Daily Comment (January 30, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with several notes on the weak economic situation in Europe, which helped spur the European Central Bank to cut interest rates again today. We next review several other international and US developments with the potential to affect the financial markets today, including a new reform of the pension system in Chile and a review of the Federal Reserve’s decision yesterday to hold US interest rates steady.

European Union: European Commission President von der Leyen yesterday unveiled the bloc’s new “Competitiveness Compass” program, which is aimed at reducing regulations and spurring increased innovation, investment, and economic growth. The plan is geared toward improving the EU’s competitiveness in comparison to the booming but increasingly protectionist US economy and the threatening Chinese economy. The plan particularly aims to boost EU activity in cloud computing and artificial intelligence.

- The plan would also reportedly include “Buy European” provisions for public procurement, much the same as the rules that the US and China have implemented favoring domestic producers.

- That would risk running afoul of World Trade Organization rules. However, given Europe’s need to compete with the US and China, the EU is prepared to take the chance.

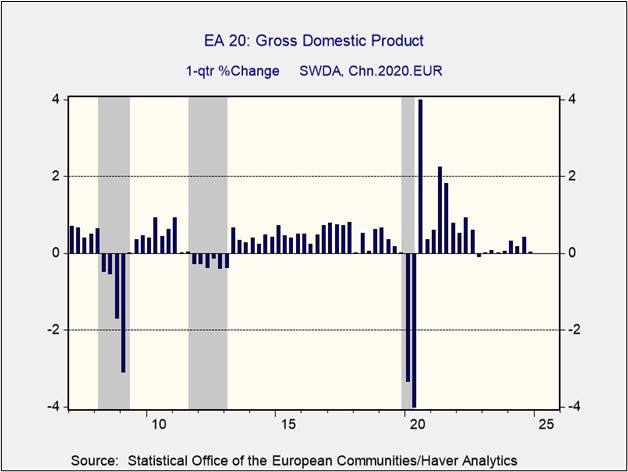

Eurozone Economic Growth: Highlighting the broader EU’s economic stagnation, new data shows that the eurozone’s fourth-quarter gross domestic product was flat with the third quarter, short of the expected rise of 0.1% and much weaker than the 0.4% gain in the previous period. Compared with the fourth quarter of 2023, the region’s GDP was up just 0.9%. The weak growth largely stems from tepid corporate investment and a deteriorating trade balance.

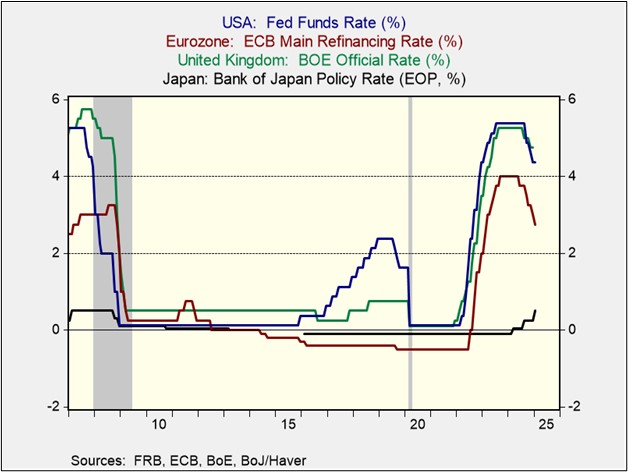

Eurozone Monetary Policy: Consistent with eurozone’s stagnant economic growth, the European Central Bank today cut its benchmark short-term interest rate to 2.75% from its previous level of 3.00%, as widely expected. That marked the ECB’s fifth rate cut in its last six policy meetings. In addition, since the Fed held its benchmark fed funds rate steady yesterday (see below), the ECB’s move increased the rate differential between the eurozone and the US. The euro is nevertheless roughly flat on the day, trading at $1.0410.

Chile: Both houses of the legislature have now approved a major reform of the country’s pensions system, whose meager payouts helped prompt mass demonstrations six years ago. The reform will boost employer contributions to the system and promote competition between private-sector pension fund managers. The increase in the system’s funds may also help boost activity in the Chilean financial markets.

US Monetary Policy: The Fed yesterday decided to hold its benchmark fed funds short-term interest rate steady at 4.25% to 4.50%. The policymakers also decided to keep reducing the central bank’s holdings of Treasury securities, agency debt, and mortgage-backed obligations. Both decisions were widely expected. Importantly, Fed Chair Powell said in his post-decision press conference that the Fed would need to see “real progress on inflation” or unexpected weakness in the labor market before considering further rate reductions.

- The policy statement and Powell’s press-conference remarks support our view that the monetary policymakers will probably implement only a limited number of rate cuts in 2025. They may even hold rates steady or potentially raise them if inflation pressures rebound.

- In response to the Fed’s action, President Trump castigated the policymakers for keeping interest rates too high, suggesting that he will continue to pressure the Fed for more rate cuts in the coming months, even if they would risk a rebound in inflation pressures.

US Fiscal Policy: The federal government’s Office of Personnel Management has reportedly been surprised that its anti-diversity directive last week has turned up so few employees to discharge. The directive had required agencies to identify all employees working full-time on diversity, equity, inclusion, and accessibility and prepare to fire them. The Department of Veteran Affairs has identified only 60 such employees, and other agencies have identified far fewer. OPM is now expanding its definition of employees subject to the directive.

- The failure to identify legions of DEI workers could mean that officials in the new administration had a false understanding of how many such workers were on the federal payroll. It could also reflect some lower-level officials trying to protect their employees. Perhaps more likely, it could be a combination of such factors.

- In any case, the situation suggests that the new administration may find it harder to purge large numbers of federal workers than it expected, especially given the political and legal issues such an effort could entail.