Daily Comment (January 8, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Note: The Confluence offices will be closed tomorrow, January 9, for the Day of Mourning, and we will not publish a Daily Comment.

Good morning! Concerns about the deficit and inflation continue to weigh on investor sentiment. In sports news, New Orleans Pelicans forward Zion Williamson scored 22 points in a loss to the Timberwolves in his first game back from injury. Today’s Comment will cover our perspective on the rise in 10-year Treasury yields, tensions between the US and its allies, and several other key developments. As always, the report concludes with a summary of international and domestic data releases.

Long-Term Yields Rise: Equity prices plummeted after 10-year Treasury yields rose to their highest level since October 2023. A disappointing bond sale and broader concerns about a return of inflation drove the rise in interest rates. As a result, the S&P 500 fell 1.1% on the day, while the tech-heavy NASDAQ composite closed down 1.9%.

- On Tuesday, $39 billion of Treasury securities were auctioned at a concerningly high yield of 4.68%. This yield, marginally above the initial indicated level, signaled weak investor demand. While the 10-year Treasury rates reached 5% in 2023, the auction marked the highest yield for newly issued securities in over 16 years, raising concerns about the state of the Treasury market.

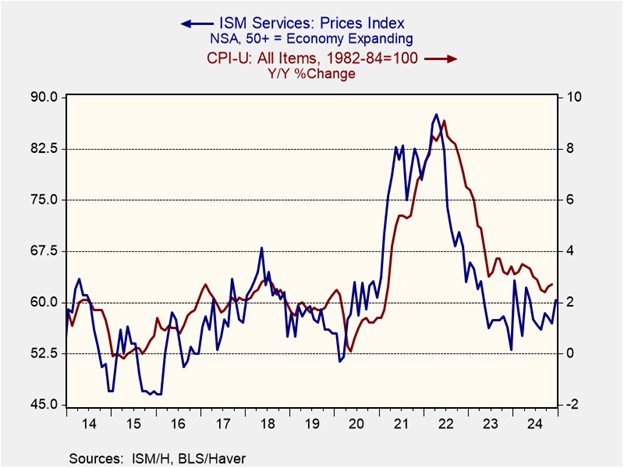

- Fears of a resurgence in inflationary pressures and tightening labor market conditions may have influenced the auction’s relatively weak performance. The December ISM PMI Services Index registered at 54.1, surpassing expectations of 53.3, with its sub-component prices index exceeding 60 for the first time since January 2024. Concurrently, the BLS Job Openings and Labor Turnover Survey (JOLTS) revealed a significant increase in job listings in November, rising from 7.839 million to 8.098 million.

- The weak auction and stronger-than-expected economic data will likely heighten market focus on the upcoming jobs report. The unemployment rate will be particularly scrutinized, as last year’s rise from 3.7% to 4.2% significantly influenced the Fed’s decision to cut rates by 100 basis points in 2024. A decline in the unemployment rate could jeopardize projected cuts unless inflation demonstrates a substantial decrease.

- The CME FedWatch Tool currently suggests only a 25-basis-point rate cut by the central bank for 2025. While this scenario seems plausible, we believe the possibility of rates remaining unchanged throughout the year remains significant, especially if inflation fails to demonstrate substantial progress, and the labor market remains tight in the coming months.

Rifts Emerge Within the Western Alliance: President-elect Donald Trump has proposed annexing Canada and Greenland, as well as renaming the Gulf of Mexico to the Gulf of America, signaling a dramatic shift in US policy. In a news conference, Trump declined to rule out the use of military or economic measures to achieve these ambitions, further raising tensions.

- Western allies have unsurprisingly dismissed Trump’s attempts to acquire additional territory, warning of potential retaliation if aggression occurs. French Minister Jean-Noël Barrot stated that the EU is ready to defend the sovereignty of its members against any use of force. Similarly, Canadian PM Justin Trudeau firmly rejected the idea of being annexed by the US and implied that force would not be beneficial to either side.

