Daily Comment (January 16, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] All eyes are on the U.K. but financial markets are coping with the uncertainty rather well. Here is what we are watching this morning:

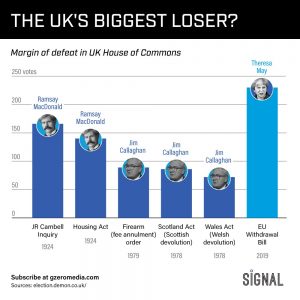

Brexit: PM May suffered a historic defeat.

It is the largest defeat in the modern era, with her margin of defeat at 230 votes.[1] Of the 317 Conservative MPs, 118 rejected the proposal. In response, as expected, Labour leader Corbyn tabled[2] a no-confidence vote which will occur later today at 7:00 GMT (around 2:00 EST). However, it is unlikely that Corbyn’s motion will pass as the Tories who defected on the Brexit vote will likely not want to see early elections and a potential Labour victory. If Corbyn’s motion passes, by some chance, then Parliament would have 14 days to appoint a new PM. Given that May has already survived a Conservative leadership challenge, there isn’t really an obvious alternative from her party to replace her. New elections would likely devolve into a de facto referendum on Brexit.

Now that it is clear May’s plan is dead, what is the plan going forward? Well, there really isn’t one. Here is what we know for sure:

- The EU isn’t changing its position.[3] This isn’t necessarily because the EU wants to punish the U.K. (although some members clearly do) but because achieving consensus among all the members is really difficult. Because it allows any member to veto important measures, the EU is, by design, inflexible. Thus, changes are really hard.

- Only a minority support a hard Brexit. Although some of the more doctrinaire Brexit supporters relish the upheaval caused by a sudden break with the EU, the majority of U.K. citizens don’t want this outcome. Neither does the EU. A hard Brexit would likely look like the abrupt changes that occur in wartime when supply chains are suddenly broken. However, a hard Brexit will lack the fiscal spending that accompanies war and the spirit of unity that also follows.

- Although denials continue,[4] odds favor a delay to the March 28 deadline.[5] One path being considered is the Boles amendment,[6] which would set up a committee in Parliament to negotiate the exit while specifically rejecting a hard Brexit. May opposed this plan because she felt she needed the threat of a hard Brexit to swing support to her plan. Clearly, that tactic failed and so the Boles plan is getting a new look. We suspect the Boles plan, in the end, would end up with the U.K. in a similar position as Norway, which is part of the EU free market but not a voting member. Unfortunately, it isn’t obvious that the EU would allow Britain to follow this option due to the size of its economy. Thus, the Boles plan may be a non-starter.

- Labour is more focused on taking power and less on executing Brexit. Part of the reason is that Corbyn’s position on the EU is ambiguous; he thinks it’s too friendly to business and doesn’t like interference from Brussels on foreign policy. Therefore, Labour has done nothing to address the Brexit issue. The risk for Labour is that it would find itself in power and then actually have to develop a Brexit policy. At this point, it isn’t clear that the party has one.[7] This means there is no real leadership on the Brexit issue that commands a majority.

- There is increasing talk of a new referendum. The problem is that it is unclear what decision would be put to the voters. We think a politically feasible plan is one that would keep Britain in the EU but with a carve-out on immigration and free movement of peoples. While the Schengen Area is considered by many to be sacrosanct (it allows for any member of the EU to move through Europe without visas or passports), growing populist opposition to the free movement may make a British exception more palatable. Nevertheless, the danger of a second referendum is that it could lead to an inconclusive result if not carefully crafted.

Assuming May survives the no-confidence measure, she will have three days[8] to offer an alternative plan. It is unlikely she can provide an alternative measure. She may simply decide to resign, although that seems unlikely. She might propose her own referendum. But, the most likely response would be to try to extend the deadline, which we suspect the EU would approve.

So, how did we get into this mess? The original vote on Brexit was a reflection of populist uprisings seen across the West. Much of the anger toward the EU was driven by rapid changes in society caused, in part, by high levels of immigration. The EU’s open borders were a factor in rising immigration. Brexit became symbolic, much like the border wall debate in this country. However, the Brexit supporters offered a vision of the future that was never going to happen. They sold a story that the U.K. could leave the EU but retain all the trading benefits of the EU free market, not pay dues, control the border and be free to make new trade deals. The reality is clearly less attractive. The EU is going to put up trade barriers as it does against any non-member and the U.K. needs to start the painful process of negotiating a trade deal with the EU that will likely take years to complete. And, a U.K. outside the EU is really a small island nation that will lose much of its financial services industry to Frankfurt or, more likely, New York, and it will simply not be high on anyone’s agenda for trade negotiations.

