Daily Comment (January 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the latest news on President-Elect Biden’s incoming administration, followed by a discussion of China’s success in growing its economy in 2020. We also touch on other key foreign news before turning to the latest developments related to the coronavirus pandemic.

U.S. Politics: Reports indicate that Biden’s inauguration speech tomorrow will emphasize themes of national unity and recovery from the pandemic. After that, Biden’s team has indicated he will embark on a ten-day policy sprint to push forward executive orders and legislation aimed at the pandemic, the economy, the environment, and racial issues. The package will reportedly include a proposal for an eight-year path to citizenship for 11 million people living in the U.S. without legal status.

- Separately, a slew of Biden cabinet nominees will face confirmation hearings today, including Janet Yellen for Secretary of the Treasury, Lloyd Austin for Secretary of Defense, and Avril Haines as Director of National Intelligence.

- Yellen is not only expected to argue for an aggressive package of further pandemic relief (see below), but to offer the traditional assurances that the U.S. prefers market-determined currency exchange rates; it will not deliberately push down the dollar to increase the country’s competitive advantage. All the same, we still suspect the greenback will remain in a downtrend in the coming years in response to factors like the euro’s greater attractiveness as a reserve currency and the impact of massive fiscal and monetary stimulus in the U.S.

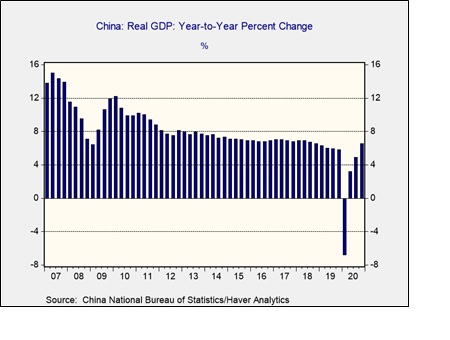

China: Official data yesterday showed the Chinese economy managed to grow in 2020 by an inflation-adjusted 2.3%, slightly beating expectations and making it the only major economy to post an annual expansion during the “Year of COVID-19.” Looking at the fourth quarter alone, Chinese gross domestic product (GDP) was 6.5% larger than in the same period one year earlier, which means the economy has already returned to its pre-coronavirus trend. China’s ability to get back to a normal economy so quickly would seem to bode well for Chinese equities. However, it is important to remember that economic and financial risks abound because of the rising bipartisan pushback in the U.S. against China’s geopolitical, economic, and domestic aggressions.

Russia: Opposition activist Alexei Navalny, who was recovering in Germany from a poisoning last summer, returned to Russia on Sunday and was immediately arrested on what appear to be trumped-up charges aimed at silencing him. Illustrating how badly the government wanted to keep his arrest under wraps, it diverted Navalny’s flight at the last moment away from a Moscow airport where his supporters were waiting to welcome him. Despite his detention, Navalny immediately punched back against the Putin government by calling for massive street protests. Navalny’s arrest has already drawn condemnation from a range of European leaders and President-Elect Biden’s nominee for National Security Advisor. If the Kremlin cracks down on Navalny too strongly, we would expect further sanctions against Russia and new headwinds for the Russian economy.

Italy: Prime Minister Conte today faces a crunch vote of confidence in the country’s Senate after Matteo Renzi, the former prime minister, removed his small party’s backing for the government last week. Conte won a confidence vote in Italy’s lower chamber yesterday, but the vote in the Senate today is expected to be much tougher. If Conte is unable to win in the upper house, he will be forced to hand in his resignation to President Mattarella, who will then ask parliamentarians to attempt to form a new coalition.

Tunisia: As the 10th anniversary of the Arab Spring approaches, nightly riots by Tunisian youths this week have underscored the depth of the economic crisis in the Arab world’s only democracy as it grapples with rising poverty and widespread unemployment. We have also noted that when global grain prices are rising rapidly, as they were in the Arab Spring and as they are right now, they often spark domestic instability in developing countries like Tunisia.

COVID-19: Official data show confirmed cases have risen to 95,668,817 worldwide, with 2,043,713 deaths. In the United States, confirmed cases rose to 24,079,744, with 399,008 deaths. Vaccine doses distributed in the U.S. now total 31,161,075, while the number of people who have received at least their first shot totals 10,595,866. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S infections totaled only about 137,000 yesterday, although the number is usually muted early in the week and during holidays. Hospitalizations related to the virus fell below 124,000, including approximately 23,200 in intensive care. Deaths also fell but remain high, as they do in many key countries around the world. In Japan, daily virus-related deaths topped 100 today for the first time since the crisis began.

- President-elect Biden has rejected an effort by President Trump to lift the bans on most travel into the U.S. from Europe, the U.K., and Brazil that were imposed by Trump in his initial response to the coronavirus pandemic last spring.

- In Switzerland, anti-lockdown activists submitted enough petition signatures to trigger a referendum on whether to remove the government’s legal authority to order lockdowns and other pandemic restrictions. The ballot could come as soon as June.

Economic and Political Impacts

- In its monthly report on the global oil market, the International Energy Agency cut its demand forecast for 2021 to 96.6 million barrels per day from 96.9 million bpd previously. The reduced forecast reflects renewed lockdowns around the world in response to resurgent infections. Nevertheless, demand would be much higher than the approximately 91.1 million bpd registered in 2020. Because of the rebound in 2021 and expectations that demand could recover to the pre-pandemic level of almost 100 million bpd by 2022, we suspect crude prices can continue to strengthen in the near term.

- Despite the IEA’s cut to its oil demand forecast, the cost of shipping goods in containers from China to Europe has more than tripled in the past eight weeks, hitting record highs as a shortage of empty containers disrupts global trade.

- Thousands of empty containers were left stranded in Europe and the U.S. in the first half of 2020 when shipping lines canceled hundreds of trips in response to pandemic lockdowns. When European and U.S. demand for Asian goods rebounded in the second half of the year, competition for available containers among shippers sent freight rates soaring.

- Rates between China and the U.S. have plateaued in response to a Chinese government request that shippers cap their trans-Pacific rates. That helped divert scarce containers to the Pacific, boosting rates further on the routes to Europe and threatening trade and economic activity between Asia and Europe.

- Bruce Flatt, the CEO of Canadian real estate firm Brookfield Asset Management (BAM, 38.74), warned that investors are underestimating the speed and extent to which people will return to work in offices and head back to shopping malls as the pandemic subsides. He is preparing to complete a $5.9 billion deal to delist Brookfield’s property arm amid frustration that the equity market does not recognize the value of its vast real estate portfolio.

- The World Economic Forum issued a report warning the pandemic threatens to widen income and other disparities within and between countries. Based on a survey of business executives, academics, and risk-management experts, the report says worsening disparities could destabilize some countries and exacerbate the frictions between the U.S. and China.

U.S. Policy Response

- In her confirmation hearing before the Senate Finance Committee today, Treasury Secretary nominee Janet Yellen plans to tell lawmakers that the U.S. risks a longer, more painful recession unless Congress approves more aid. Yellen will urge the legislators to “act big” in order to shore up the recovery. So far this morning, equity futures are rising on expectations that if Yellen makes a credible, effective case for the Biden Administration’s proposed $1.9 trillion relief plan, it would help ensure that the legislation gets passed into law.