- The move coincides with the incoming administration’s shift away from the US’s traditional role as a benevolent hegemon. This administration appears poised to adopt a more assertive, potentially even adversarial, foreign policy. Consequently, they are likely to prioritize transactional agreements that maximize national self-interest.

- Currently, financial markets seem to be discounting the risk of a significant rift between the US and its allies. Investor attention remains largely fixated on domestic concerns like inflation and the growing national debt. However, escalating tensions between the US and its allies could inject renewed uncertainty into global markets. This increased volatility could bolster demand for traditional safe-haven assets like gold and silver.

- As US global influence wanes, we anticipate a rise in demand for alternatives to the dollar. Gold and silver are likely to emerge as contenders. The current gold-to-silver ratio exceeds 80, significantly higher than the 30-year average of 67, suggesting gold’s relative expensiveness compared to silver. However, this elevated ratio may now be the norm, given its consistent range between 80 and 90 over the past four years.

Virginia Election Races: The first political test following Donald Trump’s victory brought no surprises in Virginia. Democrats retained two State House seats in left-leaning Loudoun County, while Republicans held onto their State Senate seat. The closely watched contest was seen as an early indicator of the state’s political direction for when Republican Governor Glenn Youngkin’s term ends next year.

Immigration Bill: The new Congress has passed its first bill of the year, the Laken Riley Act, which mandates the detention of undocumented immigrants for non-violent offenses such as theft. This legislation is likely the first in a series of measures aimed at restricting immigration. Financial markets will closely monitor the potential impact of this crackdown on the labor market, as it could exacerbate labor shortages and push up wages for businesses.

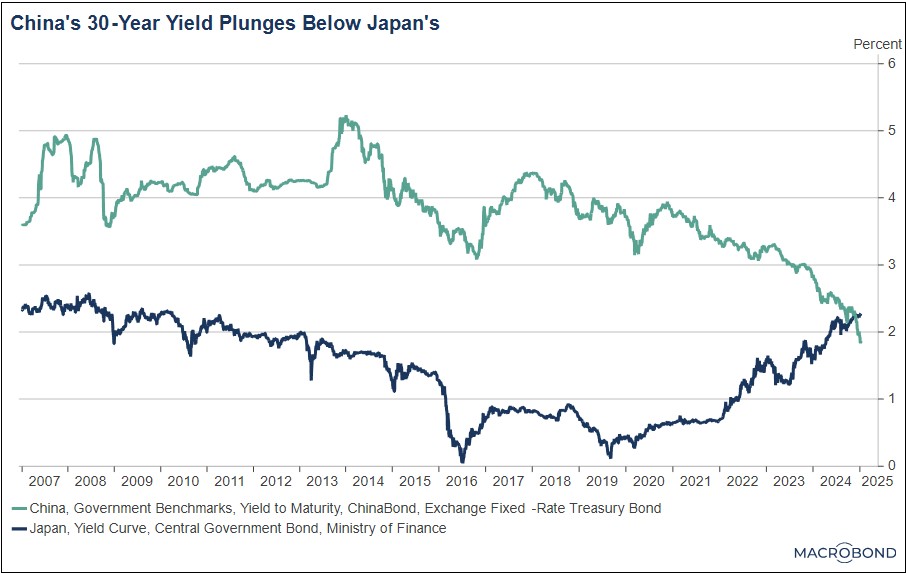

China’s Woes Continue: The country’s currency fell to a 16-year low due to fears that the Trump tariffs are likely to complicate the country’s growth efforts. Prior to this escalation, the country had been grappling with sluggish growth and deflation, exacerbated by waning investor and consumer confidence.

- The negative sentiment has also spread into the country’s bond market with the yield on 30-year government debt falling below the psychological level of 2%, placing it below the current level in Japan.

- A weakening Chinese economy poses a significant risk to global growth, as subdued consumption in the world’s second-largest economy will inevitably impact global demand. While the US remains an attractive destination for equity investments, we believe that compelling opportunities exist in international markets, particularly when analyzed on a sector-specific or individual stock basis.