The next referendum, which is a growing possibility, would need to reflect the reality of what Brexit really means, and not one based on an impossible fantasy. Figuring out how to phrase that will be really hard. In the end, the U.K. might simply decide it is better off inside the EU and negotiate hard for some degree of border protection.

So far, financial markets are taking all this political chaos rather well. Some commentators have remarked that the GBP is not paying attention at all.[9] This stance is questionable; based on parity, the GBP should be around $1.63, so there is some degree of “Brexit penalty” in the current exchange rate. However, a hard Brexit likely takes the pound to a range of $1.10 to $1.20. The financial markets are expecting a delay. The risk to the financial markets is a condition similar to the cascade of events that led to WWI; no one wanted the war that followed but their decisions led to war as the outcome. Although support for a hard Brexit is low, the likelihood grows because both sides are using the potential for a really bad outcome to sway opinion. If neither side blinks, we have the classic bad outcome from the game of chicken; neither side defects so both suffer greatly from the result.

China: China has announced a massive monetary injection of $84 bn into the banking system.[10] Although some of this money is to support the economy, much of it is to build cash levels in the system before the Chinese New Year, which falls on February 4 this year.

A hawk turns dovish: Perhaps one of the most interesting (and shocking[11]) developments from the FOMC is that KC FRB President Esther George is now supporting a pause.[12] She is arguably the most hawkish member of the FOMC. With her shift, we suspect the FOMC will be on hold for a significant period.

Shutdown issues: The president has ordered tens of thousands of government workers to return to their jobs without pay to ensure the government continues to function.[13] This announcement is occurring as the chair of Economic Advisors warns that GDP is falling 0.13 percentage points per week during the partial government closure.[14] So far, financial markets have mostly ignored the shutdown, but if the effects on the economy increase we may start to see equities weaken until progress toward a resolution is seen.

Iran oil: We noted yesterday that the State Department indicated the Trump administration was not planning to issue further oil export waivers.[15] Even with the waivers in place, Iranian oil exports have been under pressure as December export data show oil exports only at 1.1 mbpd, down from 2.5 mbpd last spring.[16]

[1] https://www.prospectmagazine.co.uk/politics/could-the-vote-on-mays-deal-end-in-an-historic-government-defeat and https://www.ft.com/content/9f45ab16-18fb-11e9-9e64-d150b3105d21?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[2] https://www.ft.com/content/6443d1d8-18ff-11e9-9e64-d150b3105d21

[3] https://www.ft.com/content/efabfd1c-1964-11e9-b93e-f4351a53f1c3

[4] Ibid.

[5] https://www.ft.com/content/e6f2cb52-1918-11e9-b93e-f4351a53f1c3

[6] https://www.ft.com/content/cf8ddb16-181c-11e9-9e64-d150b3105d21

[7] https://www.ft.com/content/a55c3abe-18b6-11e9-b93e-f4351a53f1c3?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[8] https://www.nytimes.com/2019/01/10/world/europe/theresa-may-brexit-bercow.html?module=inline

[9] https://www.axios.com/british-pound-rises-brexit-deal-theresa-may-20db0b5d-c549-4a29-88d6-d2346b410374.html (Interestingly enough, because of the government shutdown, the Commitment of Traders report from the CFTC has been suspended so we don’t know the current positioning of the GBP on the futures exchanges.)

[10] https://www.ft.com/content/7136dfa8-1944-11e9-9e64-d150b3105d21

[11] https://www.youtube.com/watch?v=O3ZOKDmorj0

[12] https://www.ft.com/content/870a0ec6-18f5-11e9-9e64-d150b3105d21?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[13] https://www.politico.com/story/2019/01/15/shutdown-employees-work-without-pay-1088020

[14] https://www.nytimes.com/2019/01/15/us/politics/government-shutdown-economy.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top

[15] http://www.arabnews.com/node/1434591/business-economy

[16] https://www.ft.com/content/5f414c6c-18ad-11e9-9e64-d150b3105d21?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56