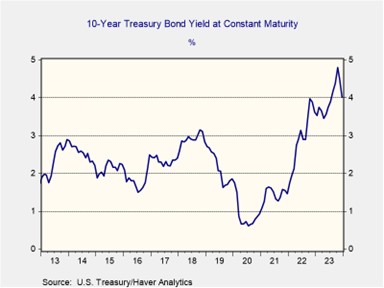

- Yields on long-duration government securities have rebounded as growing bond issuance and doubts about rate expectations weigh on bond prices. On Wednesday, a U.S. Treasury auction of $61 million of five-year bonds failed to meet expectations. The lower-than-expected demand has led to concerns that the market is saturated with Treasuries. This comes on the heels of an announcement of a heavier borrowing schedule from February to April and expectations that the Federal Reserve may not cut rates as aggressively as the market anticipates. As a result, the 30-year yield rose to the highest rate year-to-date.

- The sluggish demand in recent government bond auctions casts doubt on the sustainability of the December 2023 plunge in bond yields. The 10-year Treasury note’s yield slumped over 80 basis points since October, fueled by optimism for the easing monetary policy later in 2024. However, stronger economic data and inflation worries prompted policymakers to temper dovish talk, dampening speculation of an immediate shift. Hawkish comments sent the CME FedWatch Tool’s estimate for a Q1 rate cut plummeting from above 70% to just 40% as of today.

- The stock market’s recent sunshine might face a harsh winter from rising interest rates. A growing supply of bonds coupled with waning demand is creating a perfect storm that may force the Fed to consider changing course sooner rather than later. While some policymakers, like Dallas Fed President Lorie Logan, have advocated for a more cautious approach, such as slowing down the pace of quantitative tightening, others on the committee seem to favor a possible cut in policy rates. This internal tug-of-war will play out in next week’s FOMC meeting as Fed officials grapple with how to conduct policy going forward.

ECB Not Ready to Backdown: The European policymakers may be more willing to stick to higher-for-longer rates than the market anticipates.

- The European Central Bank left its benchmark policy rate unchanged. The decision was in line with market expectations as traders are currently pricing in the central banks’ first rate cut in June. During the press conference, ECB President Christine Lagarde emphasized that the central bank is focused on achieving its 2% target. Lagarde threw cold water on market hopes for an April rate cut, suggesting the bank may wait until the summer before it pivots. However, she maintained that the committee will remain data-dependent when deciding future policy and is prepared to make changes if necessary.

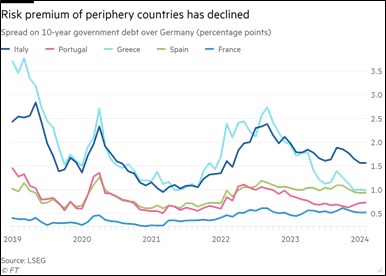

- While Germany and France, Europe’s largest economies, got off to a slow start this year, investors are still buying up government bonds in the region. The latest eurozone Purchasing Managers’ Index (PMI) indicates that the region is currently experiencing contraction, suggesting that economic growth remains sluggish. This weakness is particularly evident in Germany and France, whose PMI readings of 45.4 and 47.1, respectively, fall well below the contraction threshold of 50. Despite ongoing concerns, a promising development emerges in the eurozone periphery. Countries like Italy and Spain, once burdened by high-risk premiums, are witnessing declining bond yields due to anticipated reductions in their debt-to-GDP ratios over the next two years.

- While April rate cuts remain widely expected from the European Central Bank, the bank retains the flexibility to delay if economic data dictates. Despite tepid regional output, fears of a deep recession lack strong evidence. The unemployment rate sits near record lows, suggesting that the slowdown has not spilled over into labor markets. Furthermore, the narrowing gap in yields between core and peripheral eurozone countries, even with the planned March end of PEPP, reduces the risk of diverging borrowing costs and financial instability within the eurozone. As a result, the ECB is better positioned to remain tighter for longer than its American counterpart.

Global Chips: The West’s potential alliance against China and Russia could hinder chipmakers’ ability to meet audacious earnings expectations.

- Despite a growing effort to curtail access, the U.S. is finding it increasingly challenging to stop its rivals from obtaining high-quality chips crucial for their military and industrial development. In 2023, Russia imported over $1 billion of these strategically important components, accounting for more than half of its total chip imports, potentially fueling its war efforts in Ukraine. Adding to the concerns, Dutch lithography giant ASML (ASML, $847.31) ramped-up semiconductor equipment sales to China, in spite of an agreement between the U.S. and the Netherlands to limit shipments.

- Navigating the complexities of coordinated export controls in a fragmented world poses a growing challenge for the U.S. and its allies. Competing interests and shifting partnerships can make effective implementation difficult, even when national security concerns are at stake. This is evident in the case of leading chipmakers like Nvidia (NVDA, $613.62) and Intel (INTC, $49.09), where a quarter of their revenue originates from China. Restricting their ability to sell advanced chips in this crucial market could not only jeopardize their ambitious growth plans but also raise concerns about the effectiveness of such policies in achieving their intended strategic goals.

- Despite this policy’s unsurprising failure, governments may be forced to take a tougher stance with firms, potentially through stricter regulations or financial penalties, to achieve their desired outcomes. Speaking at the Reagan National Defense Forum in California, U.S. Secretary of Commerce Gina Raimondo warned chipmakers that she would like to stop any company looking to aid China’s bid to advance its own AI capabilities. Raimondo’s statement underscores the potential for stricter export controls, a measure not unprecedented in history. Similar restrictions were implemented during World War II and beyond to address critical national security needs. Concerns about new restrictions on chip exports could dampen the recent euphoria surrounding domestic chipmakers.

Other news: South Korean lawmaker Bae Hyun-jin was attacked on Thursday in a sign of growing political hostilities in the country. The Federal Reserve hiked rates in its Bank Term Lending Facility on Thursday as it looks to curtail arbitrage trading. The move highlights the growing concerns policymakers have about moral hazard problems when it comes to backstops.