Daily Comment (January 27, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a discussion of today’s rout in global technology stocks. We next review several other international and US developments with the potential to affect the financial markets today, including more data pointing to sluggish economic growth in China and President Trump’s short-lived tariff hikes against Colombia over the weekend.

Global Technology Stocks: The West’s recently high-flying technology stocks related to artificial intelligence, such as Nvidia and Google, are taking a beating today on news that Chinese firm DeepSeek has developed a powerful AI model that calls into question their investments in the space. In an X post on Friday, well-known Silicon Valley venture capitalist Marc Andreessen went so far as to proclaim, “DeepSeek R1 is one of the most amazing and impressive breakthroughs I’ve ever seen.”

- Importantly, DeepSeek was apparently able to produce its model without having access to the most advanced AI chips from US firms such as Nvidia. Washington has banned selling those chips to China to prevent it from surpassing the US in military and technological capabilities. It now appears that the ban has done little to slow China’s progress in AI.

- In fact, DeepSeek has apparently been able to develop its powerful model for just a small fraction of the cost to develop major AI models in the West.

- Of course, some of DeepSeek’s cost advantage probably reflects subsidies from the Chinese government. Nevertheless, the firm’s success suggests that the enormous AI investments made by the likes of Nvidia, Microsoft, Google, and Meta may be misguided or unjustified.

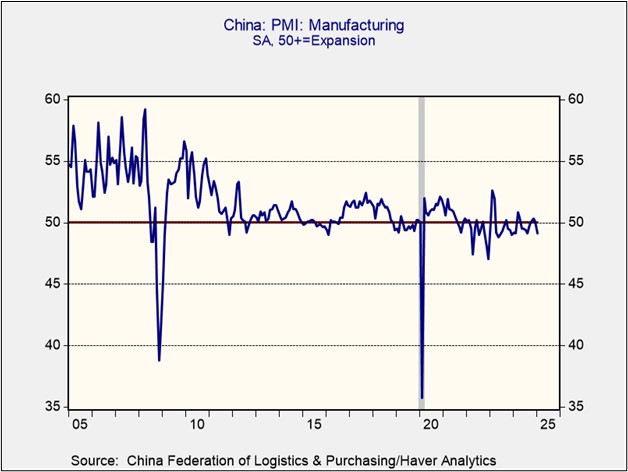

China: The official purchasing managers’ index for manufacturing fell to a seasonally adjusted 49.1 in January, short of expectations and below the 50.1 reading in December. Like all major PMIs, the Chinese one is designed so that readings over 50 indicate expanding activity. The reading for January suggests Chinese factory activity is now contracting again after three straight months of modest expansions. The data underscores the continued slowdown in Chinese economic growth due to problems such as excess capacity and high debts.

India-China: In a potential new source of tension over the coming years, the Indian government has voiced its concerns about a major new hydroelectric dam that China plans to build on the Yarlung Tsangpo River in Tibet, upstream from India. The proposed dam would be three times bigger than China’s Three Gorges dam, which is currently the world’s largest hydroelectric facility. New Delhi fears that the dam will lead to water shortages in India, or even floods if it is ever damaged in an earthquake.

Lithuania-Estonia: Officials in both Lithuania and Estonia have become the latest to endorse President Trump’s demand that the non-US members of the North Atlantic Treaty Organization hike their defense spending to at least 5% of gross domestic product. At those levels, countries such as Poland, Lithuania, and Estonia would be spending well above the US defense burden of about 3% of GDP. The spending hikes could have a major impact on those countries’ fiscal policies and help validate our positive view on non-US defense stocks.

United States-European Union: US electric-vehicle firm Tesla’s Shanghai subsidiary has sued the EU over the anti-dumping tariffs the bloc imposed on Chinese-made EVs late last year. Since Tesla is controlled by “first buddy” Elon Musk, it’s possible that the US government might ultimately side with Tesla and put pressure on the EU to drop its tariffs. Such a move could further threaten the EU’s domestic auto production and weaken the general EU economy.

United States-Denmark-Greenland: According to European diplomats briefed on the matter, a call last week between President Trump and Danish Prime Minister Frederiksen went very badly, with Trump insisting that the US should acquire the autonomous Danish island of Greenland and Frederiksen insisting it isn’t for sale. The “horrendous” tenor of the call has sparked concern in European capitals that Trump is seeking to forcibly expand US territory at their expense, much as Imperialist Russia did in the 1800s and Nazi Germany did in the 1900s.

- Our analysis suggests that the strategic and economic assets offered by Greenland are minimal compared with the potential fracturing of the US alliance system if Trump and his officials continue to strongarm Denmark for a sale of Greenland.

- Although Greenland has deposits of several important mineral resources, the ability to exploit those resources is constrained by factors such as the island’s harsh climate, limited infrastructure, and tiny available workforce.

United States-Colombia: To retaliate for the Colombian government’s refusal to accept US military deportation flights, President Trump yesterday announced 25% tariffs on all imports from Colombia and threatened to double them to 50% in one week. Trump also ordered financial sanctions on Colombia and imposed a travel ban and revoked the visas of Colombian government officials. By the end of the day, however, the White House said Colombia had agreed to all of the president’s terms and the tariffs and sanctions would be held in reserve.

- After a week in which the financial markets were encouraged by the lack of any new tariffs from the Trump administration, it now seems clear that he was perhaps just waiting for the right chance to make an example of a country, even if it’s a traditional ally such as Colombia. Even though the Colombia tariff hikes were ultimately canceled, they could well rekindle broader tariff concerns and weigh on the markets on Monday.

- Colombia’s top exports to the US include crude oil, coffee, and flowers. Given that flowers have such a short shelf life and are shipped shortly before they’re needed, the Colombia tariffs could have produced big price increases for Valentine’s Day roses in the US if they had not been rescinded.

US Monetary Policy: The Federal Reserve holds its latest policy meeting this week, with its decision due on Wednesday at 2:00 PM ET. The policymakers are widely expected to hold their benchmark fed funds interest rate unchanged at its current range of 4.25% to 4.50%. That would make Fed Chair Powell’s post-meeting news conference even more important, as investors will be looking for more guidance on the future path of rates.

US Immigration Policy: The Justice Department yesterday said it had begun a multiagency immigration enforcement operation in Chicago, although the number of arrests so far is uncertain. Meanwhile, Illinois Gov. JB Pritzker said his state would cooperate with federal authorities in deporting undocumented immigrants convicted of crimes or with pending deportation orders, but he said state law enforcement would not take part in targeted raids or profile people in the state who might be without documents.

- Similar to the situation with import tariffs, the Trump administration’s inaction on illegal immigrants in its first week may have created a false sense of security and complacency among immigrant communities and those who employ them.

- The Chicago crackdown on immigrants therefore may rekindle concerns that Trump’s immigration policies will exacerbate today’s labor shortages, especially in sectors such as construction and hospitality.